Singapore-based classifieds firm and unicorn Carousell booked $82.5 million in revenues for the financial year ended December 31, 2022, a 67% increase from the previous year, show regulatory filings.

However, the company’s losses widened in 2022 as expenses also rose, show the filings to Singapore’s Accounting and Corporate Regulatory Authority (ACRA).

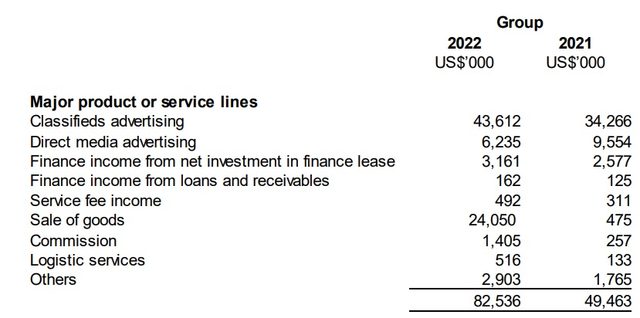

Classified advertising—about $43.6 million, up 27.4% from $34.2 million in 2021—was the biggest contributor to revenues. This includes sales from “visibility products such as bumps, listing fees, and profile promotions”.

Meanwhile, its sale of goods saw a significant jump to $24.1 million in 2022 from $475,00 in 2021, and was the second-biggest revenue contributor.

Breakdown of Carousell’s revenue

Carousell’s loss for the year widened by 50.4% to $63.1 million last year, from $41.9 million in 2021. The losses were mainly due to the increased employee benefit expenses, changes in inventories of finished goods, and marketing expenses.

Its employee benefit expenses—salaries, commissions, and bonuses, as well as contributions, and share-based payments—surged by more than 31% to $64.7 million in 2022 from $49.3 million in the previous year.

In December 2022, Carousell had slashed 110 positions, or 10% if its total headcount due to macroeconomic headwinds. At the time, the company said that it was “too optimistic” about the pace of Carousell’s impact and its increase in investments, which led it to grow its expenses and hires too quickly.

Meanwhile, the company’s changes in inventories of finished goods jumped remarkably to $22.9 million in financial year 2022, from $467,000 a year ago.

The company had a negative cash flow from operating activities of $55.5 million, while it had net cash of $10.9 million from investing activities.

At the end of 2022, the company had cash and cash equivalents of $118.9 million, down from $135.7 million in the previous year.

Its total assets stood at $315 million at the end of 2022, while it had total liabilities of $79.3 million.

DealStreetAsia has reached out to Carousell for comment.

Carousell started off in 2012 as a marketplace to buy and sell used items, mainly lifestyle products. Initially, the bulk of its transactions were from Singapore, but the company branched out to Malaysia and Taiwan in end-2014. In 2017, the company forayed into property and automotive listings.

The firm currently operates in nine markets and territories including Singapore, Indonesia, Malaysia, Taiwan, and Hong Kong.

In July, the company launched the Carousell Car Subscription service in Singapore in partnership with car subscription firm Carzuno. The service provides end-to-end digital service, enabling customers to choose their preferred car and return it without leaving their home.

Carousell has acquired startups across emerging categories such as streetwear (OxStreet), used phones (Laku6) and secondhand clothing (Refash).

The company joined Southeast Asia’s unicorn club after raising $100 million in 2021 from STIC Investments, a South Korea-based private equity investor, at a valuation of $1.1 billion. Its other backers include Mirae Asset-Naver Asia Growth Fund and NH Investment & Securities.