The Indian automobile industry, which consists of two- and three-wheelers, passenger vehicles (cars, utility vehicles and vans), and commercial vehicles, has had a good outing in CY2023. As per Vahan retail sales data on December 31, 2023 (10pm), India Auto Inc registered total sales of 2,39,15,336 units, up 11% on CY2022’s 2,15,70,424 units but this big number is still below India Auto Inc’s record sales of 2,54,47,582 units in CY2018. While sales of petrol, CNG and even diesel-engined vehicles have risen year on year, it is the growing demand for EVs which continues to make the headlines.

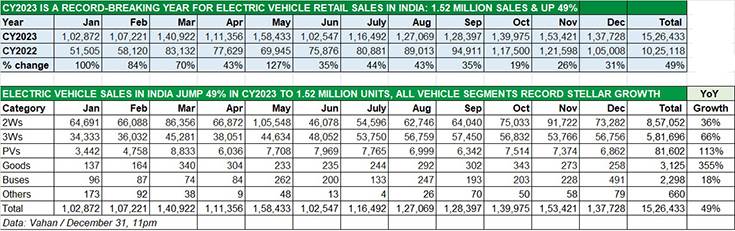

CY2023 witnessed a record total of 15,26,433 EVs sold across the country, which constitutes robust 49% YoY growth (CY2022: 10,25,118 units) and is reflective of the accelerating transition to eco-friendly, zero-emission transition in a country which is home to 20 of the world’s most polluted cities.

EV industry sales first crossed the 100,000-unit monthly sales milestone in October 2022 and since then have maintained that growth trajectory for 15 months on the trot. The 12-month data table below reveals that India EV Inc achieved 100,000-plus sales in every month of CY2023, with the best coming in May 2023 (158,432 units), ahead of the FAME subsidy being slashed from 40% to 25% for e-two-wheelers from June 1.

Decadal data table above reveals that from just a 0.01% share in CY2014, EV sales have risen to 6.38% of total India Auto Inc vehicle sales in CY2023.

OVER 3.45 MILLION ELECTRIC VEHICLES SOLD IN INDIA SINCE 2014

A deep dive into 10-year retail sales (see decadal data table above) reveals that a total of 3.45 million EVs have been sold in India since CY2014. In the early days of electric mobility in the country, demand understandably was tepid between 2014 and 2017, but crossed the 100,000-unit sales mark for the first time in 2018 with 130,252 units, up 49% YoY.

The rapid growth in EV sales numbers is reflected in the EV segment’s growing share of total automobile sales in India. The decadal data table above reveals that from just a 0.01% share in CY2014, EV sales have risen to 6.38% in CY2023.

Demand for EVs rose 91% in 2019 to 166,828 units but fell 25% to 124,652 units in the Covid-impacted 2020. It was CY2021 when the consumer shift to e-mobility, particularly in the two- and three-wheeler segments, took off – total EV sales jumped 166% YoY to 331,495 units and repeated the strong growth trajectory in CY2022 with a 209% increase to 1.02 million units. CY2023 has been the best year to date: 1.52 million units, which constitutes robust 49% YoY growth. It would have hit 50% if it weren’t for the expected marginal slowdown in sales in December 2023 – which were still up 31% YoY at 137,728 units – as consumers await the new year CY2024 registration to buy a new vehicle.

INDIA AMONG WORLD’S FASTEST GROWING EV MARKETS

India is among the many countries where the switchover to EVs is happening at a rapid pace. According to the World Resources Institutes, the top five countries with the highest share of EV registrations are Norway (EVs comprised 80% of passenger vehicle sales in 2022), Iceland (21%), Sweden (32%), the Netherlands (24%) and China (22%). Two other markets which have lower EV sales but are witnessing rapid growth are the European Union (12%) and the USA (6%).

India, which is the third-largest automobile market in the world, is aggressively driving awareness and adoption of EVs as a countermeasure to its serious air pollution problem. As is known, India is home to over 20 most polluted cities in the world. By 2030, the government has targeted EVs to account for 80% of two-wheelers and three-wheelers, 30% of passenger vehicles, 40% of buses and 70% of commercial vehicle sales.

In developing markets like India and also emerging markets, particularly in the ASEAN, two- and e-three-wheelers offer an affordable alternative to other forms of mobility which means electrification is important to support sustainable transportation.

Combined sales of electric two-wheelers (857,052 units / up 36%) and three-wheelers (581,696 units / up 66%) accounted for an overwhelming 94.25% of the Indian EV market in 2023, with electric cars, SUVs and MPVs (81,602 units / up 113%) contributing 5.34% and commercial vehicles (5,423 units / up 106% ), making up for a 0.35% share.

Suman Mishra, CEO, Mahindra Last Mile Mobility, is of the opinion that TCO or total cost of ownership of an EV is a key enabler to this shift of cargo- and passenger-carrying fleets towards EVs. Speaking at Autocar Professional’s EV Conclave in November 2023, she said: “The TCO advantage is well proven in both cargo- and passenger-carrying three-wheeler segments after considering the government subsidies. In the cargo category particularly, the rate of electrification has been significantly higher, because it is largely purchased by fleets which are better financed. Moreover, a sophisticated charging infrastructure is not required for electric three-wheelers, which can be easily recharged using a 15Amp socket, and that is also a key enabling factor towards the accelerated electrification of this segment.”

INDIA’S EVOLVING EV MARKET

CY2023 as well as the preceding two years have shown how India EV Inc is evolving when it comes to the overall electric mobility ecosystem. Whether it is the growing number of new EVs being launched, a growing level of R&D and significant investment from component manufacturers in making EV parts and creating a robust supply chain, the gradual expansion of EV charging infrastructure across the country through to exclusive EV retail showrooms from OEMs and both the Central and most State governments rolling out EV-friendly policies for EV manufacturing as well as EV buyers, the EV market dynamic is here to stay.

The initial cost of an EV compared to a conventional internal combustion engine remains 25-30% higher mainly due to the battery cost but as technology evolves, localization levels increase and OEMs benefit from economies of scale, this is bound to reduce and EV-ICE vehicle price parity could be foreseen in the not-so-long-term future in India.

What’s more, e-mobility is no longer an urban India phenomenon and has now spread to town and country as scores of vehicle users recognize the wallet-friendly nature of EVs while also contributing to eco-mobility. At present, over 30 lakh EV users are celebrating their independence from fossil fuels and helping reduce the carbon footprint. Uttar Pradesh, Maharashtra and Karnataka are the top three Indian states in terms of EV ownership, followed by Rajasthan, Delhi and Tamil Nadu.

As Shailesh Chandra, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said at Autocar Professional’s EV Conclave, ”The long-term story of BEVs is not a choice. It is an imperative because all the nations have signed for net carbon zero. The same pressure is on all the OEMs. There is no choice. It is only a matter of how fast this is going to happen.”

CY2024 has dawned and will see a host of EVs, across segments, being launched through the year. While the jury is still out as to whether the FAME II subsidy will be continued after April 2024, what remains a mainstream industry reality is the growing shift of consumers to the promise of electric mobility and also the vast potential of exports of both made-in-India EVs and EV components.

ALSO READ:

Record-breaking year for electric two-wheeler sales, Ola-TVS-Ather command 62% market share

Electric 3-wheeler sales clock 66% growth in CY2023 to over 581,000 units

Electric car, SUV and MPV sales jump 114% to over 81,000 units in CY2023