The guessing game on Li Shufu’s intentions after buying the biggest stake in Daimler is up: Automakers must cooperate, or risk being swallowed up.

That’s the takeaway from an editorial written by the owner of China’s biggest non-state carmaker in Frankfurter Allgemeine Zeitung on Sunday. Li, who in February bought a 9.7 percent

stake in Daimler AG to add to his ownership of Volvo Car Group, said traditional carmakers need to “wake up” to make the switch to a business model based more on sharing technology to generate acceptable returns in future.

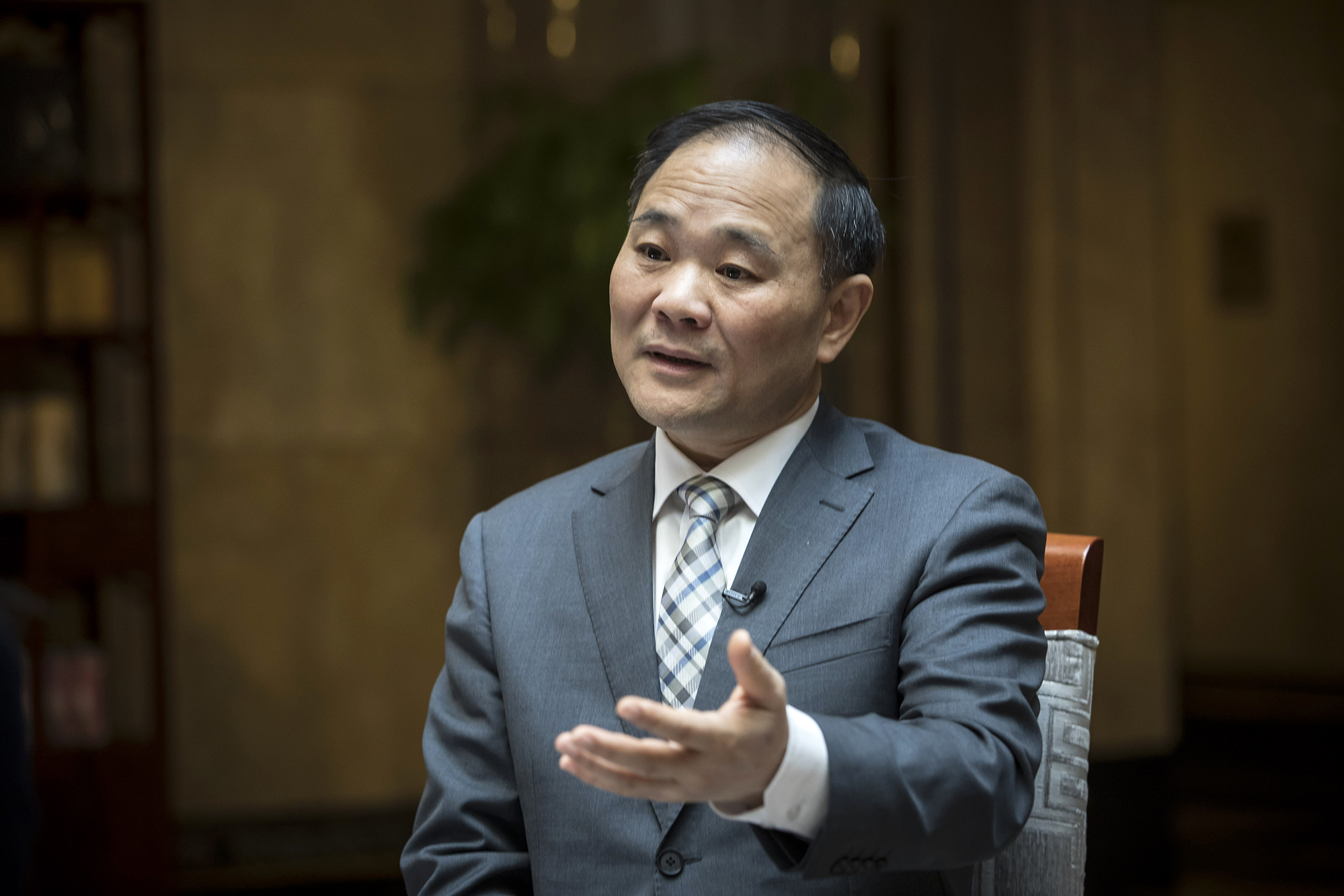

Photographer: Qilai Shen/Bloomberg

“Those companies sticking to silos will be swallowed up by the few remaining giants,” Li said. “Those who’ll bundle their shared strengths will win out in the future.”

Daimler’s position on partnerships with the company’s new biggest shareholder has been far more tepid. The world’s biggest luxury carmaker and commercial vehicle maker acknowledged “good conversations with a very successful entrepreneur” after an initial meeting, but emphasized any collaboration would hinge on keeping its existing partnerships in China happy.

Since Li’s arrival, Daimler has deepened ties with long-standing China partner BAIC Group on electric cars, with the Mercedes-Benz maker taking a near 4 percent stake in a BAIC venture.

To read more about Li’s bet on Mercedes know-how, click here

Li’s strategy, meanwhile, became clearer with last month’s unveiling of

plans to start making his Lynk & Co. mid-market brand in Europe from next year, the first Chinese vehicles to be built outside their home market. Lynk, which started sales in China last year, will produce the 01 sport-utility vehicle at Volvo’s plant in Ghent, Belgium.

Since 2010’s acquisition of Volvo Cars from Ford Motor Co. and 2013’s purchase of the iconic London Taxi Company (which has since started making electric black cabs), Li has added to his web of foreign brands and companies. Last year, he gained control of British sports carmaker Lotus and became the biggest shareholder in Volvo AB, the second-biggest truckmaker.

“Those prepared to come together to forge proprietary digital platforms that’ll be used by their different brands will have the recipe for success,” Li said in the piece also carried in Sweden’s Dagens Industri. That said, reaping global economies of scale together had to safeguard brand and management autonomy, he added.

Daimler, like other carmakers, has stepped up forming cooperations as manufacturers face an unprecedented rate of change, including the rise of electric cars and changing customer behavior. Last month, BMW and Daimler agreed to

combine their respective car-sharing services to gain clout amid intensifying competition. Earlier, Volkswagen AG’s Audi brand, BMW and Daimler

agreed to buy a real-time map business, called HERE, to gain technology that’ll eventually form the basis for self-driving vehicles.