By Dev Ashish Aneja & Abhishek Bansal

For over 100 years, from the Ford Model T days, untill a few years ago,the auto industry has been monotonous with only a few incremental improvements. However, now this industry is very dynamic and is the epicenter of technological disruptions. The wave of electrification has swept away several traditional giants like Japan, whose economy is heavily dependent on the automotive industry, and created new leaders.

Manufacturing an electric vehicle (EV) might look simpler theoretically since it has fewer parts to assemble. However, so far only two companies globally, Tesla and BYD, are able to manufacture EVs profitably. Others like Ford are making heavy losses in EV manufacturing. Ford said its annual loss in 2022 was USD 2.1 billion, and in 2023 it is projected to be USD 3 billion.

Toyota, which has traditionally been the global leader in car sales by volume for the past several years (~10million units annually) is lagging behind in EV manufacturing. The largest two car markets for Toyota are China and the USA. In the first three months of 2023, Toyota sales wee down by 10% in the US and 23% in China. These two markets and Europe are fast transitioning to EVs which Toyota does not have many in its product portfolio.

Sometime ago, Bloomberg came out with a study which says that once a country touches 5% market penetration of EVs, it is likely that this share will explode to 25%-30% in the next 5 years. Already 19 countries, including the largest car markets, have touched this percentage. EV penetration is a ticking time bomb for most incumbent car makers globally.

Over and above this, CEOs of companies such as VW have publicly admitted that the time taken by them to manufacture an EV is at least 3X of that taken by Tesla.

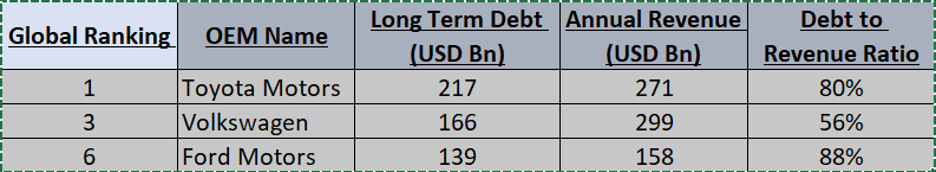

Talking about the financial health, in the list of world’s most indebted companies in 2023, three out of top six companies are auto incumbents (Toyota, VW and Ford Motors). The point to note here is that we are talking not only about companies in the auto industry, o but about companies across the spectrum.

Declining sales in major markets, heavy debts, and the supply chain woes in securing battery materials largely processed in China can prove to be a disastrous for most of the incumbent companies unless timely action is not taken. The Western OEMs are largely dependent on China for their battery supply chains especially on the mid-stream side. OEMs such as Ford and Tesla are setting up battery factories with CATL in the US.

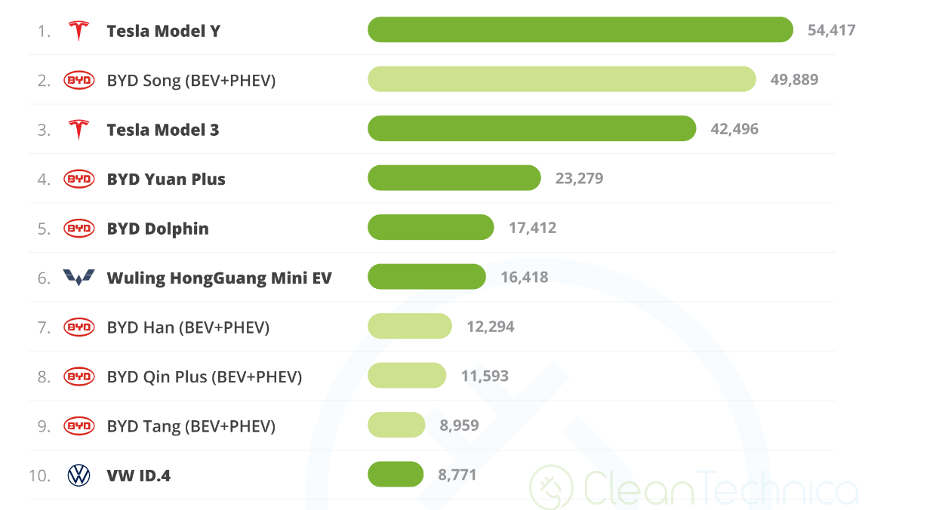

Even the European leaders such as Mercedes-Benz and BMW are not in their home country’s list of top selling EVs. As of late 2022, Tesla Model Y and Model 3 are ruling the pack here and there isn’t a single car model from Mercedes-Benz or BMW in the European sales list of top fifteen EV models.

As per Cleantechnica, in January 2023, nine out of the top ten EVs sold globally are made in China. This includes 6 models from BYD (China), 2 from Tesla (US + China) and 1 Model from Wuling, the compact Chinese EV Hatchback. The only exception is VW ID4 which is at number ten globally in the sales list and is not made in China.

No Japanese OEM is in this list. Nissan Leaf which had the first mover advantage for EVs missed the bus. India has a good opportunity to shine in this new era of mobility by capitalizing on its technological strengths. There is no doubt that EV penetration will steadily increase from where it is now. There are several tailwinds in the form of conducive government policies, rising fuel prices and an increased consumer awareness.

Over and above all these, lithium prices have fallen by about 66% in this calendar year. This will gradually reduce the battery pack prices and increase EV sales.

In the EV era, the Indian 4W auto industry is also going through a never-before change of order. Tata Motors is consistently doing a market share of 80%-90% month on month for EVs. An Indian car OEM ruling the auto sales chart has never happened in decades, as it has been been dominated by the Japanese and Koreans OEMs. The Tata Group is going the Tesla way by doing a complete vertical integration.

Tata Motors is doing EVs, Tata Auto Components takes care of all major components including the battery pack and power electronics. Tata Power is leading the charging revolution. Further, Tata Elxsi is doing automotive engineering services to support OEMs on their electrification and connectivity ambitions and lastly the newest kid on the block is Tata Technologies. Tata Group is doing an IPO after 18 years which is Tata Technologies and this company is doing engineering research and development for its clients helping them innovate faster, better and cost-efficiently.

Overall, India is well positioned to lead the EV race globally. Giga factories are being set up to manufacture battery cells as part of PLI ACC and several companies are gearing up to manufacture advanced automotive and EV components as part of PLI Auto. The Union government is actively working on the battery recycling policy as well to ensure a circular supply chain for battery cells. EVs from India are being exported globally and we believe that in the coming years, Indian EV companies are going to be at the forefront especially in the E2/3-wheeler space.

(Disclaimer: Dev Ashish Aneja is the Vice President of C4V, and ex-head of Auto and EV – Invest India, and Abhishek Bansal is Manager of Auto and EV – Invest India. Views are personal.)