Indonesia-listed tech giant GoTo’s losses widened by 124% during the financial year ended 2023, although it managed to hit a positive adjusted EBITDA in Q4 2023, according to an announcement on Tuesday.

The company’s net loss stood at 90.5 trillion rupiah in 2023, mainly driven by a 78.8-trillion-rupiah goodwill reversal as required by prevailing accounting standards following the Tokopedia-TikTok merger.

“The loss due to reversal of goodwill is non-recurring and non-cash in nature and has no impact on the company’s adjusted EBITDA and cash flow,” the company statement read.

Its losses in Q4 2023 stood at 80.9 trillion rupiah, a 315% jump from Q4 2022.

The group’s gross revenue grew 6% to 24.3 trillion rupiah for the full year 2023 from 23 trillion rupiah in the same period a year earlier. Meanwhile, its gross revenue in Q4 2023 increased around 3% to 6.5 trillion rupiah from 6.3 trillion rupiah a year earlier.

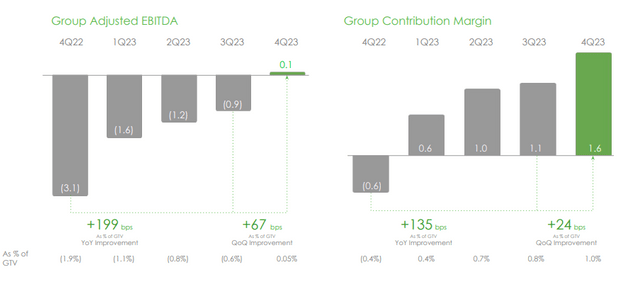

GoTo hit a positive adjusted EBITDA for the three months ended Dec 31, 2023, at 77 billion rupiah, compared to a negative adjusted EBITDA of 3.1 trillion rupiah in Q4 2022. In FY23, GoTo clocked a negative adjusted EBITDA of 3.7 trillion rupiah, a 77% improvement from 16 trillion rupiah in the same period a year earlier.

“GoTo has established a solid operational base, achieving adjusted EBITDA profitability in Q4 2023, and formed a strategic partnership with TikTok in the e-commerce domain, which will expand into financial technology and on-demand services. Looking ahead, our focus is on strengthening this base to foster accelerated, profitable growth,” Patrick Walujo, CEO of GoTo, said in a statement.

The GoTo Group’s gross transaction value (GTV) increased marginally to 163 trillion rupiah in Q4 2023, primarily driven by the company’s focus on the mass market segment. In FY23, the group’s GTV declined 1% year on year due to reduced incentives and product marketing in 2023.

GoTo managed to cut its total costs and expenses—including sales & marketing and administrative expenses—by nearly half in 2023 to 17.1 trillion rupiah from 32.2 trillion rupiah in the same period a year earlier.

Furthermore, as cash flow continues to improve, the company plans to optimise its capital usage in line with a newly developed capital allocation plan, which may include a share buyback initiative of $200 million subject to regulatory and shareholder approval.

In the beginning of this year, GoTo reported that the company achieved a positive adjusted EBITDA in Q4 2023 while surpassing the upper limit of its full-year adjusted EBITDA guidance range.

The company expects to achieve adjusted EBITDA breakeven in the financial year 2024.

“We will (achieve our target) by staying true to our mission, which extends to enriching our customers’ experience and making our products and services accessible to a broader audience. Our approach is centred on continuous product innovation and operational excellence, as we aim to increase the value we offer to existing customers, expand our wallet share, and grow our customer base. We will double down on successful strategies that help us achieve this while exploring innovative new ventures and discontinuing any initiatives that are non-scalable,” Walujo said.