India on Friday announced concessional tariffs for global electric vehicle (EV) makers such as Tesla, including a drastic cut in customs duty, as an incentive to set up manufacturing facilities in the country. The contours of the Scheme to Promote Manufacturing of Electric Passenger Cars in India are in line with a persistent demand from the Elon Musk-led company to lower India’s 70% import duty on cars if it was to establish a plant in India.

The policy allows a sharply reduced rate of 15% customs duty for up to 8,000 EVs annually imported by a company that commits to Make in India. According to the policy document, carryover of any unutilised annual import limits will be permitted. The finance ministry notified the lower duty rate on Friday.

“Companies setting up manufacturing facilities for EVs will be allowed a limited import of cars at lower custom duties,” said heavy industries minister Mahendra Nath Pandey.

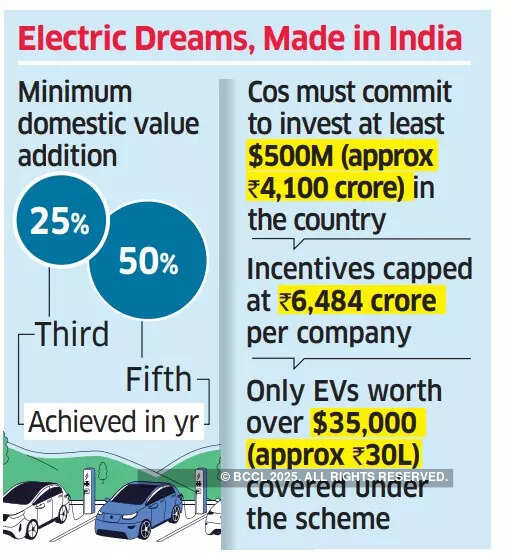

The new scheme offers the concessional import duty for five years to companies that commit fresh investment of at least $500 million in the country. “The government has unveiled a groundbreaking policy aimed at supercharging domestic EV manufacturing,” said EY partner Saurabh Agarwal.

This will propel India into the high-tech EV arena, he said. While the heavy industries ministry notified the policy, it has been steered by the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry (MOC&I).

“The idea is to kickstart four-wheeler, ecar manufacturing in India, with very stringent kind of value addition norms while also ensuring that we allow imports in a very limited quantity,” said DPIIT secretary Rajesh Kumar Singh, highlighting the thinking behind the policy. He added that 15% is the normal custom duty in most countries, including China. “In Europe and US… it is far less,” Singh said.

Without naming any automakers, he said EV companies are interested in investing in India. “At least two are there but there could be more,” he said. “There are multiple such expressions of interest.” Under the policy, each vehicle imported should be worth more than $35,000 (Rs 30 lakh) without local levies when being brought into the country. Clubbing together local taxes and marketing margins, such an imported vehicle is expected to retail at closer to Rs 40 lakh.