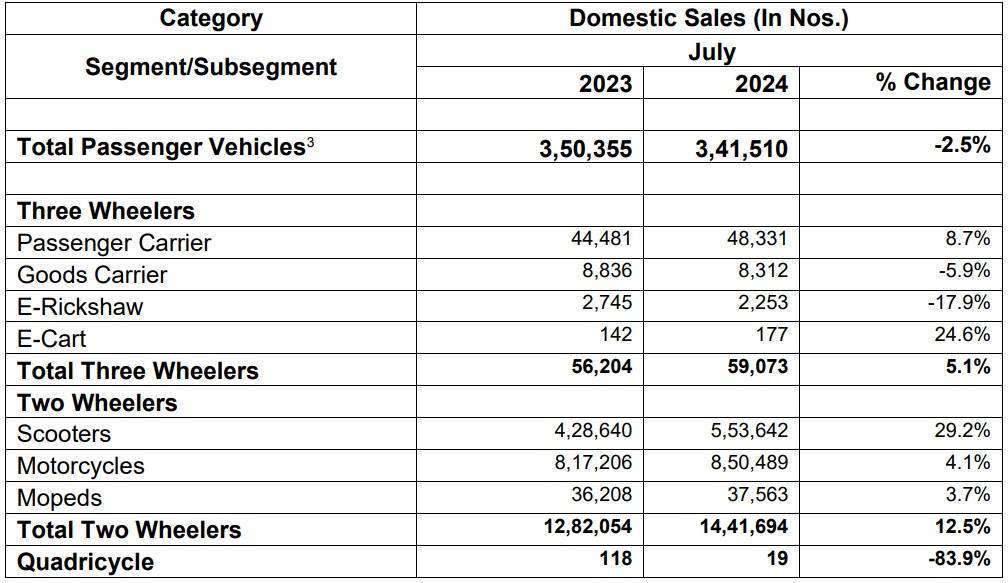

India’s passenger vehicle industry reversed its course in July, as the segment’s monthly wholesales recorded its first decline in several months. Domestic passenger vehicle dispatches in July fell 2.5% on year. However, the two-wheeler and three-wheeler segments continued to see an upward trajectory in the month.

According to the data from the Society of Indian Automobile Manufacturers (SIAM), domestic passenger vehicle dispatches in July came in at 3.42 lakh units, compared with 3.50 lakh units in the year-ago period. Major brands – Maruti Suzuki, Hyundai and Tata Motors – recorded a decline in sales.

Though the sales of utility vehicles registered a growth during the month, it could not offset the impact of the decline in the sales of compact cars and sedans. The weakness in small cars and sedans reflects the broader shift in consumer preference toward sports utility vehicles.

The declining trend in the passenger vehicle segment highlights the automakers’ efforts to rationalise the supplies to dealerships. Dealers across the country have been flagging concerns over the rising inventories, and the piling up of unsold cars at dealerships.

The Federation of Automotive Dealers Association last week, noted that passenger vehicle segment inventory has surged to historic highs of 67-72 days, amounting to Rs 73,000 crore worth of stock. However, retail sales of passenger vehicles were robust in July, with a growth of 10% on year, driven by the availability of more models and discounts.

Passenger vehicle production rose marginally by 1.2% on year to 3.98 lakh units, almost in line with domestic wholesales and exports. Indian carmakers exported 61,929 units in July, up 3.9% on year. Exports are picking up gradually, as key foreign markets gradually recover from the economic slowdown.

Production and export numbers do not include data from Tata Motors, BMW, Mercedes, JLR and Volvo Auto.

Meanwhile, domestic two-wheeler wholesales in July, recorded a growth of 12.5% on year to 14.42 lakh units. Expect Hero MotoCorp, Yamaha India and Royal Enfield, all other major automakers recorded growth. Honda Motorcycle and Scooters India dispatched the largest number of two-wheelers.

Growth in the two-wheeler market comes as the segment continues to recover, with green shoots in the rural economy. Two-wheeler sales are often seen as a proxy for the economy’s well-being. Though the summer was harsh this year, this monsoon looks normal in many states, boosting consumer sentiments.

The retail sales of two-wheelers also underline the robust demand in the market. FADA data showed that two-wheeler retails rose 17% on year in July.

Two-wheeler production during the month jumped 21.1% on year to 19.48 lakh units. Automakers usually boost the supplies to the market, ahead of the festival season, which will start in September this year. Exports also rose 7.8% on year, to 3.25 lakh units in the month.

Source: SIAM

Source: SIAM

Three-wheeler wholesales in July totalled 59,073 units, up 5.1% on a year-on-year basis. Passenger carriers recorded a growth of 8.7% to 48,331 units, while the goods carrier segment declined 5.9% to 8,312 units. Exports improved marginally by 1.1% to 27,074 units.

“The above average rainfall coupled with the upcoming festive season is likely to again propel growth in the short term. In addition, enabling budget announcements that emphasise overall economic growth, with fiscal support for infrastructure and the rural sector should augur well for the Auto sector in the medium term,” SIAM President Vinod Aggarwal said.

Read More: Maruti Suzuki says inventory ‘slightly higher, but manageable’

Read More: PV industry expects FY25 volume growth in single digit

Read More: India’s two-wheeler market to hit new peak by FY25, says Bajaj Auto’s Rakesh Sharma