As a measure of China’s importance to western carmakers, Volkswagen AG is tough to beat. Evercore ISI estimates the country contributed 43 percent of the German giant’s pretax profit last year.

So any change to rules governing local joint ventures is potentially very significant. Yet China’s plan to liberalize ownership restrictions on local joint ventures was met with barely a shrug from European stock markets on Tuesday. This suggests VW, Daimler AG and others haven’t been gifted a wad of cash by Beijing.

As the local market leader (with about 17 percent of China’s car sales), you’d have thought VW has most to gain. With more than 4 million in yearly vehicle sales, the country’s a big contributor to VW cash flows. But under the current regime, it has to leave a lot of money on the table.

That’s because Beijing forced western automakers to enter local joint ventures to accelerate the development of a domestic Chinese industry. VW’s are with SAIC Motor Corp. Ltd. and FAW Car Co. Ltd. Over the past two decades that arrangement has eased the transfer of technology and cash to Chinese partners.

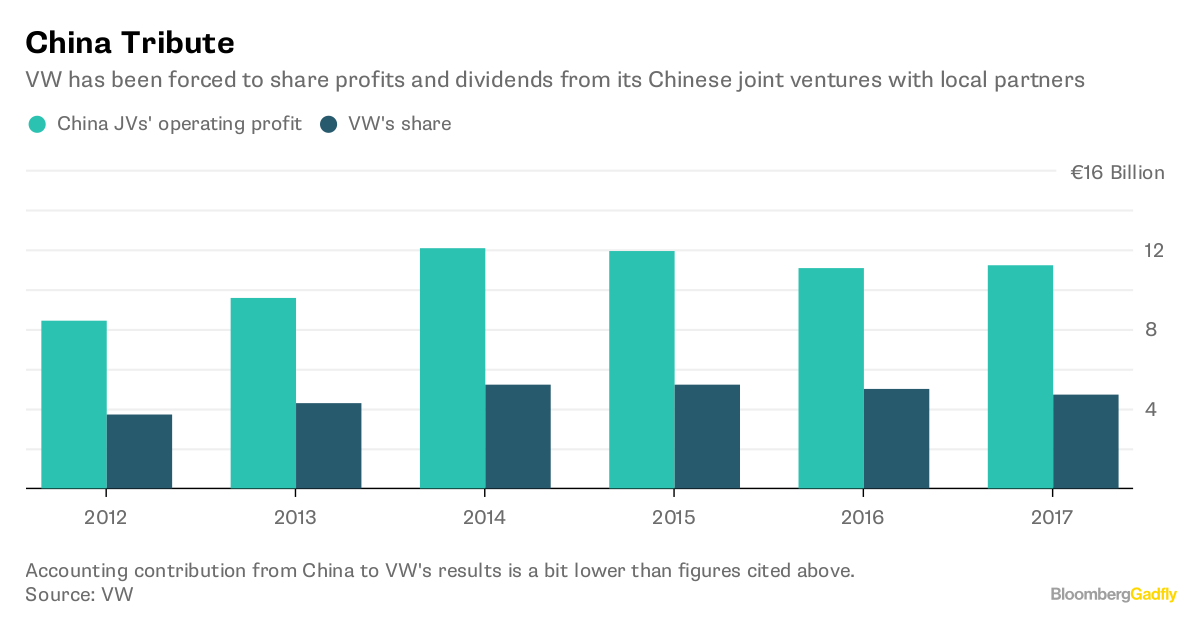

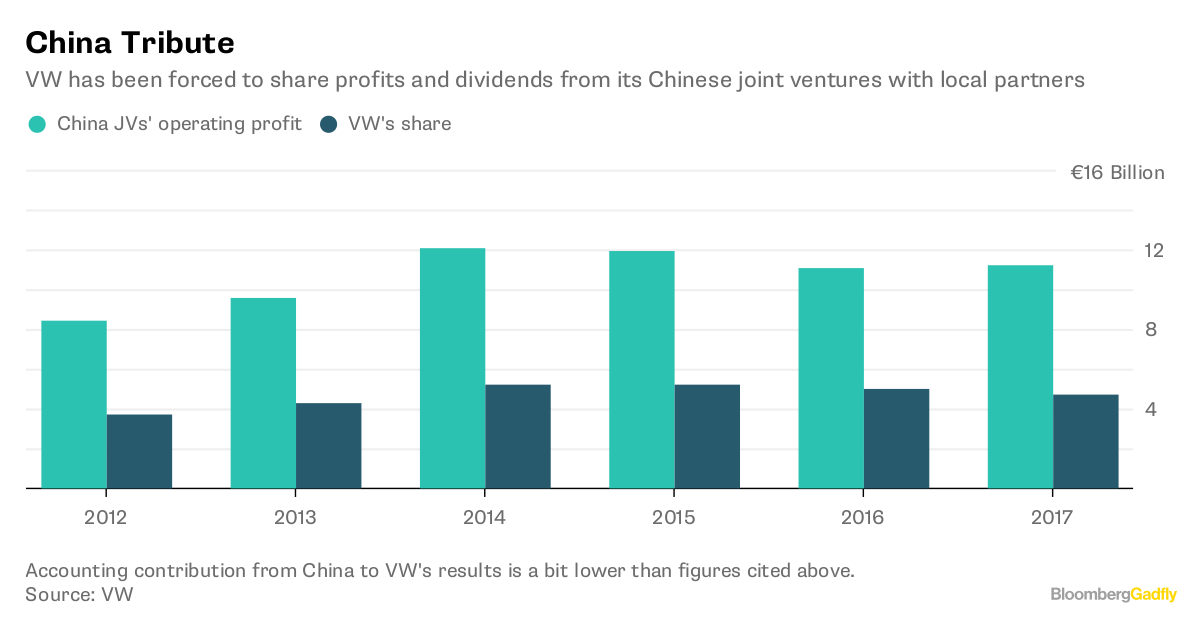

It’s not that VW has done badly out of the arrangement. It received about 20 billion euros ($25 billion) in dividends from its China joint ventures over the past six years, by my calculation. Handy for paying diesel-cheating costs. Still, had it been given freer access to China’s market from the outset, the rewards would have been massive.

China Tribute

VW has been forced to share profits and dividends from its Chinese joint ventures with local partners

Source: VW

So why did VW’s shares rise less than 1 percent on Tuesday, while those of its European peers did similar?

For starters, China won’t lift the ownership cap until 2022, slower than some investors will have hoped. And even if FAW and SAIC were willing sellers, which seems doubtful, it would cost a lot to buy them out. Before dieselgate, VW reportedly wanted to lift its stake in the FAW venture from 40 per cent to 50 percent, at a potential cost of about 5 billion euros.

Sure, western automakers could just go it alone, particularly on electric vehicles where ownership restrictions will be lifted sooner. That’s good news for Tesla Inc., which doesn’t have a factory in China yet.

But for companies like VW with a big existing Chinese presence this would mean billions more dollars of fresh investment. Undermining the existing joint-ventures might also oblige them to write down the value of their previous China investments, as Bernstein analyst Robin Zhu points out. Plus, there’s the danger that doing so angers Chinese partners and consumers. That’s not a risk western companies will take lightly in view of previous boycotts.

No wonder VW is at pains to stress that while it welcomes liberalization, the announcement won’t affect its joint ventures. In other words, China’s generosity isn’t as boundless as might first appear.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Chris Bryant in Berlin at cbryant32@bloomberg.net

To contact the editor responsible for this story:

James Boxell at jboxell@bloomberg.net

Go to Source