The rise in sales of electric passenger vehicles is now quite apparent as in the growing number of green-number-plated cars, SUVs and MPVs seen on Indian roads. Growing awareness about EVs, increased choice as a result of EV manufacturers launching new products, improving charging infrastructure particularly in urban India and the lure of a wallet- and eco-friendly vehicle are driving demand.

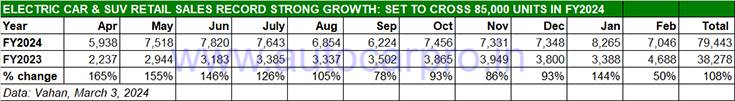

As per Vahan data as of March 3, 2024, a total of 79,443 electric cars, SUVs and MPVs (LMVs and LPVs) have been sold in the past 11 months (April 2023-February 2024). Year on year, that works out to an additional 41,165 units and strong 108% growth.

Electric PV market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers) and the Punch EV, has sold an estimated 55,734 units, which helps it maintain its lead with a 70% share in a dynamic market which is seeing rivals roll out new competitive products.

MG Motor India has sold 10,328 units in the past 11 months. Its two products – the ZS EV and Comet EV – ensure it is the firm second-ranked ePV OEM with a 13% market share.

Mahindra & Mahindra, with 5,236 units, is in third position and has a 7% EV market share with its all-electric XUV400. In mid-January 2024, the company launched the new XUV400 Pro range, with prices starting from Rs 15.49 lakh, going up to Rs 17.49 lakh for the new top-spec EL Pro variant. The prices are introductory and are applicable to deliveries until May 31, 2024.

PCA Automobiles India (Citroen India) has jumped ranks to take fourth position with sales of 1,818 EVs which gives it a market share of 2.28%. This is creditable, given that it launched the Citroen eC3, the electric version of the C3 hatchback, in February 2024.

Hyundai Motor India, which sells the premium Ioniq 5 and the Kona EVs, has clocked retail sales of 1,657 units between April 2023 and February 2024. The Ioniq 5 accounts for the bulk of the sales, which have given Hyundai a 2% market share.

BYD India, which sells the Atto 3 SUV and e6 MPV and will launch the Seal sedan on March 5, has sold a total of 1,618 units till end-February 2024.

As per the Vahan data, luxury carmakers in India sold 2,636 units in the first 11 months of FY2024. BMW India maintains its lead with 1,338 units, followed by Volvo Auto India (541 units), Mercedes-Benz (501 units), Audi (152 units), Porsche (7 units) and Jaguar Land Rover (7).