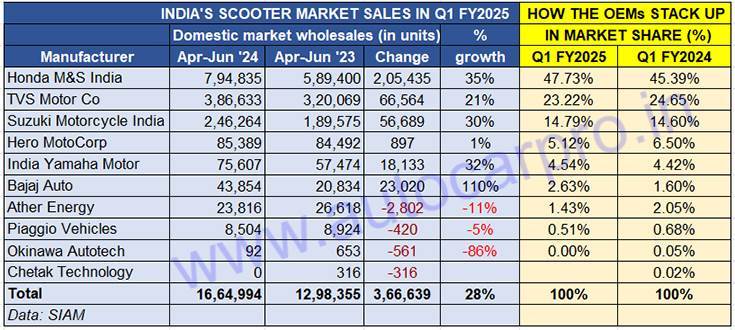

Of the four vehicle segments – passenger vehicles (up 3%), two-wheelers (p 20%), three-wheelers (up 14%) and commercial vehicles (up 3.5%) – the two-wheeler industry was the only one to have registered strong double-digit gains in April-June 2024. A fair portion of that credit goes to the scooter market which, with 1.66 million units, accounted for 33% of total two-wheeler sales of 4.98 million units. Motorcycles (3.19 million units and 17% YoY growth) and mopeds (122,715 units, up 16%) accounted for 64% and 2.46% of the overall two-wheeler market respectively.

The scooter market, with 1.66 million units and strong 28% growth, accounted for 33% of total two-wheeler sales of 4.98 million units

The scooter market, with 1.66 million units and strong 28% growth, accounted for 33% of total two-wheeler sales of 4.98 million units

As a result of the revival in the scooter market, growth has been democratised for the top six OEMs albeit the market leader, Honda Motorcycle & Scooter India (HMSI) nearly hit the 800,000 wholesales mark with 794,835 units, a 35% YoY increase and dispatching 205,435 additional scooters compared to Q1 FY2024. This stellar performance sees HMSI’s share rise to 48% from 45% a year ago. Clearly, consumer demand for the Activa brand of scooters – both the 110cc and 125cc variants – remains as strong as ever. However, as good as this Q1 number is, it is still much below the 1.11 million scooters HMSI had sold in Q1 FY2019 when the scooter industry had clocked 1.81 million scooters. This

TVS Motor Co, the longstanding No. 2 scooter OEM, dispatched 386,633 units in April-June 2024, up 21% YoY and an additional 66,564 units compared to Q1 FY2024. The dispatches comprised 337,469 units of the flagship Jupiter and NTorq scooters (up 22%) and 49,164 units of the electric iQube (up 27%). However, TVS’ market share is marginally down to 23% from 24.65% a year ago.

Suzuki Motorcycle India, with 246,264 units, posted strong 30% growth and a slight increase in market share to 14.79 percent. The company, which sells the 125cc Access, Avenis and Burgman, would have seen strong demand for the Access 125 which remains a popular buy.

At No. 4 is Hero MotoCorp, with 85,389 units in April-June 2024 and just 1% growth. The sales comprise 74,830 IC-engined scooters (Pleasure+, Maestro Edge and Destini 125) and 10,559 Hero Vida electric scooters. In fact, thanks to the 203% YoY increase in Vida sales (Q1 FY2024: 3,480), Hero MotoCorp has been saved the blushes because demand for its IC scooters (74,830 units) was down 7.63% (Q1 FY2024: 81,012 units).

India Yamaha Motor, which retails three scooters – the 125cc Ray and Fascino, and 155cc Aerox – sold a total of 75,607 units, up 32% YoY. While combined Ray and Fascino sales at 70,441 units rose 22%, Yamaha also sold 5,166 units of the Aerox. On April 14, the company had launched the keyless ignition Aerox Version S at Rs 151,000.

Bajaj Auto, which was ranked seventh a year ago, moves up one place to sixth. The company, whose sole scooter is the electric Chetak, has had a strong opening quarter in FY2025 with 40,854 Chetaks sold, up 96% YoY (April-June 2023: 20,834 units). June 2024 sales at 16,691 units are the Chetak’s highest monthly sales yet since its launch in January 2020. In the process, this zero-emission Bajaj has surpassed the cumulative 200,000 sales milestone, with the last 100,000 units being sold in just eight months.

How will demand shape up for the scooter and the overall two-wheeler industry in the months to come? The Union Budget 2024 proposals, announced yesterday, have a sharp focus on driving up income in rural India should help rev up demand. Tweaks in personal income tax, which will result in enhanced remuneration for salaried employees, could also prove to be growth enhancers.

ALSO READ:

Budget 2024 spells status quo for major schemes at India Auto Inc