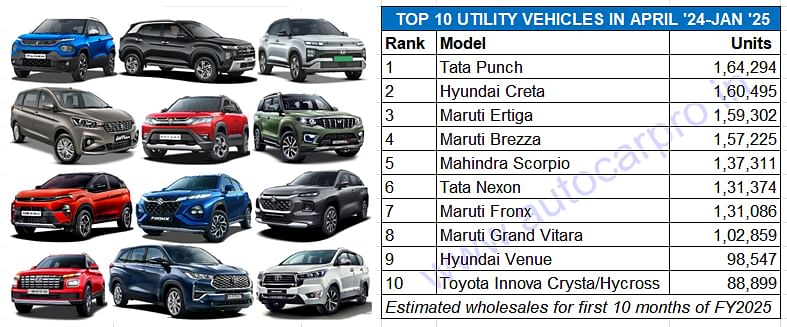

The utility vehicle (UV) segment, which comprises SUVs and MPVs, is where most of the growth in the overall passenger vehicle is happening. In CY2024, with wholesales of 2.74 million units, the UV segment not only achieved 17% YoY growth but also increased its share of overall PV sales to 64% from 57% in CY2023. This segment is also the most competitive with every OEM worth its wheel fighting for a share and slice of the action. The UV arena is a tough one, what with 32 SUV and MPV manufacturers, 128-odd individual models and over 1,000 variants. Buyers are really spoilt for choice which makes the performance of these best-selling models important in the overall scheme of things.

The Tata Punch compact SUV, Tata Motors’ best-selling model in the current fiscal, is leading the Top 10 SUV and UV chart with an estimated 164,294 units, up 22% YoY (April 2023-January 2024: 134,091 units). The Tata Punch, which went ahead of India’s longstanding best-selling passenger vehicle, the Maruti Wagon R, earlier this year continues to hold that title. At the end of January 2025, the Punch has a lead of 2,897 units over the best-selling Maruti car (161,397 units). The Punch, which is available with petrol, CNG and electric powertrains, had sold 169,844 units in FY2024, up 27% YoY, and was ranked third after the Maruti Brezza and Tata Nexon. With a host of new competition, particularly on the EV front, the Punch has its task cut out in the year ahead.

The Hyundai Creta, whose new-generation model was launched in January 2024, has powered its way past the Maruti Ertiga to take No. 2 rank with 160,495 units, up 22% YoY (April 2023-January 2024: 131,039 units). The Creta midsize SUV has received a new charge last month with the launch of its zero-emission sibling, the Creta Electric. Combined sales of 18,522 units of the Creta siblings in January saw the Creta brand achieve its best-ever monthly numbers. If the same growth momentum continues, the Creta could might drive past the Punch in the months ahead. In FY2024, the fourth-ranked Creta had clocked sales of 162,773 units, up 8% YoY.

Just 1,193 units behind the Creta is the Maruti Ertiga, the sole MPV in this bestsellers’ list, with 159,302 units, up by a robust 33% YoY (April 2023-January 2024: 119,350 units), to take No. 3 position. Considering that In FY2024, the Ertiga had sold 149,757 units, up 17% YoY, and the No. 5 position, this popular family mover is having a great run in the current fiscal.

The game-changing Maruti Brezza, which kicked off the compact SUV juggernaut all those many years ago, is the No. 4 UV in the first 10 months of FY2025 with 157,225 units, up 12% YoY (April 2023-January 2024: 139,518 units).

The Mahindra Scorpio continues to have a stellar fiscal. The best-selling Mahindra model – the Scorpio N and Scorpio Classic – have together sold a total of 137,311 units, up 23% YoY (April 2023-January 2024: 111,260 units), which translates into an additional 26,051 units. This performance sees the Scorpio twins rise two ranks to No. 5 position from No. 6 in FY2024 (141,462 units).

At an estimated 131,374 units in the first 10 months of FY2025, down 8% YoY (April 2023-January 2024: 143,244 units), the Tata Nexon is ranked sixth. In FY2024, the Tata Nexon had topped the UV chart with 171,929 units. The launch of the Nexon CNG in September as well as the Nexon ICE model acing the Bharat NCAP crash test with a 5-star rating were expected to help the Nexon recover market momentum but that didn’t happen. Sibling Punch has been outselling the Nexon right since January 2024.

At No. 7 is another compact SUV – the Maruti Fronx – with 131,086 units. This is a YoY increase of 21% (April 2023-January 2024: 108,036 units), which helps the Fronx maintain the same rank it had in FY2024 when it sold 134,735 units. In September 2024, the Fronx became the second Nexa SUV to achieve 200,000 sales, after the Grand Vitara.

The Maruti Grand Vitara midsize SUV comes in at No. 8 with 102,859 units, up 4% YoY (April 2023-January 2024: 98,935 units). In FY2024 with 121,169 units, the Grand Vitara was ranked ninth. There’s a three-row Grand Vitara in the pipeline but it won’t be available till end-2025.

The second Hyundai SUV is this list is the Hyundai Venue, the Korean manufacturer’s first compact SUV. The Venue has clocked 10-month sales of 98,547 units, down 12% on year-ago sales of 110,348 units. Demand has been flagging for the Venue, particularly since sibling Exter rolled in and with the next-gen Venue, which will up the model’s desirability quotient, slated for launch only by end-2025 or early 2026, sales will most likely continue to be tepid in the next 12-odd months.

Wrapping up the Top 10 UVs list is Toyota Kirloskar Motor’s best-selling product – the Innova MPV. Ranked No. 10, the Toyota Innova MPV with its Crysta and Hycross variants – has clocked estimated wholesales of 88,899 units, up 11% YoY (April 2023-January 2024: 79,800 units). Demand for the Innova Hycross has been particularly strong, which has helped accelerate sales for this popular people transporter. In FY2024, the Innova has sold 98,180 units.