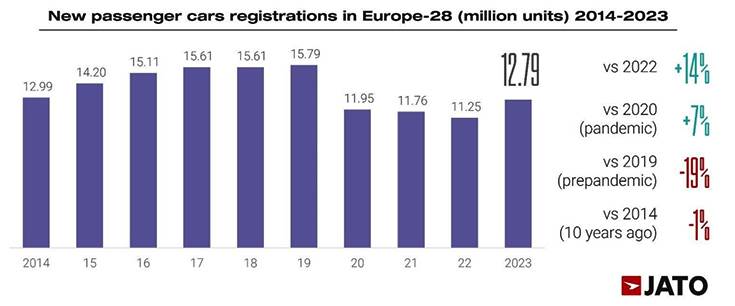

A 28% rise in electric car sales boosted Europe’s new car market to its strongest year since the Covid pandemic, according to industry analyst Jato Dynamics. A total of 12,792,151 cars were sold across Europe in 2023, up 14% on 2022 and a 7% increase over 2020.

Jato Dynamics analyst Felipe Munoz hailed the increase as a normalisation of the market, with supply chain disruption from the pandemic largely resolved. “Despite this, it’s unlikely we will see volumes surpass the 15 million units recorded in 2019,” added Munoz, who cited changing attitudes to car ownership and the increased cost of buying a new car. “Purchasing a vehicle has become more expensive, and attitudes to ownership continue to change,” he added.

A total of 12,792,151 cars were sold across Europe in 2023, up 14% on 2022 and a 7% increase over 2020 but are still 19% below 2019’s 15 million units.

A total of 12,792,151 cars were sold across Europe in 2023, up 14% on 2022 and a 7% increase over 2020 but are still 19% below 2019’s 15 million units.

Growth was driven by strong demand for new vehicles in markets including the UK, France, Italy, Spain, Belgium, Portugal, Croatia and Cyprus. However, the impact of high interest rates could be seen in Germany, which remains the largest market for new vehicles in Europe. “Some countries were more exposed than others. For example, we saw lower growth rates in Germany due to declining exports and concerns around the overall health of its economy,” said Munoz.

BEVs drive growth

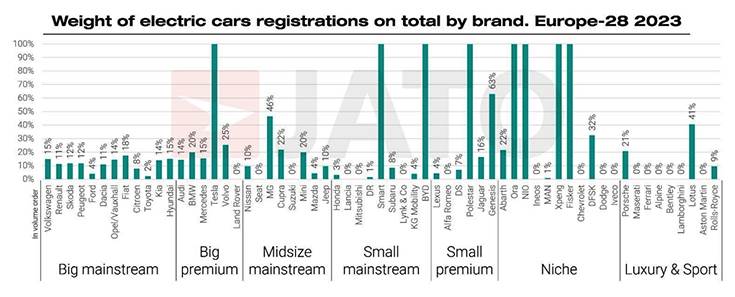

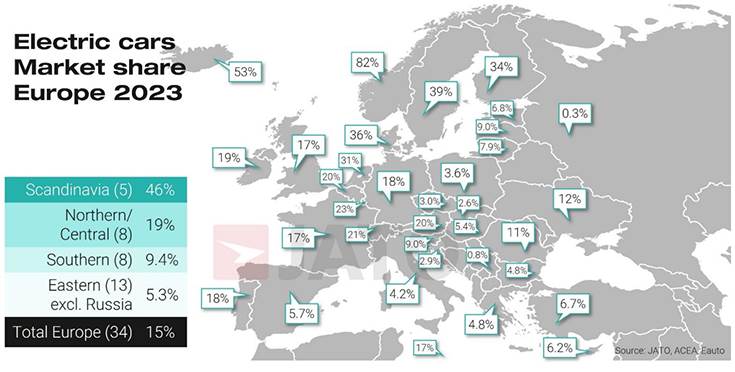

Much of the growth in Europe’s new car market in 2023 was driven by BEVs, which accounted for 15.7% of total market share with 2,011,209 units registered. This marks a new high for the category, almost equalling the 2,049,157 registrations of diesel cars. These results cement Europe’s status as the world’s second largest market for BEVs, behind China (~5 million units) but ahead of the US (1.07 million units).

According to data for 27 markets, BEV registrations made by fleets and businesses rose by 51%, compared to a 4% rise for private buyers. Notably, only 39% of overall BEV registrations were made by private buyers, down nine points from 2022. “The lack of interest from private buyers is a major hurdle for the industry to overcome. Sales to private individuals tend to be the most profitable for carmakers, and so it’s imperative that they do more to attract this type of customer,” Munoz stressed.

BEVs gained market share fastest in Finland, Denmark, Belgium, the Netherlands, and Luxembourg, rising from an already strong base in these markets. Strong growth was also recorded in markets where BEVs have a small market share, such as Slovenia (5.0% in 2022 to 9.0% in 2023), Estonia (3.4% to 6.8%) and Latvia (6.6% to 9.0%). By contrast, market share for BEVs in Croatia dropped from 3.2% in 2022 to 2.9% last year. The UK market remained stable, with a slight drop from 16.6% in 2022 to 16.5% in 2023, while minor growth of 0.5 points was recorded in Italy. Regionally, Scandinavia leads Europe by a significant margin with BEVs representing 46% of the total market, followed by Northern and Central Europe (19% market share), Southern Europe (9.4%) and Eastern Europe (5.3%). “The shift to BEVs is taking place at four different speeds,” Munoz highlighted.

Tesla sold 362,300 units in 2023 – up 56% year on year – giving the brand a record market share of 2.83%, up from 2.06% in 2022.

Chinese brands and Tesla the big disruptors

Another major change in the European automotive landscape in 2023 was the continued penetration of Chinese car brands. Seven new brands entered the market last year, joining the 23 brands already available in 2022. Overall, Chinese brands registered 321,918 units in 2023, up 79% year on year. “Although Chinese brands recorded a record market share of 2.6% in 2023, up from 1.7% in 2022, claims of an ‘invasion’ have been overstated,” said Munoz.

Only eight of the 30 Chinese brands available in Europe registered more than 1,000 units, and MG accounted for 72% of the total. The brand – founded in the UK but now under the ownership of China’s SAIC Motor – saw volumes more than double from 113,182 units to 231,818 units last year to achieve a market share of 1.81%, meaning it is now the 20th best-selling brand in Europe. MG outsold Cupra, Suzuki, Mini and Mazda, and was less than 14,000 units behind Spain’s Seat in the overall rankings.

Meanwhile, Tesla continued its extraordinary ascent up the brand rankings. The 18th most-registered brand in 2022, it has now leapfrogged Nissan and Volvo, rising to 16th place. The US manufacturer registered 362,300 units in 2023 – up 56% year on year – giving the brand a record market share of 2.83%, up from 2.06% in 2022. Tesla was the biggest market share winner within the BEV segment, followed by SAIC (MG), BMW Group, Toyota and Mercedes-Benz. By contrast, Renault Group, Stellantis, Hyundai Motor Company, Nissan and Ford posted the biggest market share losses within the BEV segment.

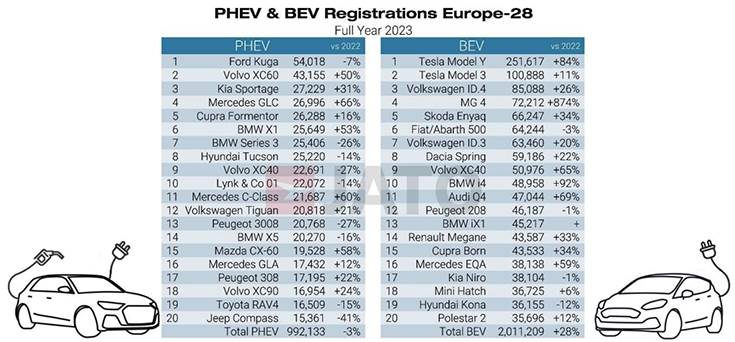

The Tesla Model Y became Europe’s most-registered model in 2023 – both the first time a non-European model and an electric model have led the rankings – and is the best-selling vehicle in markets including Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland. “The soaring popularity of the Model Y and price cuts across its range helped Tesla record its largest market share since arriving in Europe. Tesla has the right product in the right place at the right time,” Munoz commented.

Volkswagen Group boasts strong results

Germany’s Volkswagen Group held the largest market share in Europe in 2023, rising to 25.8% from 24.7% in 2022. Audi, Skoda, Seat and Cupra all gained market share last year – a result of their strong EV line-ups and attractive deals for older models such as the Audi A4, A1, and Q2 and the Seat Ibiza. Skoda’s Octavia and Kamiq, Audi’s Q4, Seat’s Ateca and Cupra’s Leon also posted strong results. Despite growing its overall market share, registrations of the VW Golf only increased by 4%, while the T-Cross saw a 5% drop. Volkswagen Group’s electric line-up performed well in 2023 with the ID.4 and the ID.3 in third and seventh place respectively in the BEV rankings.

However, these models were outperformed by direct competitors including the Tesla Model Y and the MG 4. The Model Y outsold the ID.4 by almost three times, despite boasting an average retail price 15% higher than the Volkswagen model. The MG 4 also outsold the ID.3 by 8,800 units, despite its average retail price being 5% higher than the ID.3 in Germany.

Other big winners include Suzuki, boosted by rising private registrations for the Vitara, Swift, Ignis and S-Cross models. Renault Group posted strong results for its Clio (+42%) and Dacia Jogger (+60%) models, and a strong start for the Renault Austral, while the Dacia Sendero was the second most-registered car in Europe. In sharp contrast to Volkswagen Group, Stellantis recorded the biggest loss in market share in Europe in 2023, dropping to 16.6% – its second consecutive loss since its establishment in 2021 when it had a market share of 20.3%. “The merger between Fiat Chrysler Automobiles and PSA Group to create Stellantis in 2021 has been positive for profitability, but negative for volumes and its market share. Stellantis is vulnerable to new entrants from China, and its four major brands lost ground in Europe last year,” Munoz highlighted.

Ranking by models

Ranking by models

From the models that were fully available in 2022, the strongest performers in 2023 were the Tesla Model Y, Renault Clio, MG ZS, Skoda Octavia, Toyota Corolla, Dacia Jogger, Nissan Juke, Toyota Yaris Cross, BMW i4, Seat Ibiza, and Audi Q4.

Among the latest launches (or the models that were not fully available throughout 2022), strong initial results were secured by the Renault Austral, MG 4, BMW iX1, Jeep Avenger, Nissan X-Trail, Opel/Vauxhall Astra, Peugeot 408, Alfa Romeo Tonale, and Mazda CX-60. The models which saw the biggest market share drops were the Toyota Yaris, Peugeot 208, Fiat/Abarth 500, Nissan Micra (discontinued in 2023), Ford Ecosport, Opel/Vauxhall Crossland, Toyota RAV4, Renault Zoe, Peugeot 3008, and Renault Kadjar (discontinued in 2023).

All data charts: JATO Dynamics