An indication of the growing shift to e-mobility on four wheels is seen on our roads in the form of green-plated SUVs, sedans and, more recently, hatchbacks as an increasing number of passenger vehicle buyers are preferring to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren.

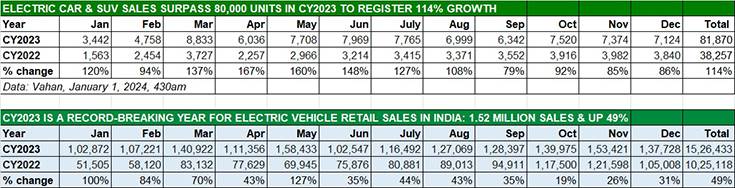

This movement is reflected in the retail sales. As per Vahan, a total of 81,870 electric cars, SUVs and MPVs were sold in the 12 months of CY2023 – 43,613 units more and up 114% YoY (CY2022: 38,257 units).

Sales of electric PVs exceeded 7,000 units for 8 consecutive montjhs since May 2023, helping the sector clock its best-ever annual sales of 81,870 units.

Sales of electric PVs exceeded 7,000 units for 8 consecutive montjhs since May 2023, helping the sector clock its best-ever annual sales of 81,870 units.

The data table above is indicative of the sustained demand last year. While FY2023-ending March 2023 (8,833 units) was the best month, May (7,708 units), June (7,969 units), July (7,765 units), October (7,520 units), November (7,374 units) and December (7,124 units) have each seen sales exceed the 7,000-units mark.

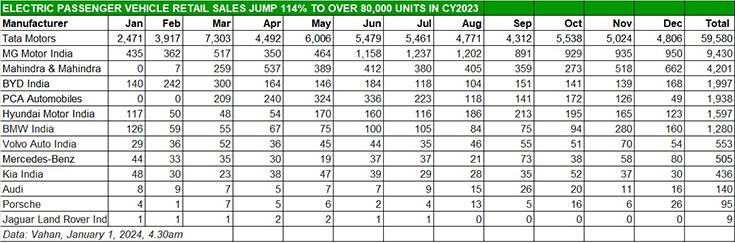

Electric PV market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), has sold an estimated 59,580 units, up 86% YoY (CY2022: 31,972 units) to maintain its commanding lead with a 73% market share. Tata’s market share used to be in excess of 80% but has now reduced due to the expanding and dynamic EV market which now has wider product choice from a growing number of rivals.

MG Motor India, with 9,430 units comprising the ZS EV and Comet EV, is the firm second-ranked ePV OEM and has a notable market share of 11.51 percent. Its CY2023 performance improves on its CY2022 sales of 3,430 units by 175 percent.

Mahindra & Mahindra, with 4,201 units, is in third position. The company, which has two products in the all-electric XUV400 – the first real rival to the high-selling Tata Nexon EV – and also retails the eVerito sedan, currently has a 5.13% EV market share.

BYD India, which sells the Atto 3 SUV and e6 MPV, is ranked fourth with total sales of 1,997 units, up 341% YoY (CY2022: 343 units) and a market share of 2.43 percent.

Just 59 units behind BYD India is PCA Automobiles India (Citroen India), which recently entered the EV market. Total sales of the Citroen eC3, the electric version of the C3 hatchback, are 1,938 units in 10 months since launch in end-February at Rs 11.50 lakh. This gives PCA India an EV market share of 2.36% – very creditable for a recent entrant and a pointer that e-hatchbacks will see demand going forward.

Korean carmakers Hyundai Motor India and Kia India have together sold 2,033 units, up 144% YoY (CY2022: 834 units). While Hyundai, which retails the Kona and the Ioniq 5, posted sales of 1,597 units, which is an increase of 158% over CY2022’s 619 units, Kia sold 436 units of the EV6 MPV, up 103% (CY2022: 215 units).

As per the Vahan data, luxury carmakers in India sold 2,582 units in CY2023, which constitutes handsome growth of 355% albeit on a low year-ago base of 567 units. BMW India has a strong lead with 1,280 units, followed by Volvo Auto India (553 units), Mercedes-Benz (505 units), Audi (140 units), Porsche (95 units) and Jaguar Land Rover (9).

ALSO READ:

EV share of auto sales in India grows to over 6% percent in CY2023

Record-breaking year for electric two-wheeler sales, Ola-TVS-Ather command 62% market share

Electric 3-wheeler sales clock 66% growth in CY2023 to over 581,000 units