Indonesia-listed PT Global Digital Niaga Tbk, an entity that includes e-commerce player Blibli, online travel agency Tiket.com, and supermarket chain Ranch Market, reported lower losses in the first three months of 2023 amid higher revenues and an improved cost structure, according to the company’s statement late on Friday.

“We started the year 2023 with optimism to tackle all the challenges ahead and having full confidence to accomplish even better growth sustainably and ultimately getting closer to profitability,” Kusumo Martanto, Blibli CEO and co-founder, said in the statement.

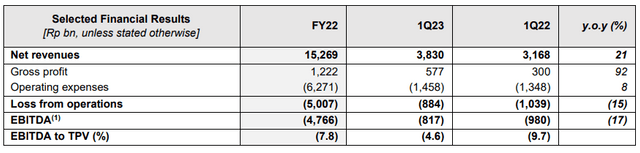

The company, which goes by its ticker BELI, recorded 883.6 billion rupiah ($60 million) in losses for the period that ended March 2023, a nearly 18% decline compared with 1.1 trillion rupiah in the corresponding period a year earlier.

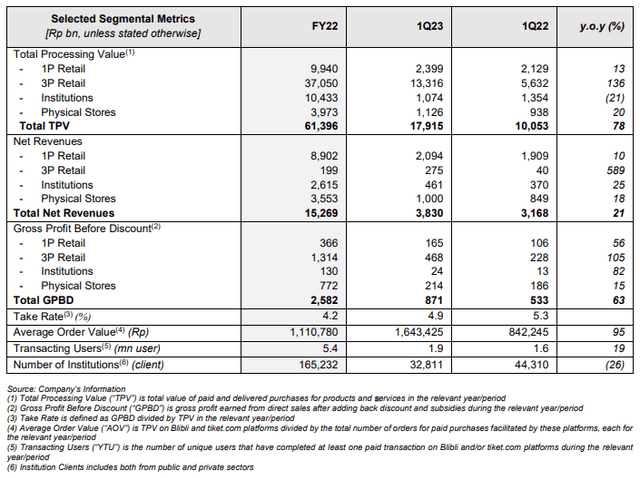

Consolidated net revenues in the Jan-Mar period grew 21% year-on-year (YoY) to 3.8 trillion rupiah. Meanwhile, the group’s total processing value (TPV)—which the company explains as the total value of paid and delivered purchases for products and services in the relevant period—jumped by 78% YoY to 17.9 trillion rupiah on the back of a strong recovery in the Indonesian online travel industry and increased demand for digital products.

Blibli focused on its omnichannel strategy throughout the first quarter by adding more physical stores in both the electronics and groceries segments, the management said in the statement. On the other hand, Blibli also introduced a unified loyalty programme in a bid to strengthen its ecosystem play.

As of March-end 2023, BELI operates 142 consumer electronic stores that include 76 mono-brand stores and 66 multibrand stores. BELI also operates 70 premium supermarkets.

Hendry, CFO and co-founder who goes by a single name, noted that Blibli’s adjustments are expected to boost its margins. The adjustments include higher fees taken by the company from third-party sellers on its e-commerce platform. Blibli is also planning to focus on private-label products which offer higher margins.

He noted that Blibli managed to improve its cost structure during the period, mainly in marketing and advertising costs as well as the general administrative expenses ratio compared to its TPV. In turn, both savings contributed to an improvement in its consolidated EBITDA performance.

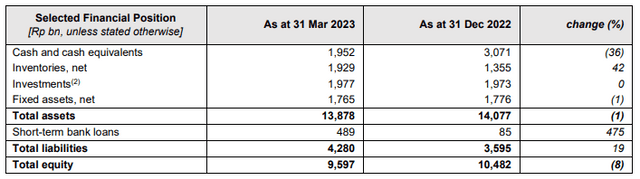

“Meanwhile, our cash position along with the available credit facilities should be sufficient to enable us to carry out all our business strategies to grow sustainably and strengthen our path to profitability,” Hendry said.

BELI, as mentioned in its statement, said it is confident of recording a stronger business performance across all segments in 2023, supported with the continued implementation of margin optimisation strategies and doing what customers actually want.

“The company will continue to further implement cost efficiency programmes across all businesses and departments, including optimising advertising and marketing expenses and IT infrastructure costs. Meanwhile, more innovation of new potential synergies within the ecosystem will be rolled out soon in order to further increase the number of transacting users and enhancing the quality of each platform,” the statement read.