Electric shock: carmakers battle strict UK electric car rules as big fines loom

As Ford announced cutting 800 UK jobs it said rules forcing companies to sell more EVs each year are ‘unworkable’

When Ford announced this week that it was cutting 800 jobs in the UK, the US carmaker also had stern words for the government. It has joined in a chorus of criticism of rules that force car companies to sell more electric vehicles each year. The rules, known as the zero-emission vehicle (ZEV) mandate, are simply “unworkable”, Ford said.

Someone should have told Ford back in 2022, when the carmaker strongly backed the policy. In fact, it went further, calling for the British government to force carmakers to sell even more electric cars each year.

“Ford believes that figures lower than Department for Transport’s current proposed trajectory will not send a strong enough signal to customers, manufacturers and investors to spur the appropriate transition,” it said at the time. “Furthermore, any lowering of targets will send the wrong signal in terms of charging infrastructure rollout.”

The carmaker did argue that the policy should be subject to review if industry conditions change, according to the government consultation response obtained by the Fast Charge newsletter. But the dramatic shift in its position nevertheless illustrates how the industry has been caught out by the slowing growth in demand for electric cars.

During the chaos of the coronavirus pandemic – with interest rates at rock bottom – carmakers found that they could sell all the cars they could make (albeit amid problems in getting parts). That has changed now. Carmakers are not experiencing the expected demand for electric cars, with a resurgence instead in sales of hybrids that combine a petrol engine with a smaller battery.

Demand for electric cars has been hit by concerns over public charger numbers, as well as a political backlash (veering into full-on culture war) from critics of net zero carbon policies who argue they are too expensive. Battery cars remain more expensive upfront (even if much cheaper in the long run) despite manufacturers being forced into steep discounts that they argue are unsustainable.

The carmakers have launched a rearguard lobbying effort to persuade the UK government to relax the mandate, but now find themselves pitted against car charger companies, fleet owners and environmental campaigners who argue that climate targets and billions of pounds of investments will be under threat if the UK government backtracks.

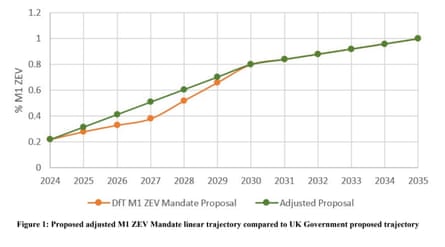

Under the mandate, electric cars must make up 22% of sales of new vehicles this year, rising to 28% in 2025 – albeit with important loopholes that can reduce the target considerably. If they miss their targets, carmakers face fines of up to £15,000 for each vehicle. No carmakers publicly argue with the goal of 80% battery electric cars by 2030, before a complete ban on new petrol and diesel engines in 2035.

The mandate is sure to be a key focus for the Society of Motor Manufacturers and Traders (SMMT) when the lobby group’s members convene on Tuesday evening at its annual black tie dinner. Executives at a hotel on Park Lane in London will expect to be ribbed by the host, comedian and TV presenter Tom Allen.

For the industry, the ZEV mandate is no laughing matter. After months of requests, on Wednesday several carmakers met the transport secretary, Louise Haigh, and business secretary, Jonathan Reynolds, in London to plead for more leeway.

The Japanese manufacturer Nissan, which runs the UK’s largest car factory at Sunderland, said the mandate was threatening “the viability of thousands of jobs and billions of pounds in investment” – even if industry insiders think it unrealistic that the company would really abandon the plant. Stellantis, the owner of the Vauxhall, Peugeot and Citroën brands, claimed in the summer that it could close van plants in Ellesmere Port and Luton because of the mandate.

Yet carmakers are not the only group claiming that billions of pounds are on the line. Companies are racing to install the chargers that electric cars require.

Vicky Read, the chief executive of Charge UK, a lobby group, was also in the room with ministers. She said there is £6bn of lined-up investment predicated on the ZEV mandate. Flip-flopping – as with Conservative prime minister Rishi Sunak’s decision to delay the ban on new petrol cars by five years – damages investment, she said.

“We must not make the same mistake again,” she said. “Anything that leads to fewer fully electric vehicles on UK roads is a no-go for us because it means fewer customers.”

after newsletter promotion

It is tricky to work out how much pressure individual carmakers are actually under. The headline target is 22% of electric car sales, but in reality they can earn “credits” that lower it. Those credits include lowering the average emissions of their new petrol cars, and “borrowing” excess electric cars made in later years. Another option is buying credits from other brands (although the British industry bristles at the thought of subsidising rivals such as China’s BYD or the US’s Tesla).

With all the loopholes, the thinktank New AutoMotive has calculated that the real target for 2022 is 18.1% – right in line with the 18.1% electric sales achieved in the first 10 months of 2024. The SMMT disputes those calculations, pointing to disparities between its sales figures and the thinktank’s, although it has not come up with an estimate.

Ben Nelmes, the New AutoMotive chief executive, said there is “a high level of uncertainty, and the target could reduce more, or less, depending on the decisions taken by the manufacturers”. Nevertheless, he said that if current trends are maintained it is realistic to think the real target for 2025 could be between 24% and 25% – rather than the headline of 28%.

Carmakers are now arguing for more of those handy “flexibilities”. Ideas presented to ministers this week included allowing carmakers to comply if they overachieve on targets in later years, and giving extra credits to electric cars made in Britain – a policy that could be attractive given the political importance of maintaining UK jobs.

The business department is thought to be open to relaxing the rules, but industry has so far found the transport department less responsive to its entreaties as it keeps its eye on climate goals.

Colin Walker, the head of transport at the Energy & Climate Intelligence Unit, a campaign group, argued that the mandate is working and is good for British consumers.

“The mandate is incentivising manufacturers to compete on price, and as prices come down, sales are going up, with more than one in five new cars sold in the UK being an EV in the last three months,” he said.

Whatever happens, the industry is unlikely to let up the pressure on the government, given jobs cuts, falling profits, and steep investment needs around the world. It is likely that some of them will face fines with the rules as they are.

David Bailey, the professor of business economics at the University of Birmingham, said he believed that more flexibilities are warranted. “The ramp-up is really quite severe,” he said. “I think companies will struggle to hit that.”