The battle between the two Indian two-wheeler legacy players – TVS Motor Co and Bajaj Auto – for supremacy in the EV market has grown intense in the first four months of FY2025. The wholesales gap between them at the end of July, for the April-July 2024 period, is less than 10,000 units. In FY2024, at the end of March 2024, the two OEMs were separated by 74,194 units, both having hit their all-time highs – TVS with 189,896 iQubes and Bajaj with 115,702 Chetaks.

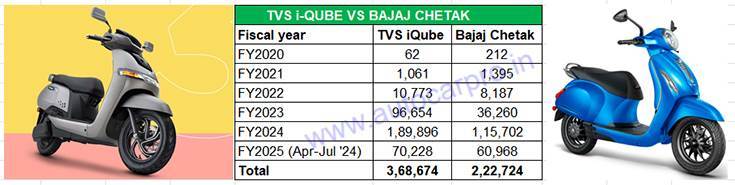

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

In the current fiscal, TVS and Bajaj Auto, which entered the Indian electric two-wheeler industry in the same month (January 2020), have both registered new cumulative sales milestones for their electric scooters. While the TVS iQube surpassed the 300,000-units mark in early April 2024, Bajaj Auto topped the 200,000 milestone in June 2024, with the last 100,000 Chetaks sold in just eight months. Clearly, these two legacy players are making their presence felt in a field teeming with EV start-ups.

Cumulative wholesales-wise, the TVS iQube (368,674 units) maintains a huge lead of 145,950 units over Bajaj Auto (222,724 units) as a result of the big sales margins in FY2023 and FY2024 (see data table above). However, in the first four months of FY2025, iQube sales seem to have slowed down while those of the Chetak have perked up. In June, the Chetak (16,691 units) even went ahead of the iQube (15,221 units) and in July, clocked its best-ever monthly numbers of 20,114 units, hitting the 20,000 sales for the first time.

July was the best month for both TVS and Bajaj in the first four months of FY2024 albeit the sales gap between the iQube and Chetak is down to 9,260 units.

July was the best month for both TVS and Bajaj in the first four months of FY2024 albeit the sales gap between the iQube and Chetak is down to 9,260 units.

What is giving the Chetak new verve in the market is the ramped-up production and a growing dealer network, which is to be expanded from its existing presence in 164 cities and 200 touchpoints to around 600 showrooms in the next three to four months. Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

With stiff petrol prices and most Indian states offering plenty of incentives to accelerate electric mobility, both the Bajaj Chetak and TVS iQube should continue to see robust demand in the coming months. Ola Electric remains the e-two-wheeler market leader by car but in an expanding marketplace with new products, what ticks the boxes for both TVS and Bajaj is their strong brand image, reliable aftersales support and an expanding market launch strategy.

ALSO READ:

Electric two-wheeler sales in July cross 100,000 units after four months