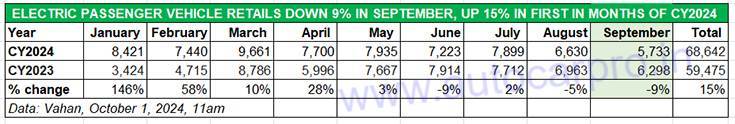

Mirroring the trend in global electric passenger vehicle market, particularly Europe which saw BEVs (battery electric vehicles) record their largest YoY decline since January 2017 – of 36% in August – demand for electric cars, SUVs and MPVs in India fell to a 19-month low of 5,733 units in September 2024. This is a year-on-year decline of 9% (September 2023: 6,298 units). Demand rose consistently and hit a high of 9,661 units in the FAME II-ending month of March 2024. However, since then, as per retail sales data from the Vahan website, monthly numbers have gone down to 7,500 levels, dropping to 6,630 units (down 5% YoY) in August and now 5,733 units in September.

CY2024 had opened with strong sales of 8,421 units (up 146% YoY), dropped 11% month on month to 7,440 units in February but went on to this year’s best figure of 9,661 EVs in the FY2024-ending month of March. For the next three months (April-June 2024), ePV monthly retails averaged 7,619 units. Let’s take a closer look at the key players’ market performance.

CY2024 had opened with strong sales of 8,421 units (up 146% YoY), dropped 11% month on month to 7,440 units in February but went on to this year’s best figure of 9,661 EVs in the FY2024-ending month of March. For the next three months (April-June 2024), ePV monthly retails averaged 7,619 units. Let’s take a closer look at the key players’ market performance.

Tata Motors’ market share reduces to 61% in September

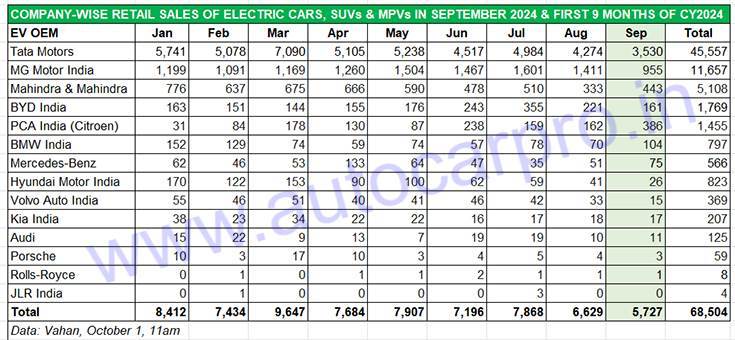

Electric passenger vehicle market leader Tata Motors, which has the largest portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV, sold 3,530 EVs in September 2024. This is a YoY decline of 18% YoY (September 2023: 4,320 EVs) and is the company’s lowest monthly number since February 2023 (3,919 EVs). Last month’s performance is reflected in the reduced market share – in September 2024, Tata Motors’ ePV market share was 61%, down from the 68% it had in September 2023.

In an effort to rev up demand and ahead of the festive season beginning, on September 10, Tata Motors slashed prices of its EV range other than the Curvv EV – the Nexon EV (by Rs 300,000), Punch EV (by 120,000) and the Tiago EV (by Rs 40,000) for a limited period up to October 31, 2024. However, that doesn’t seem to have reflected in the September numbers but just might in October. The company is also offering six months of free charging at any of the over 5,500 Tata Power charging points across the country, as a value add.

Tata Motors has, in the first nine months of CY2024, retailed 45,557 EVs, which is an increase of 3% YoY (January-September 2023: 44,231 EVs). At this stage of the current calendar year, Tata Motors has achieved 76% of its total CY2023 sales of 59,511 units.

MG Motor India, which retails the ZS EV and Comet EV, sold 955 units in September, up 7% on year-ago sales of 894 units but down 32% month-on-month (August 1,411 units). Its September 2024 sales are also the lowest in the first nine months of CY2024.

The company, which now operates under the JSW Group brand, has a market share of 16.65% in September. For the January-September 2024 period, total retails of 11,657 units are already 23% more than its CY203 sales of 9,484 units.

On September 11, MG Motor India launched its third EV – the MG Windsor EV – priced at Rs 13.49 lakh (ex-showroom). Billed as India’s first intelligent Crossover Utility Vehicle (CUV), the Windsor EV combines features of both a sedan and an SUV.

Last month saw MG Motor India introduce the Battery-as-a-Service (BaaS) program for its two EVs This financing scheme debuted with the recently launched MG Windsor, allowing customers to purchase the car without the battery and rent the battery to pay as per usage. According to the OEM, the BaaS program essentially brings down the upfront acquisition cost of an EV while also reducing running costs over an extended period.

The company is also upping the ante on the sales network front by expanding to Tier 3 and Tier 4 cities as well as rural markets across India. There are plans to set up 100 new touchpoints by the end of 2024, and setting up 520 touchpoints in 270 cities by the end of March 2025.

Mahindra & Mahindra is ranked third on the electric passenger vehicle ladder-board with sale of 443 XUV 400s, its sole EV, in September 2024, up 23% YoY (September 2023: 361 units) and 33% month on month (August 2024: 333 units). This gives the company a 7.72% market share. M&M’s first nine-month sales in the year to date at 5,108 units are a near doubling of sales and up 85% YoY (January-September 2023: 2,754 units). M&M had sold 4,208 EVs in CY2023.

Mahindra & Mahindra is ranked third on the electric passenger vehicle ladder-board with sale of 443 XUV 400s, its sole EV, in September 2024, up 23% YoY (September 2023: 361 units) and 33% month on month (August 2024: 333 units). This gives the company a 7.72% market share. M&M’s first nine-month sales in the year to date at 5,108 units are a near doubling of sales and up 85% YoY (January-September 2023: 2,754 units). M&M had sold 4,208 EVs in CY2023.

M&M, which will have added manufacturing capacity of around 100,000 units for its upcoming Born Electric vehicles by end-March 2025, plans to invest Rs 12,000 crore towards its EV programme. It has announced 4-5 new models on the INGLO platform, which will have key components from the Volkswagen Group.

BYD India, which sells the all-electric Atto 3 SUV, e6 MPV and the Seal sedan maintains its No. 4 EV OEM position on the cumulative sales front but has dropped to fifth in September, ceding that ranking to PCA Motors. In September 2024, BYD sold 161 EVs, down 27% on August 2024’s 221 units but up marginally on the year-ago 151 units. The Chinese EV OEM is 242 units away from surpassing its CY2023 total of 2,011 units.

On October 8, BYD India will launch the new eMAX 7 MPV, which offers a generational update from the BYD e6. The eMAX 7 incorporates advanced technology, improved performance, and a longer driving range, along with safety features and intelligent systems aimed at enhancing the driving experience. The interior emphasises comfort and ergonomic design for all passengers.

September 2024 has turned out to be the best-ever month for PCA Motors (Citroen India) with 386 units sold, 50 units more than the previous best in June 2023 (336 units). The company, which retails the e-C3, the electric avatar of the C3 hatchback, is seeing growing demand particularly from EV fleet operators.

The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E. By end-September, PCA Motors with 1,455 units has already achieved 75% of its CY2023 sales of 1,947 units.

Hyundai Motor India, which has discontinued the Kona in India, sold 26 Ioniq 5 EVs in September, 15 fewer than it did in August. This is the company’s lowest monthly EV sales in the past nine months. Cumulative January-September 2024-month sales at 823 units are down 26% YoY (January-September 2023: 1,116 units). Hyundai had sold a total of 1,601 EVs in CY2023.

LUXURY EV RETAILS DOWN 14% IN SEPTEMBER, UP 20% IN JANUARY-SEPTEMBER 2024

LUXURY EV RETAILS DOWN 14% IN SEPTEMBER, UP 20% IN JANUARY-SEPTEMBER 2024

As per Vahan retail sales data, deliveries of luxury electric cars, sedans and SUVs dropped 14% YoY in September 2024 to 209 units (September 2023: 245 units). However, the cumulative nine-month sales reflect strong 20% YoY growth – the January-September 2024 total of 1,928 units constitute an additional 321 EVs over 1,607 units sold in the year-ago period.

With three months left in CY2024, cumulative luxury electric PV retails from seven OEMs, at 1,928 units, are 714 units shy of the CY2023 total of 2,642 units.

BMW India remains the luxury EV market leader both in September (104 units) and in the first nine months of 2024 (797 units), which gives it a luxury EV market share of 50% for September and 41% for the January-September 2024 period.

Mercedes-Benz India sold 75 EVs in September 2024, 24 more than in August and its second-best monthly sales in the year, after April’s 133 units. Its combined January-September 2024 sales (566 EVs) are up 56% YoY (January-September 2023: 329 EVs) and give it a 29% share of the luxury EV market in the year to date. Importantly, for the German carmaker, it has surpassed its CY2023 total of 515 units.

Volvo Auto India sold 15 EVs in September, 18 fewer units than it did in August. Its cumulative nine-month sales at 369 units and give it a 19% market luxury PV market share. In CY2023, Volvo had sold a total of 570 EVs.

Audi India sold 11 EVs last month and takes its nine-month total to 125 units, up 34% YoY (January-September 2023: 93 units) and currently has a 6.50% share of the luxury passenger vehicle market in the year to date.

EV OEMS EYEING FRESH MOMENTUM IN THE FESTIVE SEASON

The overall Indian electric passenger vehicle industry is, to some extent, witnessing some consumer demand move away to hybrid models. Also, one of the reasons for the tepid demand in September is that the second half, with ‘Pitru Paksh’, is considered not the ideal time to buy a new vehicle. But with October opening up with Navratri, followed by Dussehra on the 12th of the month, and Diwali on November 1, electric car and SUV manufacturers will be looking to up the ante with special offers, and bring back the sales momentum they saw in the first half of this year.

ALSO READ: Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%