Tata Hitachi is gearing up for its next growth chapter with three clear priorities: ramping up exports, deepening its dominance in mining equipment, and accelerating the shift towards electrified machines. The Rs 5,200-crore company plans to more than double exports over the next five years, assemble high-value mining trucks locally, and commercialise its first Electric-powered excavator in a near future.

These moves come at a time when the Indian construction equipment (CE) market is experiencing both rapid expansion and intense competition. Infrastructure spending by the government has pushed excavator sales to the 30,000–32,000 unit range, but the number of active players has surged from just four or five a decade ago to over a dozen today. Chinese brands, in particular, have shaken up pricing and credit norms, forcing established players to redefine their value propositions.

For Managing Director Sandeep Singh, these challenges are not new. They are the next phase in a journey of transformation he has led since taking charge — a journey that began with stabilisation and is now about strategic expansion.

From Restructuring to Revival

When Singh took the helm, the 40-year-old joint venture between Tata Motors and Hitachi Construction Machinery (HCM) was in the red. Operational inefficiencies, a scattered manufacturing footprint, and intense price competition were eating into margins.

Singh’s early playbook was about consolidation and focus: shutting underutilised plants, streamlining the product range, vendor base, cutting waste, and investing in brand-building and dealer engagement. With India’s CE market still recovering from cyclical downturns and government policy shifts, these moves helped build a resilient base. Within two years, Tata Hitachi had returned to profitability.

“The fundamentals were clear — build customer trust through quality and service, simplify operations, and strengthen our market position,” Singh says.

Defending Share in a Crowded Excavator Market

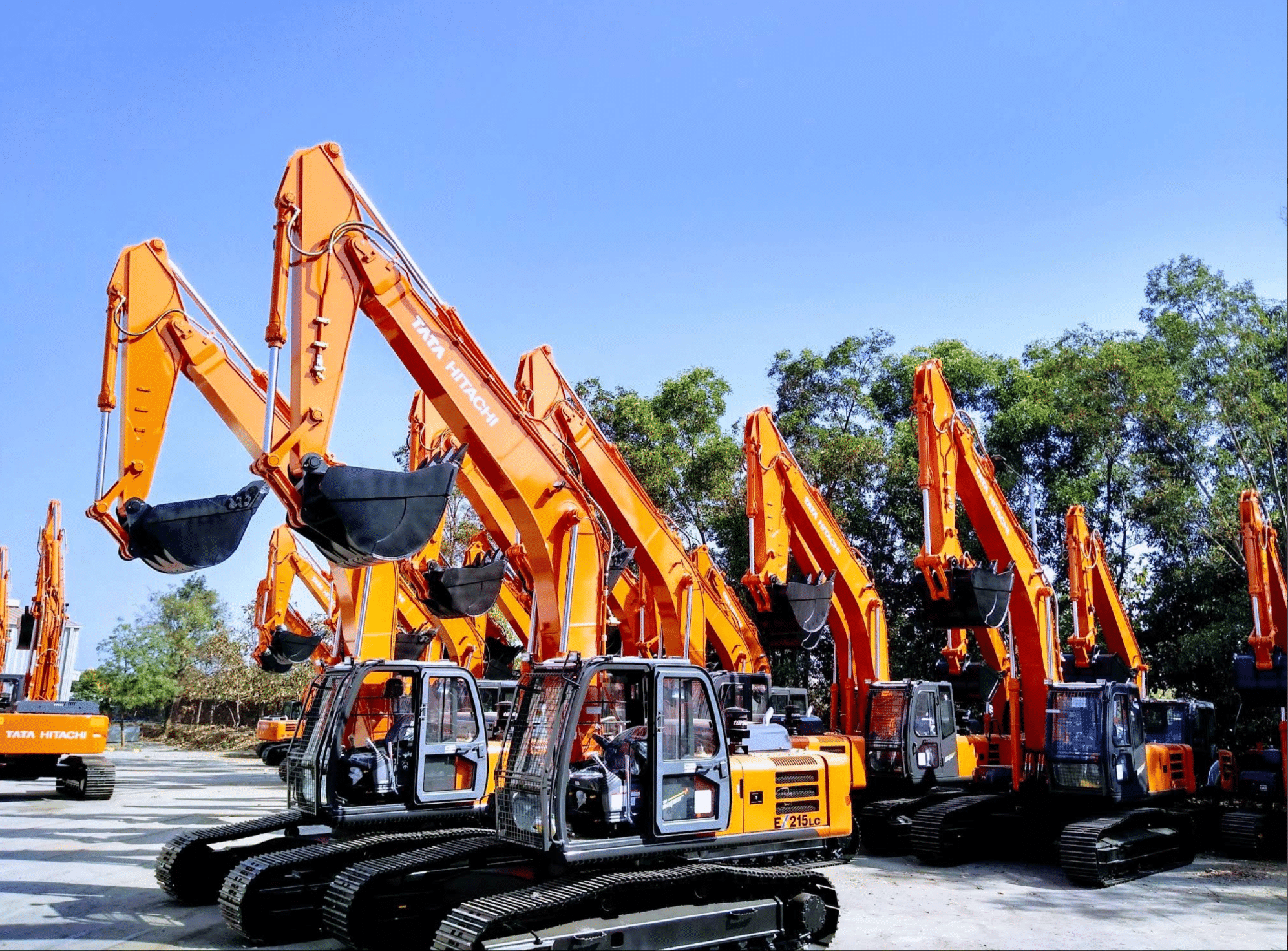

Excavators remain Tata Hitachi’s bread-and-butter, accounting for the majority of its 8,300 annual sales. The company holds a 23% share, down from 30% earlier, as more manufacturers — including Korean, Japanese, and Chinese brands — entered the fray.

In a market where price pressure is relentless and finance-led sales models are gaining ground, Tata Hitachi has leveraged its quality, service reputation, and localisation capability to remain relevant. Singh’s counter to Chinese aggression was to compete with them with value proposition on cost competitiveness while keeping product quality reliability intact.

“We’ve contained Chinese penetration in India because customers know our machines deliver higher uptime with low cost of ownership,” he notes.

Mining as a Growth Engine

Mining has emerged as a strategic high-margin vertical. Tata Hitachi now commands over 30% share in the mining excavator segment and is winning landmark orders — including 190-ton and 360-ton models worth over Rs 20 crore each, as well as hybrid-electric dump trucks.

The mining segment is seeing renewed activity on the back of coal production targets and large private-sector mining investments. Equipment reliability, higher utilisation and fast turnarounds are critical, giving Tata Hitachi a strong advantage.

The company also runs a certified refurbishment programme, extending machine lifecycles beyond 40,000 hours in some cases — more than the industry norm — which appeals to customers in tight financing environments.

Exports and Global Mandate

Exports, currently 500 units a year, are targeted to grow to 1,500–2,000 by financial year 2029. Tata Hitachi will develop and assemble models in India for the Middle East, Africa, and Southeast Asia — markets where Chinese brands are also expanding rapidly, and where cost-efficient yet high-quality products can create a distinct niche.

Hitachi Construction Machinery (HCM) has also entrusted its Indian arm with global product development responsibility. A new Global Technical Development Centre in Dharwad will hire 200 engineers in the next few years to design products for international markets — a significant signal of India’s strategic role in HCM’s supply chain.

Electrification Bet

While alternative fuels are being explored globally, Tata Hitachi is betting big on electric solutions. A locally developed battery-powered mini excavator is undergoing trials, with launch targeted in 12-24 months. Globally, HCM is also working on battery-operated dump trucks, with commercial rollout in 2027.

The electric CE segment is still at a nascent stage in India, largely constrained by cost acceptance and charging infrastructure, but export markets in Europe and Japan are already creating demand for zero-emission equipment.

“India will eventually see these machines, but our development work here will feed global markets first,” Singh says.

Sustained Investment to Build Niches

Tata Hitachi has been consistently investing Rs 100–150 crore annually, a commitment Singh says will continue in order to strengthen the company’s product niches and market reach. Recent spends include a new ED paint shop at Dharwad, integrating warehousing into the plant, and ongoing upgrades to manufacturing and service capabilities.

Policy and Industry Outlook

The proposed Construction Equipment, Material and Manufacturing Act aims to phase out older, more polluting machines and enforce stricter emissions norms. Singh expects this to boost both domestic replacement demand and export competitiveness.

With the CE industry expected to benefit from continued public capital expenditure, the next decade could see India rise as both a major consumer and exporter of heavy equipment.

The Road Ahead

For Singh, Tata Hitachi’s transformation is not complete. “This is a 24×7, service-driven business. Staying ahead means constant innovation, deeper customer engagement, and competing globally from India,” he says.

From a turnaround story to a growth play rooted in mining, exports, electrification, and sustained investment, Tata Hitachi’s evolving game-plan reflects both a sharper strategic focus and the resilience to navigate one of the most demanding construction equipment markets in the world.