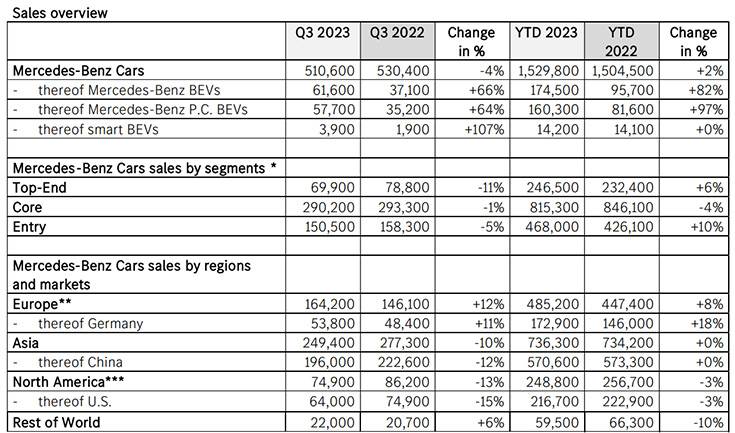

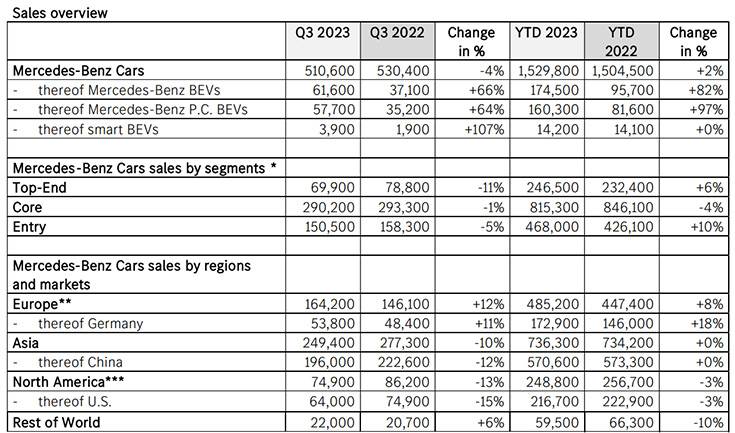

Mercedes-Benz Cars sales reached 510,600 units (-4%) in the third quarter of CY2023. The German luxury carmaker states that volumes were impacted by a model changeover for the E-Class and a supply-chain bottleneck which constrained availability of the GLC. Sales of the Mercedes-Maybach rose by 26% during the same period.

Meanwhile, the transformation of Mercedes-Benz continues with hybrid and electric vehicles now accounting for 20% of overall sales and battery electric car (BEV) sales up 66% in the quarter. In the first nine months of the year, Mercedes-Benz Passenger Car battery-electric vehicle sales almost doubled (+97%) and Top-End vehicle sales rose 6%. Total sales reached 1,529,800 units (+2%) in the three quarters ending September, in line with the Mercedes-Benz Cars full-year guidance of keeping sales at the prior-year level.

BEV sales up 66% at 61,600 units

Sales of Mercedes-Benz Cars battery electric vehicles (BEV) reached 61,600 units (+66%) in the third quarter, boosted by the EQA (+108%) and EQB (+96%) models, which remain strong sellers even ahead of their mid-lifecycle upgrades.

The EQS and EQS SUV models continue to lead the electric luxury segment, with 26,300 (+53%) units sold year-to-date. Sales of the electric smart reached 3,900 units (+107%) in Q3. Including plug-in hybrids, xEV sales at Mercedes-Benz Passenger Cars increased by 19% to 98,400 units in the third quarter resulting in more than a million Mercedes-Benz electric and hybrid vehicles on the road.

Top-End segment sales down 11% at 69,900 units in Q3

Sales in the Top-End segment (Mercedes-AMG, Mercedes-Maybach, G-Class, S-Class, GLS, EQS and EQS SUV) reached 246,500 units (+6%) in the first nine months of the year and 69,900 units in Q3 (-11%). Mercedes-AMG sales were impacted by model changeovers, in particular of the GLC. Mercedes-AMG BEV sales rose by 51% in the third quarter.

The G-Class once again proved its unique positioning in the market with Q3 sales up by 11% even ahead of a model makeover in 2024, Mercedes-Maybach sales were up by 26% to 6,600 units during the same period. Sales of the GLS SUV increased by 3% to 13,300 units in Q3 and the all-electric EQS SUV more than doubled sales to 3,700 units (+162%).

The Mercedes-Benz S-Class is still outpacing its competitors with a growth of 9% in the third quarter in China, reaching a dominating market share of more than 50% in its segment. Worldwide, S-Class sales reached 16.900 units in Q3 (-18%).

Core segment sales down 1% to 290,200 units in Q3

Q3 sales in the Core segment (all derivatives from C- and E-Class, incl. EQC, EQE and EQE SUV) reached 290,200 units (-1%) underpinned by the C-Class, which saw sales of 82,000 units (+6%) between July and September and reached 241,700 units (+11%) in the first nine months of the year.

Sales of the E-Class increased by +3% to 75,200 units in the third quarter, ahead of a model changeover which will see a new generation of the E-Class hit European showrooms this autumn. Demand for the new GLC continues to outstrip supply. Sales during the quarter were down 17% to 81,500 units as production was impacted by a supplier bottleneck.

Entry segment sales down 5% to 150,500 units

Sales in the Entry segment (all derivatives from A- and B-Class incl. EQA, EQB and smart) reached 150,500 units (-5%) as the A-Class and B-Class models received a mid-lifecycle makeover. Thanks to strong sales of electric vehicles, the BEV-share of third-quarter sales in the entry segment reached 23%. Sales of GLA and GLB reached 26,800 (-15%) and 36,300 units (-9%) respectively, impacted by part shortages.

SALES BY REGIONS AND MARKETS

Sales of Mercedes-Benz Cars developed with regional differences in the third quarter.

In Europe Q3 sales increased by 12% to 164,200 units and reached 485,200 units (+8%) in the nine-month period. Main driver in Europe was the new GLC with 25,300 units (+104%) in Q3. Sales in Germany remain strong with an increase of 11% in Q3 to 53,800 units and a plus of 18% to 172,900 units in the first three quarters of 2023. BEV sales in Germany doubled to 11,200 units (+100%) in Q3 driven by strong EQA sales (+258%). Furthermore, sales of the C-Class (+41%) and the new GLC (+87%) contributed to the positive development in the third quarter in Germany. Furthermore, the UK achieved a strong sales result with 23,100 units (+23%) in Q3.

Sales in Asia were on the same level year-to-date September, reaching 736,300 units (+0%). In China, the G-Class and Mercedes-Maybach set new records in Q3 with sales up by 35% and 30% respectively. Additionally, the S-Class achieved a new all-time best in Q3 in China with 9,400 units (+9%) sold. Further sales growth in China was limited by model changes of Mercedes-AMG and parts availability for GLC and entry-level vehicles. Sales in Korea increased by 16% to 19,700 units pushed by strong sales of the Core segment (+51%), especially C- and E-Class plus the all-electric EQE and EQE SUV. In Japan, sales were up by 3% to 11,600 units driven by strong Top-End sales (+37%). Sales in India increased by 9%.

In North America sales reached 248,800 units end of September (-3%). Battery electric vehicles (BEV) sales in the United States more than doubled in Q3 to 10,000 units (+137%), reaching 33,800 units (+315%) year-to-date. Main driver has been the EQE SUV and EQS SUV which accounted for almost half of BEV sales end of September. Top-End sales in the U.S. stayed on record level year-to-date reaching 72,400 units (+20%) driven by Mercedes-AMG (+32%), the G-Class (+61%) and Mercedes-Maybach (+171%). Overall Q3 sales were influenced by model changes of Mercedes-AMG derivatives and parts availability for the GLC.