As the strike began, GM was the most vulnerable, with its Cadillac and Chevrolet brands having the lowest inventory among domestic brands. Cadillac, still in early November, had the fifth lowest inventory among major brands with a 48 days’ supply.

Graphic: Cox Automotive

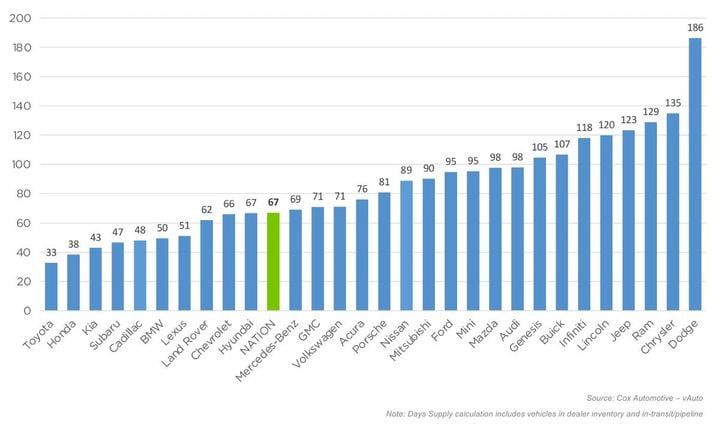

Despite UAW strikes at several plants throughout the month, new-vehicle inventory at the start of November was even higher than in early October, according to Cox Automotive’s analysis of vAuto Available Inventory data released Nov. 13.

The UAW and Detroit automakers have reached tentative contracts and settled the strike. Workers are back on the job as they vote on new contracts.

The total U.S. supply of available unsold new vehicles climbed to 2.4 million units, up 62%, or 919,000 units, from the same time a year ago. Inventory numbers include vehicles available on dealer lots and some in transit.

Days of supply climbed to 67 at the start of November, up from 60 at the start of October. Inventory, measured as days’ supply, was 41% higher than the same timeframe from one year ago. Days’ supply was last in the 60s, once considered normal and ideal, in March 2021.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period ended Nov. 6. Sales for the full month of October edged up nearly 2% from a year ago but were down 10% from September, thanks in part to one fewer selling day. The sales pace faded near the end of the month as the UAW strikes were ending.

Due to the strike, Detroit automakers scaled back sales to fleet customers, which helped push fleet sales down 10% from October 2022. October saw the first year-over-year fleet sales decline in 2023.

“Days of supply is creeping higher as the sales pace is slowing at the start of this year’s final quarter,” said Cox Automotive Senior Economist Charlie Chesbrough in a news release. “The supply issues that started in 2021 appear to have passed as most brands have seen their availability improve substantially. However, market headwinds from high interest rates and high prices are muting sales. As we enter the holiday sales season, greater discounting from the automakers seems likely. Otherwise, the days of supply will rise even further.”

Stellantis Still Has Highest Supply Despite Plants Going on Strike

Stellantis brands emerged from the UAW strike as it entered it – with the highest days’ supply among major brands. Dodge had the highest days’ supply, followed by Chrysler, Ram and Jeep, all with more than 100 days’ supply at the start of November.

As the strike began, GM was the most vulnerable, with its Cadillac and Chevrolet brands having the lowest inventory among domestic brands. Cadillac, still in early November, had the fifth lowest inventory among major brands with a 48 days’ supply. Cadillac’s highly profitable Escalade models had extremely low inventory, at around 20 days’ supply.

Chevrolet opened November in somewhat better shape than Cadillac with 66 days of supply. The newly redesigned Colorado pickup had only 24 days’ supply at the start of November as the UAW struck the Missouri plant that makes the Colorado and GMC Canyon. Chevrolet’s large profit-generating SUVs, the Suburban and Tahoe, each had under 35 days of supply. The Traverse and Trax also had low supplies. The Trax is made in South Korea, so the strike did not hurt it. However, the UAW went on strike at the Michigan plant that makes the Traverse, so some production was lost with that important vehicle.

GMC had a 71 days’ supply. Buick had more than 100 days’ supply.

Ford entered November with plenty of inventory overall. The Ford brand had 95 days of supply. The Ford Ranger was down to 34 days’ supply as the union hit the Michigan plant that makes it in September. The Bronco, made at the same Michigan plant, also had below-average inventory. Lincoln had more than 100 days’ supply.

As usual, Toyota, Honda, Kia and Subaru had the lowest supply among non-luxury brands starting in November. Of luxury brands, Cadillac, BMW, Lexus and Land Rover had the lowest.

Inventory Levels for Trucks Highest, Crossovers and Sedans Lowest

Of the top-selling 30 models, large trucks from the Detroit automakers had the largest supply entering November. Specifically, the Ram 1500, Chevrolet Silverado and Ford F-150 took top spots for high supply, which is normal for the industry.

Of top-sellers, small cars and crossovers had the lowest supply, with the Toyota Corolla Cross at the bottom with a skimpy 19 days’ supply. Other models at the low end included the new Toyota Grand Highlander, Honda CR-V hybrid and Toyota Corolla. The new Chevrolet Trax was also at the low end.

Average New-Vehicle Price Dipped

The average listing price – or asking price – remained relatively stable through October. At the start of the month, the average listing price for a new vehicle was $166 higher than how the month ended. The average listing price of $47,251 at the end of October was 1.5% below the same time a year ago.

Originally posted on Vehicle Remarketing