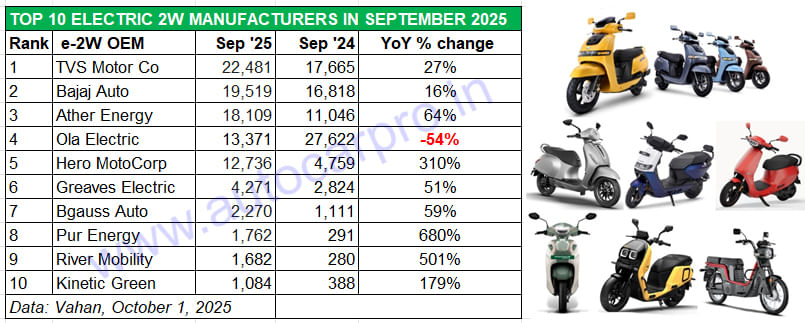

If ever there was a doubt that the recent GST 2.0-driven reduction on internal combustion engine (ICE) vehicles would dampen sales of electric two-wheelers, then September 2025 retail sales numbers have banished that. As per Vahan statistics (October 1, 2025), 104,056 electric 2Ws were sold last month, up 15% YoY (September 2024: 90,550 units), only 904 units down on August 2025’s 104,960 units.

Unlike the electric passenger vehicle as well as the e-3-wheeler industry, which have felt the heat of the surge in demand for ICE models, the e-2W segment has been far more resilient. This can be attributed to the long-term, wallet-friendly benefits of e-mobility on two wheels particularly in view of high petrol and CNG prices. And also the fact that e-2Ws are the most affordable form of e-mobility.

TVS Motor Co is in great nick this year. Having topped the market for the first time in April 2025 since its market entry in January 2020, the company has held onto the No. 1 e-2W OEM title for the sixth month in a row. In September, TVS sold 22,481 units, up 27% YoY, which gives it a 22% market share for the month. Its highest monthly sales this year were in March (30,769 units). Month on month, last month’s sales are down 7% on August’s 24,281 units.

The company, whose main growth driver till now has been the iQube, recently launched the Orbiter e-scooter at Rs 99,900 (ex-showroom Bengaluru), inclusive of PM E-Drive Scheme subsidies. This prices the Orbiter — which has a 3.1 kWh battery pack — on par with the base iQube variant that features a smaller 2.2 kWh battery pack. The Orbiter, which has a top speed of 68kph, is designed for urban commuting and has an IDC range of 158 km per charge. Deliveries of TVS’ newest EV are slated to begin at the end of this month and should further boost TVS’ monthly numbers.

Bajaj Auto, whose ranking had dropped from No. 2 to No. 5 in August, mainly due to production hurdles in July and first-half August caused by global rare earth magnet (REM) availability, is back in the ‘game’. The Pune-based company reclaimed its No. 2 spot with 19,519 units in September, up 16% YoY. This total is 2,962 units behind TVS and gives Bajaj Auto a 19% market share.

Ather Energy is maintaining its strong growth that it has displayed from the start of the year with a 17% market share last month. The smart e-scooter maker delivered 18,109 units, up 64% YoY (September 2024: 11,046 units). This also makes September 2025 Ather’s best sales month since its market entry in CY2018, beating the previous best of 18,069 units in August 2025. Its flagship Rizta family e-scooter, which surpassed 100,000 wholesale units 13 months after its launch in April, remains Ather’s key growth driver and currently contributes over 60% of its sales each month. This is noteworthy given that the three-variant flagship scooter is a premium product that stands out from the crowd.

Ola Electric, the e-2W market leader not very long ago, is currently ranked fourth amongst the 200-odd players in this segment. In September, as per Vahan, Ola delivered 13,371 units, down 57% YoY (September 2024: 27,622 units) for a 13% market share. It is the sole e-2W OEM in the Top 10 to see a YoY sales decline in September 2025. The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price points — from entry-level mass mobility through to premium. The S1 Pro, equipped with a 4 kWh battery, has a claimed 142 km range on a single charge. Ola also manufactures and sells the Roadster X electric motorcycle, which develops peak power of 11 kW, a top speed of 125 kph, and has a range of 501 km.

Hero MotoCorp, the world’s largest two-wheeler manufacturer which has dropped prices on its entire range of ICE motorcycles and scooters, is having a strong run in the e-2W market. In September, the company sold 12,736 Vida e-scooters, up 310% YoY on a low year-ago base (September 2024: 4,759 units). The strong run is thanks to robust consumer demand for the new Vida VX2, as a result of which Hero MotoCorp, which entered the electric two-wheeler industry in October 2022, has surpassed 10,000 units for three months in a row.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, which markets the Ampere brand of e-scooters, maintains its sixth rank with 4,271 units — this constitutes strong growth of 51% YoY and gives it a 4% market share. The company has three key e-scooter brands: Nexus (EX and ST), Magnus (Neo and EX), and Reo (80 and Li Plus). While the flagship Nexus remains the best-selling product for GEM and Ampere Vehicles, the company is seeing growing demand for the new Ampere Reo 80, launched in April at Rs 59,900. GEM has recently launched the upgraded Nexus, whose highlight is ‘Map Mirroring’ technology, along with an enhanced connectivity platform called Nex.IO. The upgraded Nexus features a 7-inch TFT display that provides full-screen navigation with zoom functionality, estimated time of arrival, and distance-to-next-turn information. The system also integrates dashboard monitoring, music control, call connectivity, and safety alerts.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is also witnessing strong demand for its two products, the RUV 350 and Max C12. In September, Bgauss sold 2,270 units, up 59% YoY, to take the seventh rank.

Pur Energy, the Hyderabad-based EV startup incubated from the i-TIC at IIT Hyderabad, is now a regular entry in the monthly Top 10 e-2W OEM list. The company, which has a five-model portfolio has clocked sales of 1,762 units in September, up 680% on a low year-ago base of 291 units.

Another startup which continues to make news is the Bengaluru-based River Mobility, which has a single product – the River Indie. With deliveries of 1,682 units in September, the company has registered its best-ever monthly retail sales since it entered the market in October 2023.

Wrapping up the Top 10 e-2W OEM list for August is Kinetic Green whose portfolio includes the e-Zulu, Zing and the e-Luna moped. The company clocked retails of 1,084 units last month.

India’s e-2W market, which has around 210 players, is the largest contributor to India EV Inc with a 57% share of the 181,760 EVs sold in India across the e-2W, e-3W, e-PV and e-CV categories in September 2025. The segment remains the preserve of six players – TVS, Bajaj Auto, Ola Electric, Ather Energy, Hero MotoCorp and Greaves Electric Mobility – who between them accounted for 90,487 units or an 87% share of total sales of 104,056 units in September, reflecting just where the market strength lies.

Between January and September, the electric two-wheeler industry, which now has plenty of products on offer – more scooters, a growing number of motorcycles and some mopeds – has sold 918,934 units, which marks 13% YoY growth (January-September 2024: 815,419 units). This total is 80% of the segment’s record retail sales of 1.14 million units in CY2024. India e-2W Inc needs to sell an additional 230,465 to surpass that score, with three months including the festive October, left in this calendar year.

ALSO READ: GST ICE effect – Electric car and SUV sales slow down after two months of record growth