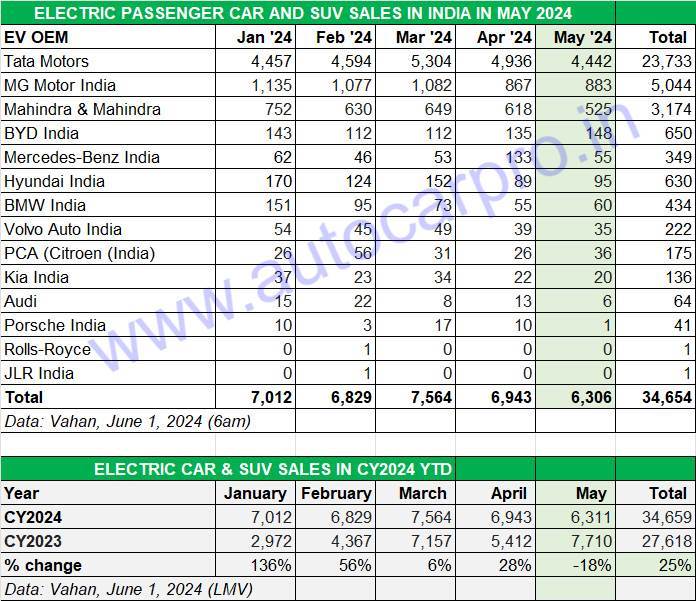

After a good opening month of FY2025 which saw retail sales of 6,943 electric passenger vehicles, up 28% YoY (April 2023: 5,412 units), demand was tepid in the scorching month of May 2024. Total retails last month, as per Vahan data for light motor vehicles, as of June 1 morning, were 6,311 units, down 18% on May 2023’s 7,710 units.

It is likely that May 2024, which saw hectic election activity across the country along with the blistering heat in different parts of the country, would have witnessed fewer potential buyer visits to electric PV showrooms. Also, given that the month of May is part of the holiday season, a fair number of this target audience would have been out.

Nevertheless, on the cumulative sales front, the growth trajectory remains in high double digits. At 34,659 units sold in the January to May 2024 period, the YoY increase is 25% (January-May 2023: 27,618 units).

Cumulative sales of electric passenger vehicles in the first five months of CY2024 at 34,659 units are up 25% year on year.

Cumulative sales of electric passenger vehicles in the first five months of CY2024 at 34,659 units are up 25% year on year.

Electric PV market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers) and the Punch EV, retailed a total of 4,442 units in May 2024, which helps it maintain its lead with a 70% market share, slightly down from the 71% share in April. For the first five months of this year, Tata Motors’ cumulative sales at 23,733 units make for a 68% market share, reflecting the growing competition in the form of new products and choice for the buyer.

The well-entrenched No. 2 OEM, MG Motor India sold 883 units in May 2024, with its two products – the ZS EV and Comet EV – giving it a 14% market share.

Mahindra & Mahindra, with 525 units of the XUV400, is in third position and has an 8% EV market share. In mid-January 2024, the company launched the new XUV400 Pro range, with prices starting from Rs 15.49 lakh, going up to Rs 17.49 lakh for the new top-spec EL Pro variant.

BYD India, which sells the Atto 3 SUV, e6 MPV and launched the Seal sedan on March 5, has maintains its fourth position it acquired in April in May with sales of 148 units. This is the company’s best monthly performance in the year to date, the previous best being 143 units in January 2024. Expect the Seal sedan to have contributed to the growth.

Hyundai Motor India, with 95 EVs sold in May, takes fifth rank both for the month and for the January-May 2024 period with cumulative sales of 630 units, just 20 units behind BYD.

As per the Vahan data, luxury carmakers in India sold 157 units in May 2024, which gives them a 2.48% share of the Indian EV market last month. Their May 2024 numbers are down 34% on April 2024’s sales of 237 luxury cars and SUVs. BMW India topped the chart last month with 60 units, followed by Mercedes-Benz India (55 units) and Volvo Auto India (35 units).

The electric luxury car and SUV segment continues to witness strong growth, which comes on the back of a sterling performance in CY2023 when estimated retail sales at 2,640 units were up 366% on CY2022’s 566 units. In the current calendar year, cumulative sales of 1,112 units in the first five months are already 42% of CY2023’s total retails.