Mahindra & Mahindra which sold over half-a-million SUVs (528,460 units) for the first time in a calendar year in CY2024 and also in FY2025 (551,487 units) is now headed towards breaking both these records.

In the current calendar year’s first nine months, M&M has sold 446,697 SUVs, up 16% YoY (January-September 2024: 386,310 SUVs) and already 85% of its CY2024 wholesales, which means it needs to sell another 81,763 units to surpass that total.

Given the current strong sales momentum, particularly after the GST 2.0-driven price reductions and three months left to go this year, expect M&M to register record wholesales of around 610,000 SUVs (up 15% YoY) in CY2025.

Given the current growth trend, 600,000-plus sales should also be for the asking in FY2026. Furthermore, halfway into the current fiscal year (April-September 2025), the company has dispatched 297,570 units, up 14% YoY (April-September 2024: 260,210 units).

This total is 253,917 units away from the 600,000-unit mark. Given the monthly sales average of 49,595 units in the past six months, which is likely to increase in the coming months, M&M will go on to the surpass the 600,000 milestone for the first time in a fiscal in FY2026.

Other than in August 2025, when factory dispatches were rationalised ahead of the planned GST cut, M&M has registered strong double-digit growth right since January 2025.

Scorpio Twins and Thar Lead the Sales Charge

In India’s highly competitive UV market, M&M, which has 10 SUVs (Bolero, Bolero Neo, Bolero Neo+, Scorpio, Scorpio N, Scorpio Classic, Thar, Thar Roxx XUV3XO, XUV400 and XUV700) and the Marazzo MPV, is extremely well placed to capitalise on the surging demand for this vehicle type.

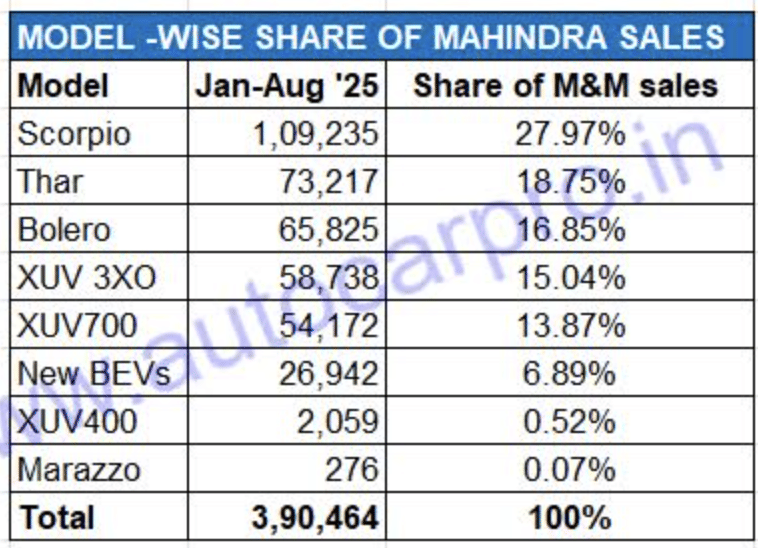

While the model-wise sales split for the Mahindra SUV portfolio for September 2025 is not yet available, the wholesales numbers for the first eight months of this year offer good insight the key growth drivers (see model-wise wholesales split for January-August 2025 below).

While the Scorpio twins had a 28% share of M&M’s wholesales in January-August, the Thar Roxx and Thar combine (19% share) has overtaken the Bolero in the model-wise ranking.

The Mahindra Scorpio, available as the Scorpio N and Scorpio Classic, is currently the best-selling model for the company. At 109,235 units, the Scorpio twins accounted for 28% of M&M’s total dispatches of 390,464 SUVs in the first eight months of 2025.

The Thar brand, which comprises of the three-door Thar and the five-door Thar Roxx, has gone past the Bolero to take No. 2 rank in the Mahindra SUV stable. At 73,217 units sold between January-August 2025, the Thar brand has a 19% model-wise share. This is mainly due to the strong consumer demand for the more mainstream Thar Roxx which has clocked sales of over 71,000 units in just 11 months after launch in October 2024.

The indefatigable and sturdy workhorse Bolero and Bolero Neo are ranked No. 3 with 65,825 units which give the Bolero brand a 17% share of M&M’s SUV sales in the first eight months of CY2025.

Flagship model, the XUV700 takes fifth rank in the Mahindra stable with 54,172 units and a 14% share. Launched a year after the Thar, the feature-laden, big-on-safety XUV700 has sold over 300,000 units since August 2021

Mahindra’s growing market share in the EV market is thanks to the launch of the two born electric SUVs – the BE 6 and XEV 9e. Total wholesales of 26,942 units of these two e-SUVs give them a 6.89% share of the record 390,464 SUVs that M&M has sold between January and August 2025.

Meanwhile, the all-electric XUV400 has clocked total dispatches of 2,059 units in the eight-month period under review.

Along with the general consumer shift towards SUVs, what is also helping the company’s accelerated sales drive is the sharper focus on safety. In mid-November 2024, the Thar Roxx, XUV 3XO and XUV400 each scored a top five-star rating from the Bharat New Car Assessment Programme (Bharat-NCAP). These models have now joined Mahindra’s growing portfolio of five-star-rated vehicles, which includes the XUV700 and Scorpio-N.

M&M is also benefiting from its substantially ramped-up production at its factories to feed its dealers across India and ensure stock is available for customers. Given the strong demand for most of its SUVs, the company has outlined plans to further increase output.

ALSO READ: GST ICE effect – slower e-PV sales after two months of record growth