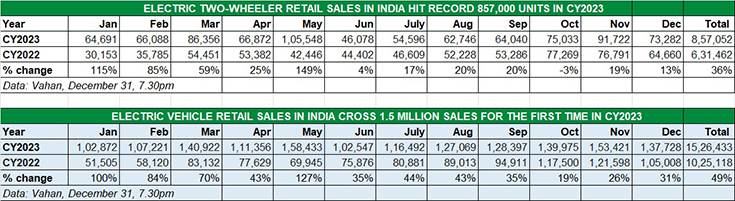

If India’s electric vehicle (EV) industry has been able to surpass annual sales of over 1.5 million units for the first time in a calendar year in 2023, it is thanks to the big volumes provided by the most affordable sub-segment – electric two-wheelers. Of the total 15,26,433 EVs sold across all segments in India in 2023 (up 49% YoY), electric scooters and motorcycles accounted for 857,052 units or 56%, recording strong double-digit growth of 36% (CY2022: 631,462 units).

While the initial cost of an electric two-wheeler remains higher than its petrol-engined sibling, what is making a growing number of consumers make the transition to e-mobility is the EV promise of wallet-friendliness in the long term. Petrol prices (Rs 106.29 on December 31 in Mumbai) have remained more or less unchanged since May 2022 albeit they are likely to see a price cut early in the new year.

Two-wheeled EV manufacturers are also benefiting from sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for e-two-wheelers used for e-commerce and food deliveries. This is thanks to the key advantage stemming from TCO (Total Cost of Ownership), particularly for fleet operators who clock plenty of kilometres each day. Like the aircraft industry, e-vehicles used for fleet operations make money the more they are on the road. It’s a plug-in-plug-out seamless operation for them – while 50% of the fleet would be out on the job, the other half is getting charged, ready to replace their parched brethren when they come in for their ‘juice’ of electricity.

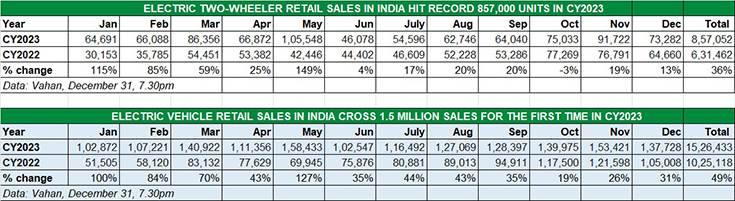

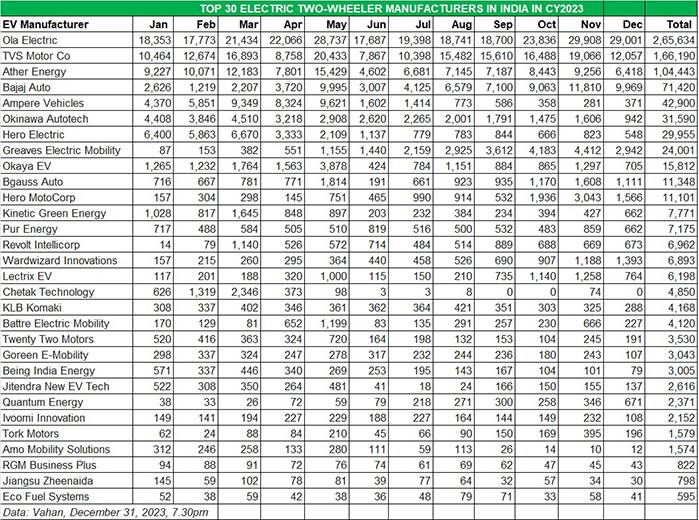

In a field comprising nearly 180 players, there are three OEMs which have captured the market in 2023. Ola Electric, TVS Motor Co and Ather Energy have each sold in excess of 100,000 units this year, and each has recorded its best-ever annual performance. The combined sales of this trio add up to 536,267 units, which constitutes 63% of India’s total e-two-wheeler sales. Interestingly, all three have their manufacturing plants in Tamil Nadu. While these three will continue to up the ante in the new year, the dark horse for CY2024 is Bajaj Auto, which has seen strong demand for its Chetak in CY2023.

Ola recorded strong 143% YoY growth in CY2023 and commands a 31% shre of the electric two-wheeler market in India. (Image: Ola)

OLA ELECTRIC: 265,634 units, 31% market share, 143% YoY growth

Ola, the first Indian EV maker to sell over 250,000 units in a single year, sold a total of 265,634 units to record handsome 143% YoY growth (CY2022: 109,394 units). This gives it a commanding share of 31 percent. Ola maintained its strong sales momentum through the year – 18,353 units in January, crossed the 20,000-unit mark for the first time in March (21,434 units) and notched a monthly best in festive November (29,908 units). In all of CY2023, Ola’s market share has been in excess of 25%, hitting a high of 38% in June when e-two-wheeler sales had crashed as a result of the slashed-by-25% FAME subsidy and total industry sales were down by 56% to 46,071 units.

On December 8, Ola began deliveries of its all-new S1 X+. Built on the Gen 2 platform, the S1 X+, which has a 3kWh battery, offers a certified range of 151km. Powered by a 6kW motor, the S1 X+ does the 0-40kph sprint in 3.3 seconds and can clock a top speed of 90kph.

Ola recently expanded its S1 portfolio to five scooters. Priced at Rs 147,499, the second-gen S1 Pro is the flagship scooter while the S1 Air costs Rs 1,19,999. Ola has targeted the ICE scooter market with its S1X in three variants – S1 X+, S1 X (3kWh), and S1 X (2kWh). CY2023 has seen Ola expand its D2C omnichannel distribution network and as of end-October 2023, the EV OEM had 935 experience centres and 392 service centres across India.

TVs sold 166,190 iQubes in 2023, which is a 252% YoY increase (CY2022: 47,185 iQubes) and gives it an EV market share of 19.39 percent.

TVS MOTOR CO: 166,190 units, 19.39% market share, 252% YoY growth

TVS Motor Co too has delivered a strong performance and with a single product – 166,190 iQubes, which is a 252% YoY increase (CY2022: 47,185 iQubes) and gives it an EV market share of 19.39 percent. In September, the iQube rode past the cumulative 200,000 sales milestone in 45 months since launch in January 2020. In August, the company had launched its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

Available in three variants (iQube, iQube S and iQube ST), the zero-emission TVS is priced between Rs 117,000 and Rs 124,000 (on-road Delhi) including the now-reduced FAME II subsidy (from 40% to 15%) and other state subsidies, for the iQube and iQube S respectively.

The top-spec iQube ST variant has a range of 140km on a single charge, nearly twice the 75km range on the first-gen model. The refreshed iQube retains its all-LED lights and 12-inch wheels but gets a host of connectivity features, driven by the various TFT instrument clusters on offer.

Since the e-scooter’s launch, TVS has gradually expanded its iQube retail network to over 140 cities and 310 touchpoints, and plans to double it to almost 600 touchpoints. Meanwhile, the company continues to improve on the ease of charging quotient for iQube owners, who currently have access to over 2,000 charging points with various charging partners through the TVS iQube mobile app.

Between January-November 2023, TVS Motor Co sold a total of 28,24,448 two-wheelers in India, of which 175,949 comprised the iQube which makes for an EV penetration level of 6.22 percent. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

The company, which has expanded its EV sales programme to Nepal and to Europe (from January 2024), is understood to be plotting a series of new EVs targeted at different customer segments with a complete portfolio offering between 5 to 25 kilowatts.

With retail sales of 104,443 units in CY2022, up 101.60% (CY2022: 51,806 units), Ather Energy currently has a 12% EV market share.

ATHER ENERGY: 104,443 units, 12.18% market share, 101% YoY growth

India’s No. 3 e-two-wheeler OEM is Bengaluru-based Ather Energy, registered CY2023 sales of 104,443 units, up 101.60% (CY2022: 51,806 units), which gives it a 12% market share.

While Ather’s rapid growth has been in tandem with the Indian electric two-wheeler market, with an aggressive Bajaj Auto hard on its heels, it is getting ready to protect its turf. The company is gearing up to launch the new Apex 450, billed to be the quickest and most powerful Ather yet. The company recently received a shot in the arm with early investor Hero MotoCorp set to increase its stake to 39.7% in January 2024.

Ather says it is developing a new platform, which will spawn two brand-new EVs. On November 22, Ather co-founder Tarun Mehta officially confirmed via a social media post about the upcoming launch of two new electric scooters – a family-oriented EV and an evolution of the existing 450X – in 2024. The new Ather could be tuned to deliver greater range and gentler performance and also likely be priced below the existing Ather 450 range to make it accessible to a wider audience. “It’s designed with your entire family in mind, offering comfort, ample size, and a whole lot more – all wrapped up in one fantastic package. We’re ensuring it’s affordable, making the Ather family experience accessible to more people,” said Mehta.

On the network front, Ather at present has around 150 experience centres across 100 cities. It plans to expand this to 120 cities and 200 outlets by end-FY2024. While it will refrain from going into deep rural areas, Ather Energy is confident that its upcoming products will strengthen its potential in Tier-2, Tier-3, and Tier-4 markets.

Bajaj Auto, with sales of 71,420 units, is hard on Ather’s (w)heels. On December 1, it launched the new avatar called Chetak Urbane MY2024 (above) with a 113km range and top speed of 73kph. Image: Bajaj Auto

Bajaj Auto, with sales of 71,420 units, is hard on Ather’s (w)heels. On December 1, it launched the new avatar called Chetak Urbane MY2024 (above) with a 113km range and top speed of 73kph. Image: Bajaj Auto

BAJAJ AUTO: 71,420 units, 8.33% market share, 235% YoY growth

While Ola, TVS and Ather continue their market-leading journey, the industry’s eyes though are on Bajaj Auto. The Pune-based legacy player, which entered the EV market in January 2020 (just like TVS), has recorded annual sales of 71,420 units, up 235% YoY (CY2022: 25,315 units).

Demand for the Chetak, Bajaj Auto’s sole electric scooter, is rising with every passing month as can be seen from the comprehensive Top 30 company-wise sales data table below. The Bajaj Chetak had a market share of 13% in November, quite a jump from the 4% it had in January 2023. The company is looking to ramp up production as well as expand its network of exclusive Chetak showrooms. Expect Bajaj Auto to be among the EV newsmakers in CY2024.

On December 1, 2023, Bajaj Auto launched a new avatar of the Chetak called the Urbane, which costs Rs 115,000 in its standard form, and Rs 121,000 for an additional ‘Tecpac’, which unlocks more features and performance. The company website lists the Chetak Urbane as having slightly higher range (113km) than the current Chetak (108km). However, in the case of the Urbane, this is the IDC-certified range, while for the current Chetak Premium, 108km is its claimed real-world range (its IDC rating is 126km). The new Chetak Urbane gets the same 2.9kWh battery capacity as the current model. The Chetak Urbane utilises the same colour LCD display as the Premium variant. In standard form, the Urbane offers a 63kph top speed, and comes with only one riding mode – Eco. With the ‘Tecpac’ installed, top speed rises to 73kph and the user gets a Sport riding mode as well.

Ramped-up production and an expanded Bajaj Chetak network, currently in 141 cities across India, is to be expanded to 250 cities by March 2024, should make Bajaj Auto a regular entry in the best-selling two-wheeler EVs monthly chart in India.

HOW THE OTHER OEMS STACK UP

In fifth position from the 185 players is Greaves Cotton company Ampere Vehicles with 42,900 units. Ampere’s sister arm Greaves Electric Mobility clocked sales of 24,001 units, which gives it eighth rank. Their combined sales add up to 66,901 units, which still puts Greaves behind No. 4 OEM, Bajaj Auto.

In fifth position is Okinawa Autotech with 31,590 units, down 69% YoY (CY2022: 103,621 units), a climbdown from its second rank in CY2022.

Hero Electric sold 29,955 e-scooters to get a 3.49% market share but like Okinawa has seen a sharp fall year on year – a similar 69% sales decline from CY2022’s 97,829 units which had given it the No.3 position.

Some of the other OEMs which recorded strong MoM growth include Okaya EV (15,812 units), Bgauss Auto (11,348 units), Kinetic Green Energy (7,771 units), Pur Energy (7,175 units), Revolt Intellicorp (6,962 units), Wardwizard Innovations (6,893 units) and Lectrix EV (6,198 units). Hero MotoCorp, which is seeing a surge in demand for its ICE commuter motorcycles as a result of the rural market bouncing back, sold 11,101 Vida e-scooters and is ranked 10th in a field of 180 players.

A MILLION ELECTRIC TWO-WHEELERS AND MORE IN 2024?

Calendar year 2024 has dawned today. Will the next 365 days deliver a sales pace that will help e-two-wheeler manufacturers surpass the 1-million-units mark?

Most of the leading OEMs like Ola, TVS, Ather Energy and Bajaj Auto, as well as a few others have outlined plans to launch new products this year. This, along with the increased coverage of EV charging infrastructure, both private and public, will act as a catalyst for growth in CY2024.

What is creditworthy about this segment’s performance in CY2023 is that, despite the sharp slashing of the FAME II subsidy by 25% in June, sales have rallied back. The fact that 467,497 e-two-wheelers were bought at higher prices compared to 389,555 units between January-May 2023 reflects a growing maturity in the market and a level of resilience, which offers hope to OEMS when the FAME II subsidy, which is active at present till March 31, 2024, is completely withdrawn. Or will it get an extension? The jury is still out on that at the moment but suffice it to say that the first three months of 2024 should see strong demand come EV OEMs’ way both from personal buyers as well as fleet operators. Stay plugged in as we bring you the latest updates on India EV Inc’s speedy zero-emission ride.

ALSO READ:

EV share of auto sales in India grows to over 6% percent in CY2023

Electric 3-wheeler sales clock 66% growth in CY2023 to over 581,000 units

Electric car, SUV and MPV sales jump 114% to over 81,000 units in CY2023