Skoda Kylaq, the sub-4 meter SUV launched with much fanfare, continues to deliver dividends for its maker, even as tough demand conditions and GST-related uncertainty resulted in a slowdown in its sales in the third quarter ended September.

With 34,500 units sold between January and September 2025 out of Skoda’s total 53,355 units, the Kylaq remains the undisputed bestseller. The compact SUV has emerged as the Czech automaker’s biggest success in India, partly due to its sensible market positioning and partly due to the overall demand for small SUVs in India.

This is despite the fact that Q3 sales have decelerated to 10,786 units due to an overall slowdown in the Indian carmarket from Q2’s peak of 13,509 units. Interestingly, Skoda Auto India’s overall numbers are up 110% year-on-year for the quarter, largely thanks to the Kylaq.

Industry-Wide Headwinds

After launching in January 2025, the compact SUV quickly became Skoda India’s best-selling model by February. Quarter-on-quarter growth was impressive in the first half – sales jumped 32% from Q1’s 10,205 units to Q2’s 13,509 units, establishing the model as a genuine market disruptor.

The period between July and September saw the Kylaq clock 10,786 units – falling short of Q2’s performance, largely because of lower sales in July and August, which together accounted for just 6,476 units over two months. September showed a modest recovery.

The reasons for the slowdown may have less to do with Kylaq and more to do with industry-wide challenges. The market was gripped by uncertainty and speculation regarding the proposed GST reduction on vehicles throughout July, August, and most of September. With buyers anticipating significant price cuts, purchase decisions were deferred across segments, leading to muted demand industry-wide.

The GST reduction from 28% to 18% came into effect on September 22, 2025 – just eight days before the quarter ended. This timing meant that for much of the quarter, the market was in a holding pattern. Customers waited for clarity on pricing, dealers postponed promotional activities pending final rate announcements, and OEMs operated in an environment of uncertainty that made demand forecasting exceptionally difficult.

Kylaq’s rival Syros also saw a similar pattern. The compact SUV experienced an even more dramatic collapse during the same period – dropping from over 5,000 units monthly in its first quarter to just 774 units in June, 834 units in July, and 308 units in August. In the first eight months of 2025, the Kylaq sold 30,190 units, comfortably ahead of rival Kia Syros’ 25,513 units.

This suggests the Kylaq’s relative resilience, maintaining monthly averages above 3,000 units even during the worst of the GST uncertainty.

Meanwhile, the company is expecting to make up the slack in the coming days as the GST reduction made the Kylaq cheaper by up to Rs 1.19 lakh, with the seven-variant lineup now starting at Rs 7.55 lakh and extending to Rs 12.80 lakh ex-showroom.

“The festive season, coupled with the simplified GST framework, has created a strong tailwind across the industry,” said Ashish Gupta, Brand Director, Skoda Auto India. “Our September and Q3 results reflect the strong customer response to our product portfolio, particularly the Kylaq, which has become a true growth driver for us.”

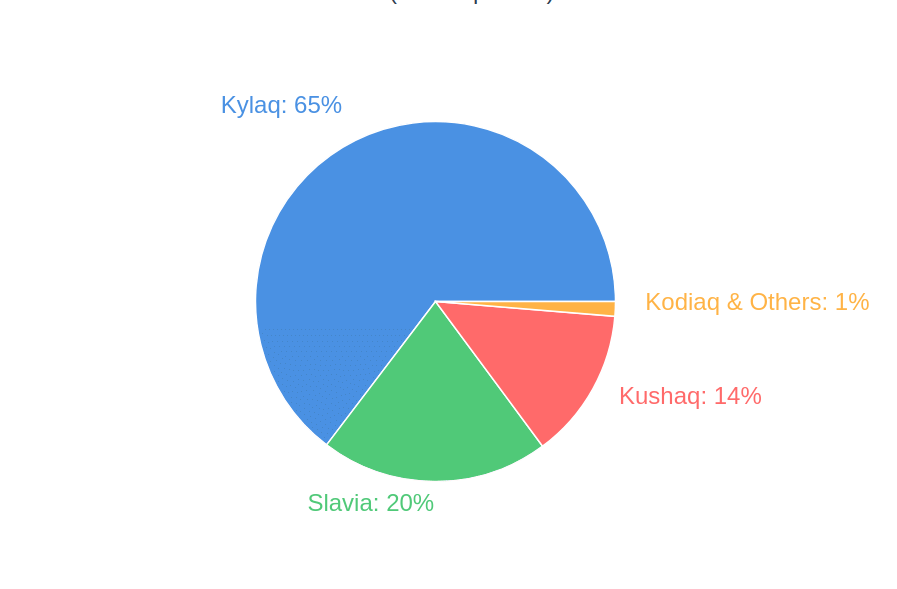

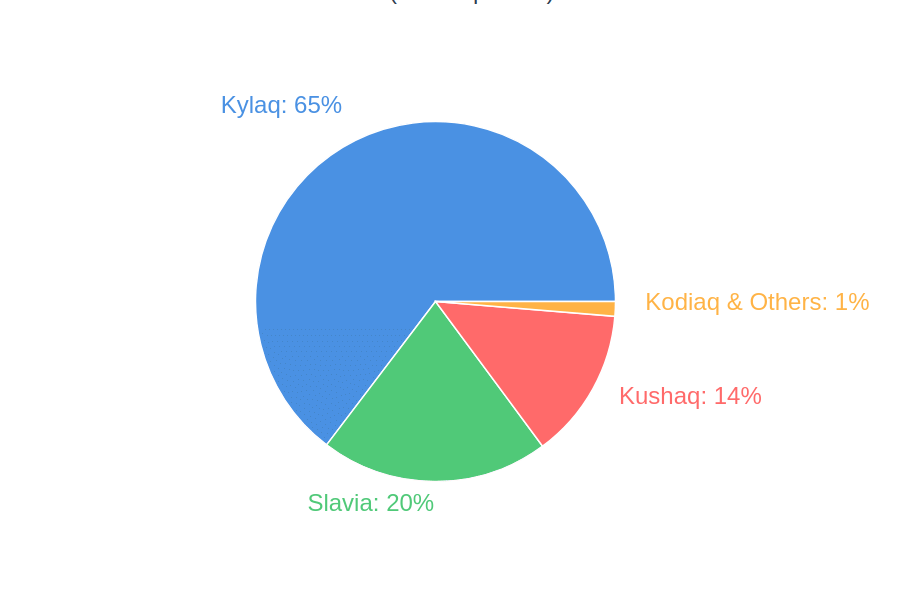

Despite the quarterly hiccup, the Kylaq’s importance to Skoda’s India strategy cannot be overstated. At 65% of total sales, it has single-handedly transformed the brand’s positioning from a niche player to a mainstream contender. By comparison, the Slavia sedan and Kushaq SUV – previously Skoda’s volume drivers – together account for less than 35% of sales.

The Kylaq operates in India’s ultra-competitive compact SUV segment, which accounts for nearly 48% of the total utility vehicle market. Between January and August 2025, the compact SUV category recorded estimated sales of 892,057 units out of the overall UV segment’s 1.85 million units. This makes it both the biggest opportunity and the most contested battleground in Indian automotive.

The model competes not just against compact SUVs but also premium hatchbacks and compact sedans, targeting customers seeking a do-it-all family car. Its 1.0-litre turbo-petrol engine developing 115hp and 178Nm of torque delivers a top speed of 188kph, while fuel efficiency figures of 19.05kpl in the city and 19.68kpl on the highway address the practical concerns of value-conscious buyers.

Safety credentials have proven to be a strong differentiator as well. The Kylaq holds the distinction of being the best-performing compact SUV in Bharat NCAP tests with a five-star rating, scoring 30.88 out of 32 points in Adult Occupant Protection and 45 out of 49 points in Child Occupant Protection. In a market increasingly focused on safety, these ratings provide tangible reassurance to buyers.

Skoda Auto India remains bullish about the Kylaq’s trajectory despite the Q3 slowdown. The company expects sales to hit the 8,000-unit monthly mark by the end of CY2025 – a target that would require averaging approximately 7,000-8,000 units in the final quarter, representing a significant uptick from Q3’s average of 3,595 units per month.

Meanwhile, the GST reduction’s full impact will materialize in Q4 as awareness spreads and inventory at new prices becomes widely available. The festive season – typically the strongest sales period for Indian automotive – is expected to drive footfalls across Skoda’s expanded network.

Production capacity has been ramped up to meet anticipated demand. The Chakan plant, which produces the Kylaq alongside the Kushaq, Volkswagen Taigun and Virtus on the shared MQB-A0-IN platform, is now geared to deliver higher volumes.

As the festive season unfolds and the full benefits of GST reduction permeate the market, all eyes will be on whether the Kylaq can reignite the growth trajectory that made Q2 2025 its strongest quarter yet.