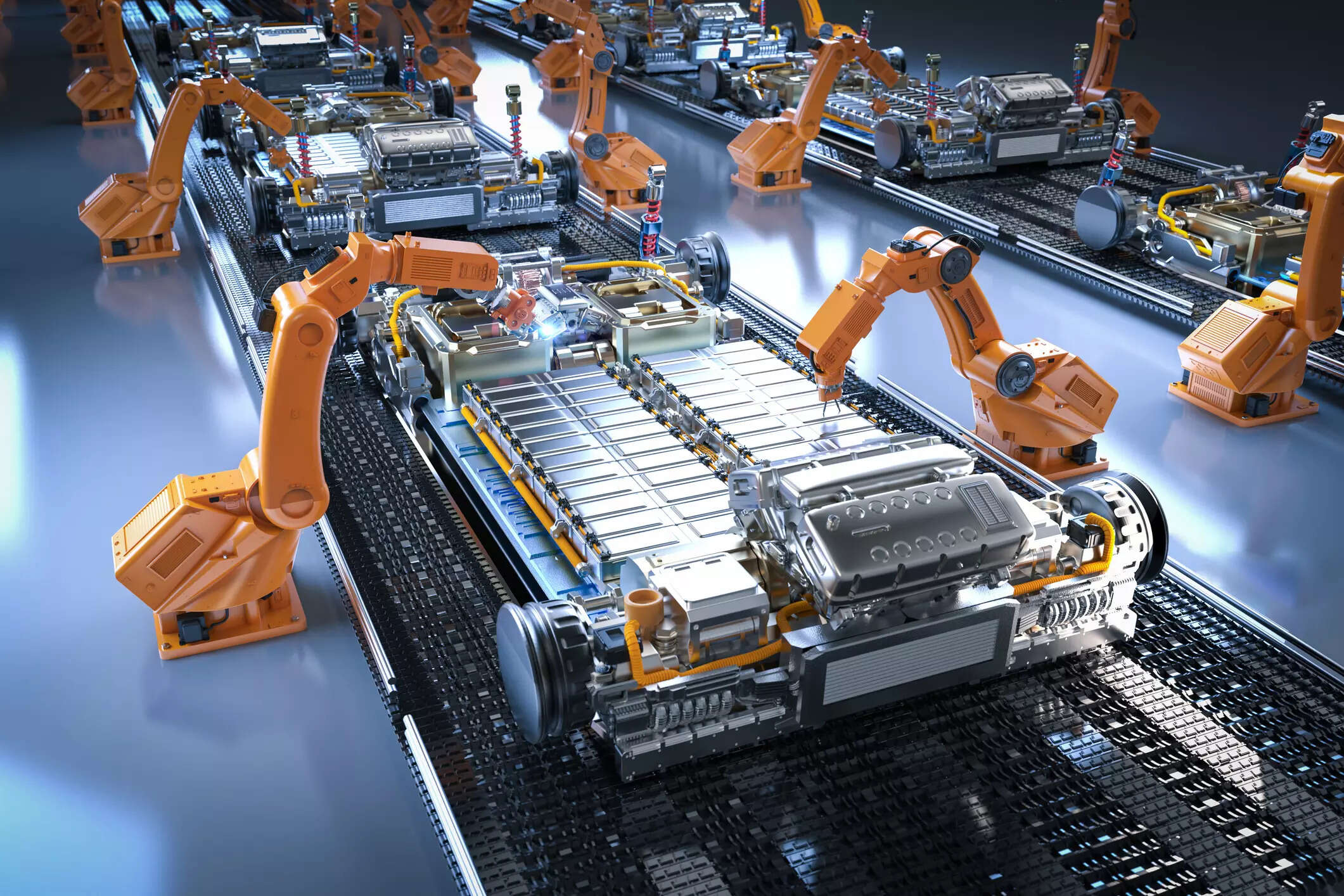

Europe is seeking to lure electric vehicle (EV) battery makers to build factories in the region as the bloc – home to carmakers such as Volkswagen and Stellantis – tries to cut its dependency on Asia and win a green subsidy race with the United States.

They also want to attract suppliers of components and ingredients for making electric vehicles and their batteries.

GERMANY

Sweden’s Northvolt said on May 13 it will invest 3-5 billion euros (USD 3.3-5.5 billion) in an EV battery plant in Heide in the northern state of Schleswig-Holstein as long as subsidies are approved. One source close to the matter estimated the subsidies at more than 600 million euros.

Volkswagen plans to build six battery factories in Europe totalling 240 gigawatt (GWh) of capacity by 2030. Production at its first battery plant, “SalzGiga”, in Salzgitter in the Lower Saxony region will start in 2025.

China’s CATL, which has been expanding rapidly outside China, is ramping up production at its plant near Erfurt in the central state of Thuringia.

Germany’s BASF is building a battery materials site in the eastern city of Schwarzheide in Brandenburg.

U.S. Microvast built a factory in Ludwigsfelde, south of Berlin.

Automotive Cells Company (ACC) – a joint venture of Stellantis, Mercedes Benz and TotalEnergies – plans to spend over 7 billion euros on three gigafactories in Europe, with a capacity of 40 GWh each by 2030. One will be located in Kaiserslautern in the western state of Rhineland-Palatinate.

Gigafactory is a term popularised by Tesla CEO Elon Musk and refers to plants producing batteries on a large scale.

FRANCE

Joint venture ACC has built a gigafactory in Billy-Berclau Douvrin, France, as part of its plan for three gigafactories in Europe. ACC has inaugurated the gigafactory on May 30, with operations starting in the second half of the year.

Taiwan’s ProLogium announced on May 13 plans for a 5.2-billion-euro plant in Dunkirk – its first such overseas investment – after France offered deal sweeteners and competitive power prices, executives from the company said.

Envision is investing up to 2 billion euros in its AESC gigafactory in Douai close to the electric car hub known as “Renault ElectriCity”. The plant will have a capacity of 9 GWh in 2024, with the aim of reaching 24 GWh by 2030.

“Renault ElectriCity” pools three of the group’s plants in northern France, Douai, Ruitz and Maubeuge.

French start-up Verkor plans to build a gigafactory in Dunkirk, for a targeted capacity of 12 GWh, enough to power more than 100,000 vehicles. Renault would be its biggest supplier.

Blue Solutions’s gigafactory operates in Ergue-Gaberic, near Quimper since 2013. According to its Managing Director, Jean-Luc Monfort, in 2021, the company envisaged that both lines in Quimper and a line in Montreal would have a annual capacity of 1.5 GWh.

SPAIN

Spain, Europe’s largest carmaker after Germany, signed a deal in July 2022 with China’s Envision to build an EV battery plant worth 2.5 billion euros in Navalmoral de la Mata in the central-western region of Extremadura, with planned annual capacity of 30 GWh.

Volkswagen and its partners said last year they would invest 10 billion euros to build a 40 GWh battery plant in Sagunto near Valencia, with production to start by 2026, and produce electric vehicles at its two car factories in Spain.

BASQUEVOLT plans to invest more than 700 million euros to build a plant in the Basque Country.

Slovakian battery manufacturer InoBat said last October it had signed a declaration of intent with the Spanish government to set up an EV battery factory in central Spain’s city Valladolid, expected to cost 3 billion euros.

China’s BYD Co, the world’s biggest seller of EV and plug-in hybrids, could request funds from a revamped government scheme called PERTE aimed at encouraging EV production in the country, Spanish newspaper Expansion said in April.

Volkswagen and Renault also plan to request funds from the PERTE scheme. Stellantis and newcomer AEHRA may do the same.

India’s Tata Group said in February it was looking at Spain or Britain as possible battery factory locations.

ITALY

Joint venture ACC plans to spend over 2 billion euros to develop a 40 GWh gigafactory in the southern city of Termoli, with an investment of 2 billion euros. Operations are expected to start in 2026.

POLAND

LG Chem EV battery in Wroclaw started production in the second half of 2017, with a capacity of 100,000 batteries per year. The European Commission approved in March 2022 Poland’s measures of 95 million euros to support the expansion of the plant, which aims to reach capacity of 115 GWh in 2025.

HUNGARY

Samsung’s 1.2-billion-euro Goed factory, with an annual capacity of 30 GWh, has been in operation since 2018.

SWEDEN

Northvolt’s Skelleftea factory has been operating since 2021. It aims to achieve an annual capacity of 40 GWh by 2025.