Mahindra & Mahindra Limited, one of India’s leading automotive and farm equipment manufacturers, reported robust financial results for the first quarter ended June 30, 2025, with consolidated revenue jumping 23% year-on-year to Rs 45,436 crores from Rs 37,010 crores in the same period last year.

The company’s net profit attributable to shareholders increased by 24% to Rs 4,083 crores in Q1 FY2026, compared to Rs 3,283 crores in Q1 FY2025. Total comprehensive income for the quarter stood at Rs 4,631 crores, up 29% from Rs 3,581 crores in the corresponding quarter of the previous year.

“Our diversified business model continues to deliver strong results across segments,” the company noted in its earnings statement. The profit before tax grew 22% to Rs 5,644 crores from Rs 4,621 crores year-on-year.

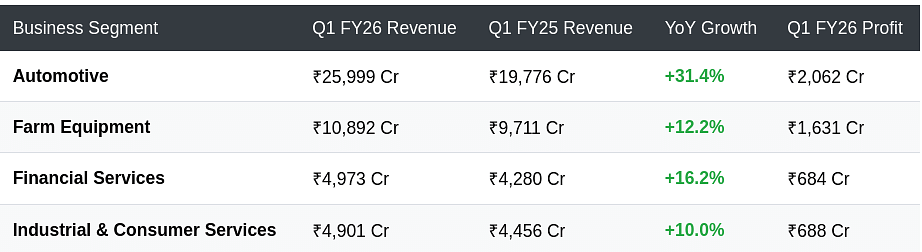

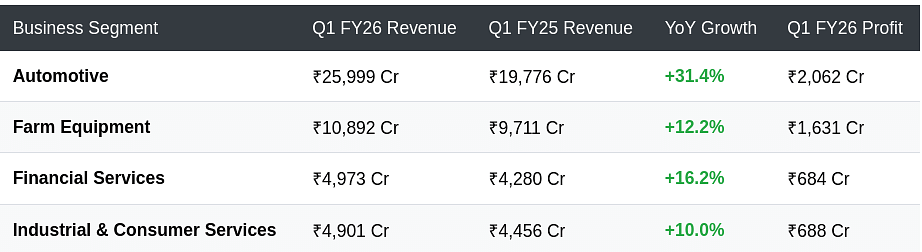

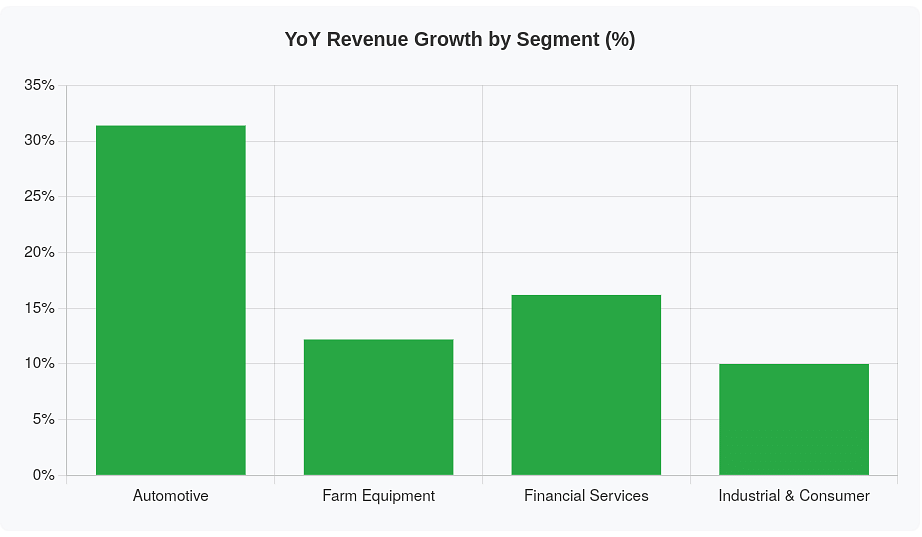

Segment-wise Performance

Automotive Business Leads Growth

The automotive segment, Mahindra’s largest business, posted impressive growth with revenue increasing 31% to Rs 25,999 crores from Rs 19,776 crores in Q1 FY2025. The segment’s profit after share of associates and joint ventures stood at Rs 2,062 crores, up 15% from Rs 1,787 crores in the same quarter last year.

The strong performance was driven by robust demand for the company’s SUV portfolio and improved supply chain conditions. Segment assets in the automotive business reached Rs 49,892 crores, reflecting the company’s continued investments in new product development and capacity expansion.

Farm Equipment Shows Resilience

Despite facing headwinds from seasonal factors, the farm equipment segment maintained steady performance with revenue of Rs 10,892 crores compared to Rs 9,711 crores in Q1 FY2025, marking a 12% increase. The segment profit remained stable at Rs 1,631 crores, compared to Rs 1,540 crores in the previous year.

The farm equipment business continues to benefit from favorable rural sentiment and the company’s strong distribution network across domestic and international markets.

Financial Services Delivers Consistent Growth

Mahindra’s financial services arm reported a 16% increase in revenue to Rs 4,973 crores from Rs 4,280 crores year-on-year. The segment’s profit after share of associates rose to Rs 684 crores from Rs 657 crores, demonstrating the resilience of the lending portfolio despite a challenging interest rate environment.

The financial services segment assets grew to Rs 1,42,860 crores, reflecting healthy loan book growth while maintaining asset quality standards.

Industrial and Consumer Services Shows Mixed Performance

The industrial businesses and consumer services segment posted revenue of Rs 4,901 crores, up 10% from Rs 4,456 crores in Q1 FY2025. However, segment profit increased marginally to Rs 688 crores from Rs 630 crores, as the business faced margin pressures from increased competition and input cost inflation.

Operational Metrics

The company’s operational efficiency showed improvement with:

- Employee benefits expense as a percentage of revenue declining marginally

- Finance costs well-managed at Rs 2,431 crores despite higher interest rates

- Depreciation and amortization expenses at Rs 1,548 crores, reflecting ongoing capital investments

Mahindra’s consolidated assets grew to Rs 2,84,065 crores as of June 30, 2025, from Rs 2,43,433 crores a year ago, indicating the company’s expanding scale of operations. The company maintained a healthy equity base with paid-up equity share capital of Rs 558.25 crores and other equity of Rs 76,481 crores.

Basic earnings per share for the quarter increased to Rs 36.58 from Rs 29.44 in Q1 FY2025, representing a 24% growth. Diluted earnings per share stood at Rs 36.43, compared to Rs 29.32 in the corresponding quarter of the previous year.

The strong Q1 performance positions Mahindra well for the remainder of FY2026. The company’s diversified business model, with significant presence in automotive, farm equipment, and financial services, provides resilience against sector-specific challenges.

The automotive segment is expected to continue its growth momentum driven by new product launches and strong demand for SUVs, althogh there has been a marked slowdown in urban demand in recent months.

The farm equipment business is likely to benefit from normal monsoon predictions and continued government support for the agricultural sector. Financial services are expected to maintain steady growth while focusing on asset quality.