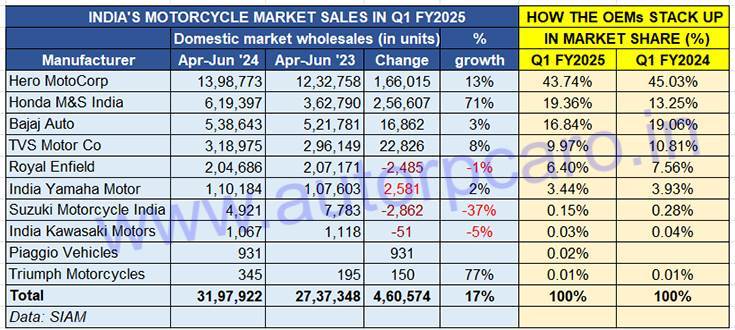

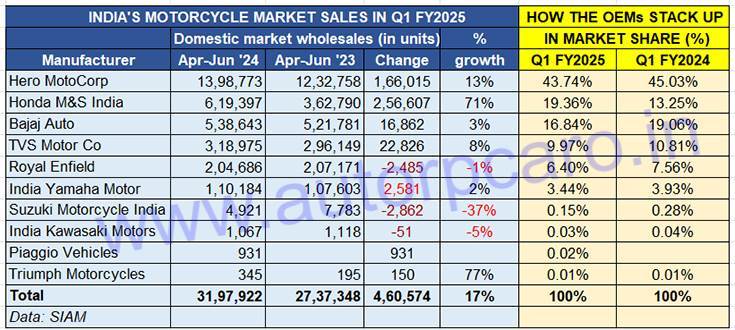

A revival of demand in the two-wheeler industry has meant that all three sub-segments – motorcycles, scooters and mopeds – posted double-digit gains in the first quarter of FY2025. A total of 3.19 million two-wheelers were sold between April and June 2024, up 17% (Q1 FY2024: 2.73 million units). Motorcycles (3.19 million units / 17% YoY growth) led the charge, followed by scooters (1.66 million units / 28% growth) and mopeds (122,715 units / 16% growth).

The bulk of the motorcycle demand, as always, was in the volume segment – commuter bikes. In Q1 FY2025, a total of 15,03,398 such fuel-sipping motorcycles were sold, up 12% (Q1 FY2024: 1.34 million). The second in terms of volume is the 110-125cc executive bike segment with 913,793 units, up 19.62% (Q1 FY2024: 763,905), followed by the 150-200cc segment with 334,207 units, up 21% (Q1 FY2024: 224,655). The two other segments which registered six-figures sales are the 125-150cc category – 174,934 units, up by a strong 64% (Q1 FY2024: 106,609) and the 250-350cc segment. Sales in the 250-350cc segment were down 3.5% YoY to 195,129 units (Q1 FY2024: 202,215).

Let’s take a quick look at each of the top six motorcycle manufacturers and their Q1 performance.

Market leader Hero MotoCorp remains in an unassailable position – its 1.39 million units saw it dispatch an additional 166,015 bikes to post 13% growth. However, despite the big number, Hero MotoCorp’s bike market share has fallen marginally to 43.74% from 45.02% a year ago. The 97.2cc HF Deluxe, Splendor + and Passion Plus account for the bulk of its sales – 11,94,641 units, up 12% and comprising 85% of the company’s total dispatches in Q1. In the 110-125cc category, the Passion XTEC, Super Splendor and Glamour together clocked 181,723 units, up 19 percent. In the 125-150cc category, the XPulse and Xtreme sold 15,137 units, down 3 percent. The company’s recent entry into the 350-500cc segment with the Harley-Davidson 440 and Mavrick 440 saw it sell 5,125 units.

In terms of YoY gains, Honda Motorcycle & Scooter India has achieved the most amongst all the OEMs in Q1 FY2025. The Japanese automaker sold 619,397 units to record handsome 71% YoY growth (Q1 FY2024: 362,790 units). This works out to an additional 256,607 units, which is reflected in HMSI expanding its bike market share sizeably to 19% from 13% a year ago. The entry level duo of the Shine 100 and CD110 Dream sold 109,732 units, up 106% (Q1 FY2024: 53,135). HMSI’s biggest gains continue to be in the 110-125cc segment – the Shine 125 sold a total of 387,832 units, up 43% (Q! FY2024: 271,745), and accounted for 63% of the company’s total bike sales. While the 149cc Unicorn sold 51,491 units, HMSI saw strong gains in the 150-200cc segment – CB 200X, Hornet 2.0, XBlade – with sales of 59,774, up 123% (Q1 FY2024: 23,692).

Bajaj Auto, ranked third on the motorcycle OEM ladder-board, dispatched 538,643 units in Q1, just 3% more than it did a year ago. In the entry-level 100-110cc segment, its sales at 125,423 units were down 9 percent. Demand in the segment above (125cc) was also down – the 226,041 units constitute a decline of 5.67% YoY. Things were better though in the 125-150cc category with 83,264 units, up 58 percent albeit the 65,135 units in the 150-200cc category saw a more tepid increase of 1.43 percent. The 200-250cc category saw Bajaj sell 26,085 units, up 22% YoY. Where Bajaj has hit a sixer is in the 350-500cc category – the 12,695 units emanating from the Dominar, Pulsar, Husqvarna, KTM and Triumph brands are a stellar 135% YoY increase (Q1 FY2024: 5,387 units). This mixed bag kind of performance sees Bajaj Auto’s Q1 FY2025 market share drop to 17% from 19% a year ago.

Bajaj Auto though headlined the motorcycle market in June. One of the main new product highlights of Q1 was the launch of the Bajaj Freedom 125, the world’s first CNG motorcycle, on June 5. The Freedom 125, which is claimed to slash operating costs by up to 50% compared to petrol-engined bikes, has a combined CNG-petrol range of 330km.

TVS Motor Co dispatched 318,975 motorcycles in April-June 2024, up 8% (April-June 2023: 296,149 units). In the entry level segment, the trio of the 100cc Sport and the 110cc Star City Plus and Radeon sold 73,602 units, down 15% YoY. The Raider 125, which was TVS’ best-selling motorcycle in FY2024 with 398,354 units, sold 118,197 units, up 18% YoY, and accounted for 37% of TVS entire bike sales in Q1 FY2025. The Apache series of bikes in the 150-200cc segment sold 120,588 units, up 11% YoY, and marking a resurgence of demand for the TVS Apache, which is sold across the 160, 165, 180 and 200cc capacity. TVS also sold 5,652 Ronins and 936 units of the RR 310.

Midsize motorcycle market leader Royal Enfield sold 204,686 bikes in the first three months of FY2025, down 1% on year-ago dispatches (April-June 2023: 207,171 units). The 500-800cc sub-segment is the only one in which Royal Enfield registered growth. Despite being the market leader (94% share) in the 250-350cc segment with 183,450 of its 349cc motorcycles, sales in Q1 FY2025 were down YoY by 3% (April-June 2023: 189,647 units). Likewise, in the 350-500cc sub-segment, where it has the Scram 411 and the 452cc Himalayan, RE saw its Q1 FY2025 sales down by 14% to 9,293 units from 10,840 units a year ago.

The 650cc twins (Continental GT 650 and Interceptor 650) along with the Super Meteor 650 and Shotgun 650, all powered by the same 648cc engine, continue to see strong demand, and helped prevent Royal Enfield from a higher rate of quarterly sales decline in the first quarter of FY2025.

As per the latest SIAM industry wholesales data, between April-June 2024, the Chennai-based bikemaker sold a total of 11,943 units, up 79% YoY (Q1 FY2024: 6,684 units) and commanded 96% of the 500-800cc sub-segment’s total dispatches of 12,408 units.

India Yamaha Motor is the last of the bikemakers with six-figure or more sales. At 110,184 units, Yamaha posted marginal 2% YoY growth (Q1 FY2023: 107,603 units). The company, which remains absent in the volume 110cc and 125cc segments, sold 40,178 units of the 149cc FZ series bikes, down 26% YoY. There was strong demand though for the 155cc Yamaha MT15 and YZF R15 – the 69,945 units are a 31% increase over year-ago sales of 53,437 units.

How will demand shape up for the motorcycle and the overall two-wheeler industry in the months to come? The Union Budget 2024 proposals, announced yesterday, have a sharp focus on driving up income in rural India should help further rev up demand for fuel-sipping commuter motorcycles. Meanwhile, the tweaks in personal income tax, which will result in enhanced remuneration for salaried employees, could also prove to be growth enhancers for bikes in the executive segment. Stay tuned for more updates.