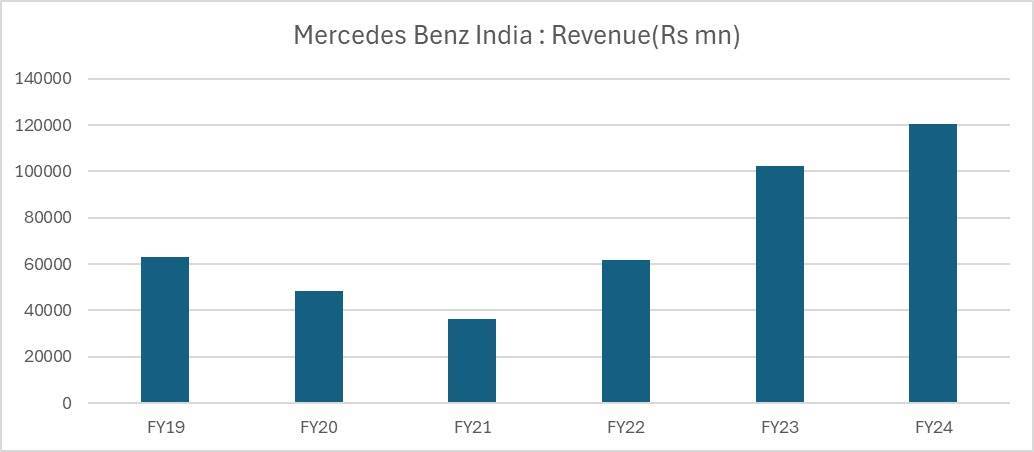

Sustained growth in the high-end expensive car market has helped Mercedes-Benz, India’s largest luxury car market, to record revenues of ₹12,000 crore in FY24, for the second consecutive year.

Yet, escalating raw material costs cast a shadow over this triumph, eroding net income by 40%, as detailed in the company’s annual report filed with the Registrar of Companies.

The financial insights sourced from the business intelligence platform Tofler revealed that Mercedes-Benz India, the local arm of the German automotive giant, saw a robust 17.6% year-on-year (YoY) increase in core business revenue, amounting to ₹12,054 crore, supplemented by ₹159 crore from ancillary income, which collectively brought total revenue for FY24 to ₹12,213 crore.

Source: Tofler

However, net profit for the maker of esteemed models like the GLE and GLC shrank by 40% to ₹510 crore, driven by a marked contraction in gross profit margins as raw material prices surged.

Source: Tofler

Reviewing the earnings for FY24, the director’s report stated, “Despite increased sales volume, the comprehensive income for the year under review is impacted due to increased material and logistics costs. The industry-wide supply chain and cost management challenges have significantly impacted the margins. In addition, there has been a drop in non-operative income.”

The sales volume, a testament to Mercedes-Benz India’s 45% market dominance in the premium segment, soared by 15.6% to a record 19,077 units in FY24, surpassing the previous peak of 18,211 units recorded in FY19.

The average realization per vehicle—a cornerstone of Mercedes-Benz’s growth in recent years—showed signs of deceleration.

In FY24, the average realization per car increased by a modest 1.84% YoY to Rs 63 lakh, up from ₹ 62 lakh in FY23. It is worth noting that over the preceding five years, the company’s average realization per car had ascended at an annual rate of 12.75%, propelling an average annual growth of 13.8%.

Over the same period, the broader Indian passenger car market posted a volume growth of 4.5%, buoyed mainly by enhanced realizations.

Source: Tofler

Mounting raw material costs proved a formidable challenge for Mercedes-Benz India, squeezing its gross margins—a vital indicator of how pricing and input costs influence profitability.

The gross margin slipped by 573 basis points YoY to 19.73% in FY24, resulting in a decline in gross profit per car from ₹15.7 lakh to ₹1.24 million. This surge in material expenses also took its toll on the operating margin, which fell to 7.40% in FY24 from 13.19% the previous year, shrinking the operating profit per vehicle to ₹473,974 from the prior year’s ₹835,667.

Nevertheless, Mercedes-Benz India’s operations continued to generate a significant cash flow. With no dividends paid out, total cash and cash equivalents grew to ₹758 crore in FY24, a substantial increase from ₹402 crore in the preceding year.

Source: Tofler

Facility upgraded for future models

Mercedes Benz India had announced an investment of ₹250 crore in the Indian operation to bring in new models through an assembly route.

The company continued to spruce up its manufacturing capabilities at its assembly plant in Chakan.

In FY23, Mercedes Benz India upgraded its existing lines to cater to a select export order for the European market. It also installed a new robotic line for its most popular sedan, the E-Class, which was industrialized in the body shop.

In its annual review, the director’s note stated that cutting-edge joining technologies such as robotic punch riveting, robotic Impact nailing, robotic flow screw drilling, and robotic spot welding were introduced, which will enable the joining of different types of sheet metals such as steel & aluminium in the body shop.

“New technology in the Paint shop was integrated with new Modular Rear axle Architecture (MRA2) called Acoustic Foam Application (AFA). In this process, liquid foam will be injected in hard-to-reach areas in BIW with high precision, enabling a smoother and quieter ride experience for customers,” added the section on technology absorption.

Over the last 12-18 months, the company has introduced new-generation brake-filling machines on all assembly lines. These machines are capable of fulfilling the revised stringent parameters of vacuum and filling pressures and will simplify the end-of-line brake testing processes.

The company has introduced the Second Generation of Integrated Starter Generator (ISG2) in Transmissions, starting with the C-Class product, besides introducing a Semi-Automatic Wheel Alignment machine for our Axle production for C-Class, GLA, A-Sedan, and S-Class.