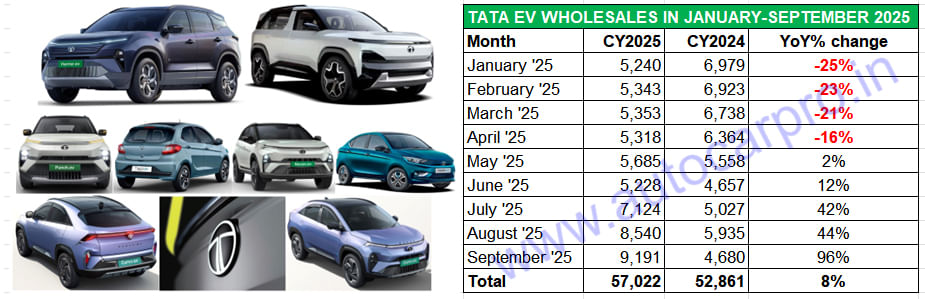

September 2025 turned out to be a red-letter month for Tata Motors. Wholesales of 59,667 passenger vehicles (up 45% YoY), including 17,800 CNG PVs and 9,191 electric vehicles (up 96% YoY), constituted the best-ever monthly numbers in each category. On the EV front, cumulative January-September 2025 sales at 57,022 units were up 8% YoY (January-September 2024: 52,861 units).

The company, which has benefited from the recent launch of the Harrier EV and continues to see demand for the Punch and Nexon EVs along with the Curvv EV, is witnessing a revival of demand for its zero-emission cars and SUVs.

The company’s EV wholesales (read: factory dispatches) have hit record monthly numbers for the last three months in a row (see 9-month data table below). While the monthly 7,000 mark was achieved for the first time in July, 8,000 was crossed in August and 9,000 in September.

After two quarters of sales decline, Tata EV sales have bounced back in Q3 (July-September 2025: 24,855 units, up 59% YoY) as a result of record sales for three months in a row.

After two quarters of sales decline, Tata EV sales have bounced back in Q3 (July-September 2025: 24,855 units, up 59% YoY) as a result of record sales for three months in a row.

After four months of decline from January to April, sales have returned to positive territory since May 2025. As a result of 24,855 EVs (up 59% YoY) being sold in Q3 CY2025 (July-September), Tata Motors’ EV sales have bounced back into positive territory after two quarters of sales decline – Q1 (January-March: 15,936 units, down 23%) and Q2 (April-June 2025: 16,231 units, down 2%).

The robust sales in Q3 CY2025 have helped drive cumulative first 9-month sales to 57,022 units, up 8% YoY (January-September 2024: 52,861 units). This strong performance positions Tata Motors well at this stage of the year to surpass its best-ever annual sales of 69,153 units in CY2023. Its CY2024 sales, at 68,980 units, fell short of the CY2023 figure by just 173 EVs.

Now, with three months still left to go in CY2025, Tata Motors needs to sell another 12,132 units to surpass its CY2023 total. Given that Tata Motors has sold a total of 410,155 passenger vehicles in the past nine months, the EV penetration with 57,022 units has risen to 13.9% from 12% a year ago, and 12% in CY2024.

Given the current momentum the company is registering, despite the fact that the overall e-PV industry experienced slower demand in September as a result of the GST-driven price cuts on IC engine PVs, one can expect Tata Motors to sell between 25,000–27,500 more EVs in Q4 CY2025 (October-December).

This includes the festive Diwali month of October, which should also result in record dispatches to dealers. December sales, however, could be muted, given that most consumers in India tend to defer their new vehicle purchase to January.

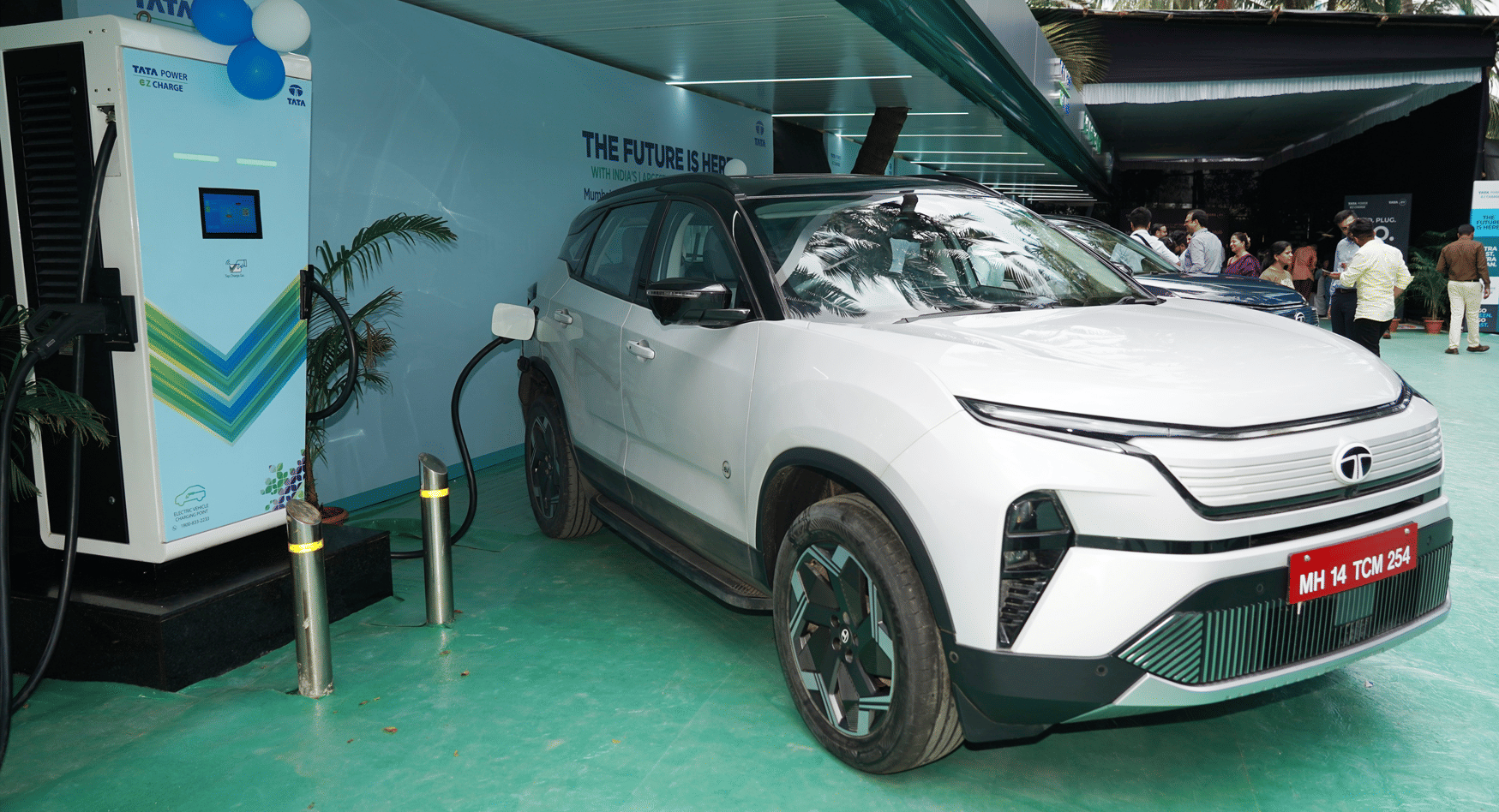

A Harrier EV gets ‘juiced’ up with a 120kW fast charger at the Tata EV MegaCharger facility near Terminal 2, Chhatrapati Shivaji Maharaj International Airport, Mumbai.

A Harrier EV gets ‘juiced’ up with a 120kW fast charger at the Tata EV MegaCharger facility near Terminal 2, Chhatrapati Shivaji Maharaj International Airport, Mumbai.

Strategic Plan to Regain e-PV Market Share

Tata Motors, which sells the electric avatars of the Punch, Nexon, Curvv, Tiago, Tigor, and Harrier, has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of which have launched new EVs in the past year and currently have a combined retail market share of 49% for the first nine months of this year.

On the retail sales front, as per Vahan data (October 3, 2025), Tata Motors sold 48,547 units between January and September 2025. This includes its best-ever monthly retails of 7,438 units in August, an 18% month-on-month increase over July 2025 (6,308 units).

However, September’s retail sales fell 17% MoM to 6,145 units, mirroring the trend of the overall e-PV industry, which felt the heat of slower sales due to the GST-driven sizeable price cuts on IC engine cars, SUVs, and MPVs.

Nevertheless, the 48,547 units represent a 6% YoY increase (January-September 2024: 45,970 units) and are already 79% of Tata’s CY2024 retails of 61,174 e-PVs.

In September, Tata Motors’ retail EV market share was 40%. While this is considerably down from the 65% market share Tata EVs commanded a year ago, monthly retail sales numbers have risen considerably from the first six months of CY2025, crossing 6,000 units for three straight months.

Tata Motors, which is taking rearguard action to protect its turf and leadership, plans to regain lost e-PV market share with a goal of holding a 50% share in a growing and more competitive market.

This strategy is part of a new product offensive that calls for a mega Rs 35,000 crore investment and involves expanding its presence in under-served segments — urban compact EVs, lifestyle SUVs, midsize family cars, and premium electric SUVs — while refreshing its core ICE portfolio.

ALSO READ: GST ICE effect – slower e-PV sales after two months of record growth