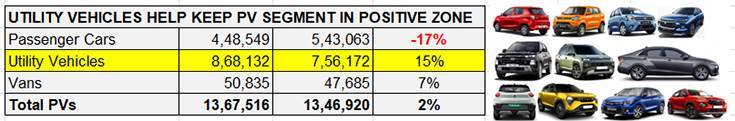

The wholesales numbers for July 2024 and the first four months of FY2025 are out and it’s amply clear that utility vehicles (UVs) have once again saved the blushes for the passenger vehicle segment. As per OEM vehicle dispatch data released by apex industry body SIAM on August 14, a total of 1.36 million cars, UVs and vans were sold in the April-July 2024 period, up just 2% YoY (April-July 2023: 1.24 million units).

Had it not been for the sustained sterling contribution from UVs (868,132 units, up 15%), the continuing dismal performance of the hatchback-sedan sub-segment (448,549 units, down 17%) would have dragged overall PV numbers into the red.

At 868,132 units, UVs constitute 63% of total passenger vehicle sales in the first four months of FY2025 and powering them is the SUV sub-segment.

At 868,132 units, UVs constitute 63% of total passenger vehicle sales in the first four months of FY2025 and powering them is the SUV sub-segment.

UVs (SUVs and MPVs) at 868,132 units constitute 63% of total PV sales in the fiscal year to date and powering them is the SUV sub-segment. Among the 90-odd models in India’s booming SUV market are some which are far more popular than the others, which are represented in the monthly Top 10 models, with the majority being compact SUVs. Let’s take a closer look at the 10 best-selling models in the April-July 2024 period.

SUV No. 1 – Tata Punch: 72,466 units, up 61% YoY

The Tata Punch, which was India’s third best-selling SUV in FY2024 after the Tata Nexon and the Maruti Brezza, has taken an early lead in FY2025. In fact, it opened the new fiscal with a new monthly high of 19,158 units in April 2024, the highest monthly stat for any SUV in the current fiscal to date.

In the first four months of FY2025, the Punch, available with petrol, CNG and electric powerplants, has clocked total dispatches of 72,466 units, which makes for a stellar 61% YoY increase (April-July 2023: 45,067 units). Not only has it outsold its sibling, the Tata Nexon – India’s best-selling SUV in FY2024, FY2023 and FY2022 – for the past seven months, but it also recently aced the Bharat NCAP crash test with a top five-star rating. The Punch’s sales in the fiscal to date give it a 54% share of Tata Motors’ total SUV dispatches of 134,647 units. In June 2024, the Punch hit the 400,000 sales milestone, becoming the fastest SUV model to do so in 33 months since its launch in October 2018.

SUV No. 2 – Hyundai Creta: 63,752 units, up 12% YoY

The Hyundai Creta, India’s best-selling midsize SUV and the No. 4 in FY2024, has jumped to No. 2 position in the April-July 2024 period, with 63,752 units, which is 47% of Hyundai Motor India’s total UV sales of 133,721 units in the past four months. The Creta got a booster shot on January 16 this year with the launch of the MY2024 facelifted Creta, which has helped further accelerate demand for the model.

In July 2024, the new Creta clocked its highest-ever monthly dispatches yet in July – 17,350 units. The rapid pace of demand for the model has meant that the new Creta cruised to 100,000-unit sales in just six months. This makes it the fastest in its segment to hit the 100,000 milestone and in half the time the Maruti Grand Vitara took.

SUV No. 3 – Maruti Brezza: 59,147 units, up 13% YoY

At No. 3 is the Maruti Brezza compact SUV with 59,147 units, up 13% YoY (April-July 2023: 52,355 units), opening the fiscal year with 17,113 units in April. The Brezza had missed out on the No. 1 SUV title in FY2024 by just 2,032 units to the Tata Nexon but, as can be seen, it will have to up the ante if it has to overtake the Punch and the Creta in FY2025. Total cumulative sales since launch of the Brezza, which drove past the million-units milestone in December 2023, are nearing the 1.1 million mark.

SUV No. 4 – Mahindra Scorpio: 53,068 units, up 39% YoY

Mahindra’s best-selling UV continues to be the Scorpio in the form of the popular Scorpio N and the Scorpio Classic. The Scorpio – No. 6 in FY2024 – is currently ranked fourth with 53,068 units, up 39% on year-ago dispatches of 38,105 units, which constitutes 23% of M&M’s total SUV sales of 165,871 units. In terms of fuel-wise sales split, the diesel-engine Scorpios have sold 48,306 units while the petrol-powered siblings sold 4,762 units. Clearly, the consumer verdict is in overwhelming favour of diesel which comprises 91% of the sales. Between the Scorpio N and the Classic, demand is understood to be sizeably more for the Scorpio N.

SUV No. 5 – Tata Nexon: 48,593 units, down 13% YoY

The game-changing Tata Nexon compact SUV, which was India’s best-selling SUV in FY2024, FY2023 and FY2022 – is clearly feeling the heat of the revved-up competition as well as from its own sibling, the Punch. At 48,593 units, the Nexon’s sales in the first four months of FY2025 are down 13% YoY (April-July 2023: 55,601 units). The Nexon, sold in petrol, diesel and electric avatars, is slated to get CNG power later this fiscal. Will the Nexon numbers stage a recovery in Q2 and beyond? We’ll have to wait and see but it just might be that the competition has, by then, taken an unsurmountable lead.

SUV No. 6 – Maruti Fronx: 47,580 units, up 19% YoY

Next up is on the SUV ladder-board is the Maruti Fronx compact SUV with 47,580 units, which gives it a 21% share of Maruti Suzuki’s UV sales of 2,19,432 units between April and July. FY2024 saw Maruti Suzuki launch three all-new Nexa models – Fronx, Jimny and the Invicto. Of these three, the Fronx has been the most successful – not only was it the fastest Indian passenger vehicle to hit the 100,000 sales mark in just 10 months, but it also surpassed the 150,000 unit milestone in just 14 months after launch in April 2023.

SUV No. 7 – Hyundai Venue: 37,177 units, down 12% YoY

The Hyundai Venue, the first compact SUV from Hyundai Motor India, is the second model after the Tata Nexon to see a sales decline. At 37,177 units, the Venue sold 5,046 fewer units than it did in the year-ago period. Demand for the Venue seems to have slowed down in the wake of the rollout of the Exter, Hyundai’s second compact SUV launched a year ago. The Exter has sold 28,398 units in the frst four months of FY2025.

SUV No. 8 – Maruti Grand Vitara: 36,463 units, up 1% YoY

At 36,463 units sold between April-July 2024, the Maruti Grand Vitara’s sales are up just 1% YoY. Maruti Suzuki India’s flagship model wins over buyers with its fuel-efficient hybrid system, clever packaging and interior quality. In early July 12024, this premium Nexa midsize SUV, which was the fastest midsize SUV to hit the 100,000 sales in 12 months, raced past the 200,000 milestone in 22 months. The Grand Vitara continues to be a key contributor to the carmaker’s Nexa brand’s sales, and has been one of the top models to help the premium sales channel achieve the 2.5 million units milestone, news which Autocar Professional broke on June 8, 2024.

SUV No. 9 – Kia Sonet: 34,609 units, up 16% YoY

The penultimate SUV in this Top 10 listing is the Kia Sonet compact SUV with 34,609 units, up 16% YoY (April-July 2023: 29,962 units). Launched in January 2024, the new Sonet compact SUV, which is equipped with plenty of features and also ADAS, has emerged as Kia India’s highest-selling model.

It has outsold the Seltos midsize SUV for seven straight months this year and, along with the Carens MPV, has helped propel demand for the Korean brand. In the first four months of FY2025, Kia has sold a total of 81,275 units, which gives the Sonet a share of 42 percent.

SUV No. 10 – Mahindra XUV300/3XO: 32,501 units, up 64%

Wrapping up the Top 10 SUVs for the first four months of FY2025 is the Mahindra XUV 300 / 3XO. The compact SUV’s sales in the past four months, at 32,501 units, are a strong 64% YoY increase (April-July 2023: 19,814 units). The recent launch of the 3XO – the facelifted version of the XUV300 – on April 29 has given a new charge to sales. The youngest Mahindra in town has been priced aggressively from Rs 749,000 – the XUV 3XO is targeted to be new disrupter in the compact SUV market.

The Top 10 best-selling models listed above together add up to 485,356 units comprising 332,073 compact SUVs and 153,283 midsize SUVs.

The Top 10 best-selling models listed above together add up to 485,356 units comprising 332,073 compact SUVs and 153,283 midsize SUVs.

COMPACT SUVs IN FULL CHARGE BUT DEMAND FOR MIDSIZE SUVs GROWING

Compact SUVs continue to rule over midsize SUVs, maintaining their grip on the market. This segment, which registered sales of over a million units in FY2024 and a 25% share of the record 2.52 million UV dispatches in India, has seen total dispatches of 446,685 units in April-July 2024. This constitutes 51% of the total UVs sold (446,685 units) and translates into every second SUV sold being a compact (less than 4,000mm-long model).

The Top 10 best-selling models listed above together add up to 485,356 units comprising 332,073 compact SUVs and 153,283 midsize SUVs, which makes for a 68:32 percent ratio in favour of compact SUVs. Small, as they say, can often be big. . .