Singapore-based shopping and rewards platform ShopBack is trimming its workforce by 24%, eliminating 195 roles, according to an announcement on Tuesday.

ShopBack, backed by Singapore state investor Temasek, had posted losses of $60.8 million for the year ended March 31, 2023—up 27.5% from the previous year. The firm’s revenue, meanwhile, declined about 25% to $87.68 million in FY2023, DealStreetAsia reported in January based on regulatory filings.

While its total assets more than doubled to S$345.4 million in FY2023 from S$160.5 million in FY2022, total liabilities, soared 4x to S$735.5 million from S$169.6 million.

In FY2022, the company had tripled its revenues but losses narrowed only marginally.

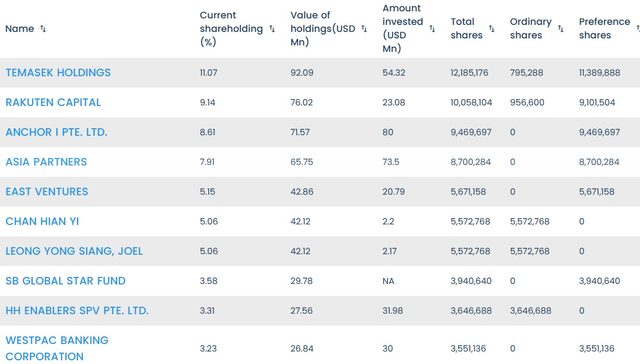

According to DealStreetAsia’s DATA VANTAGE, the cashback platform has raised more than $383 million to date. Its top backers include Temasek, Rakuten Capital, SoftBank Ventures Asia, Asia Partners and East Ventures.

ShopBack’s top shareholders

The company embarked on an ambitious expansion plan in 2021 and early 2022 wherein it scaled up its team from 550 to over 900 employees. In 2021, it acquired the fintech platform Hoolah, which allowed it to expand its buy-now-pay-later (BNPL) services in Southeast Asia. However, it will be discontinuing its BNPL service in March, the company said without citing reasons.

From Q2 2022 the company was unable to sustain its aggressive growth path and started to focus more on cost efficiency.

Henry Chan, CEO & Co-founder of Shopback said in the announcement that the company had since cut back on salary increments, performance bonuses, and welfare budgets. “Despite our efforts to reduce costs since 2022, sustainable growth remains a challenge.” Chan acknowledged that charting an aggressive expansion path was an error in judgement.

Founded in 2014, ShopBack operates in 11 countries, with a major presence in Southeast Asia and Australia. The company provides a shopping platform with cashback and other rewards from brands and retailers like Foodpanda and Dyson.