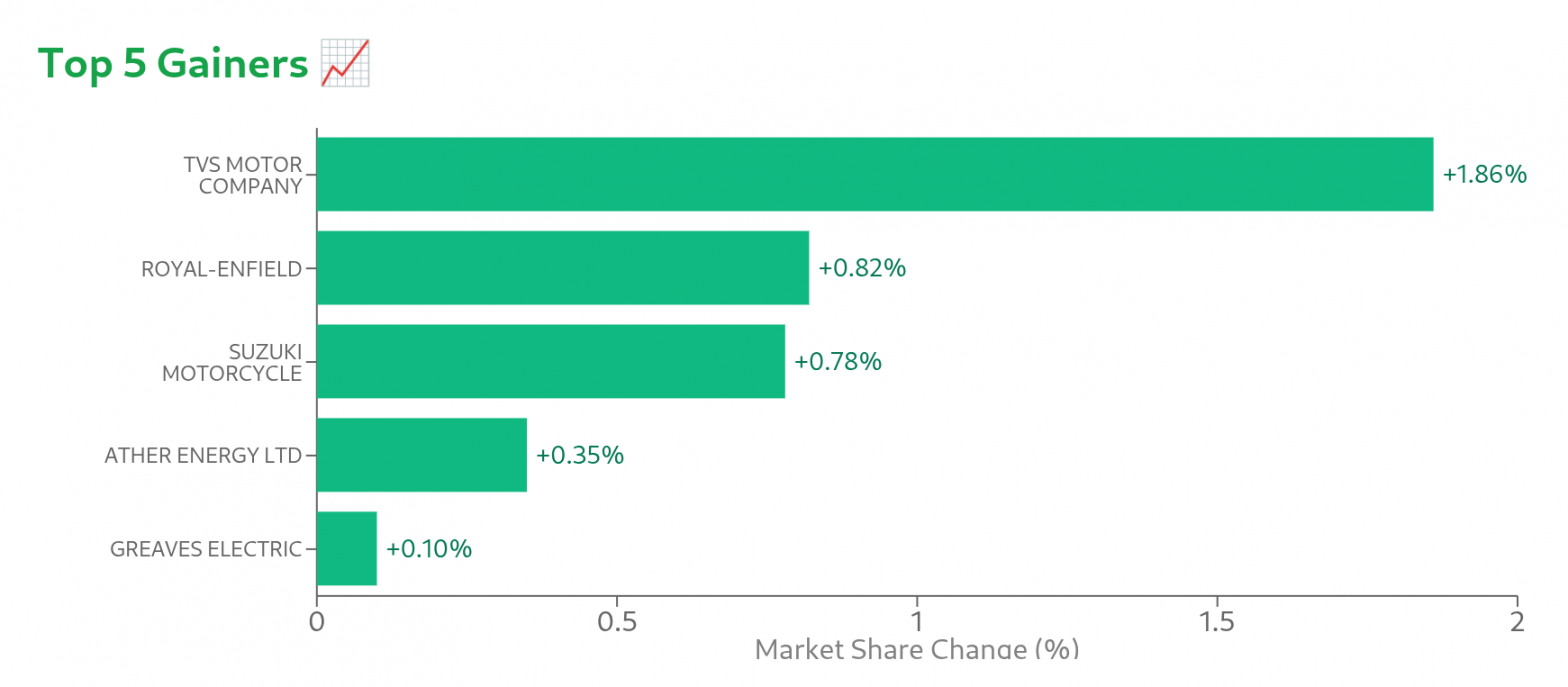

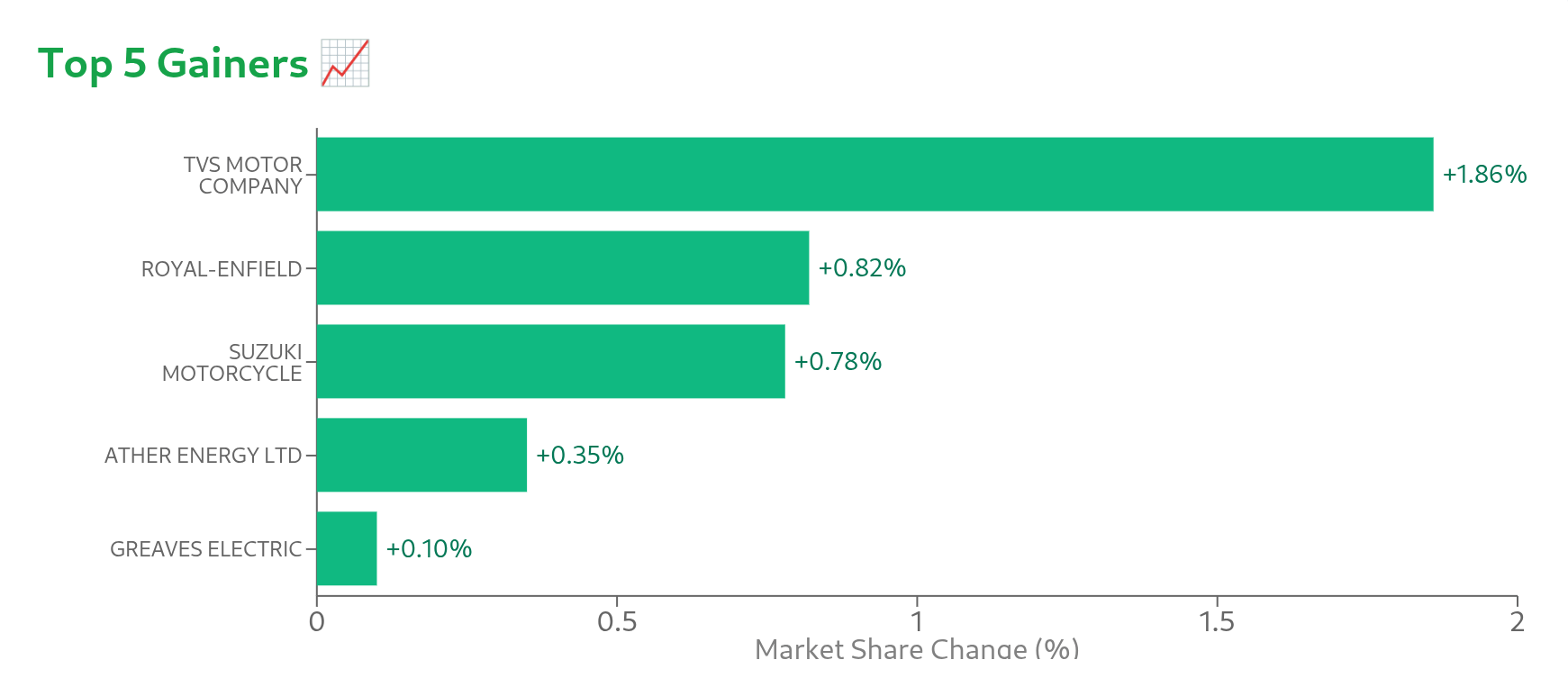

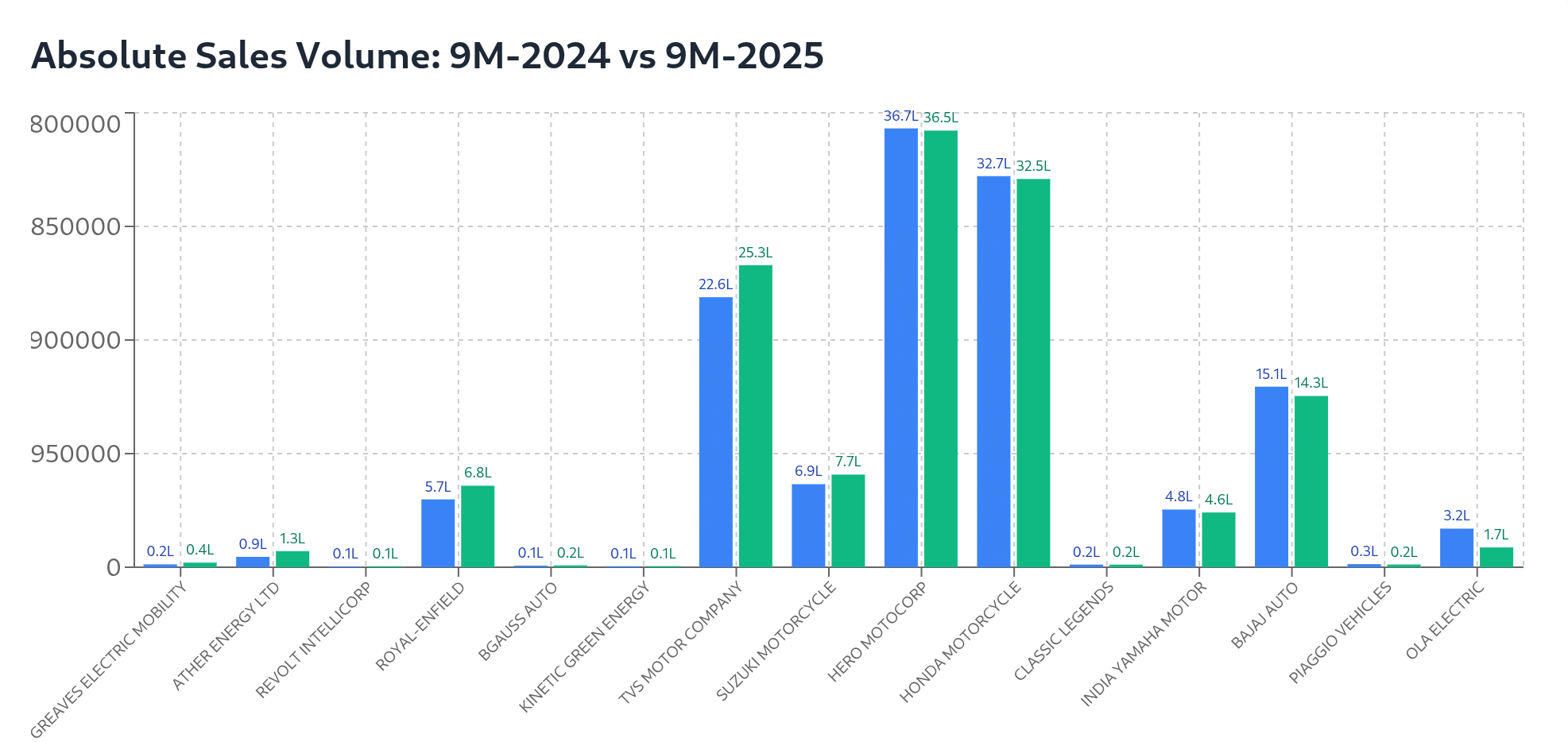

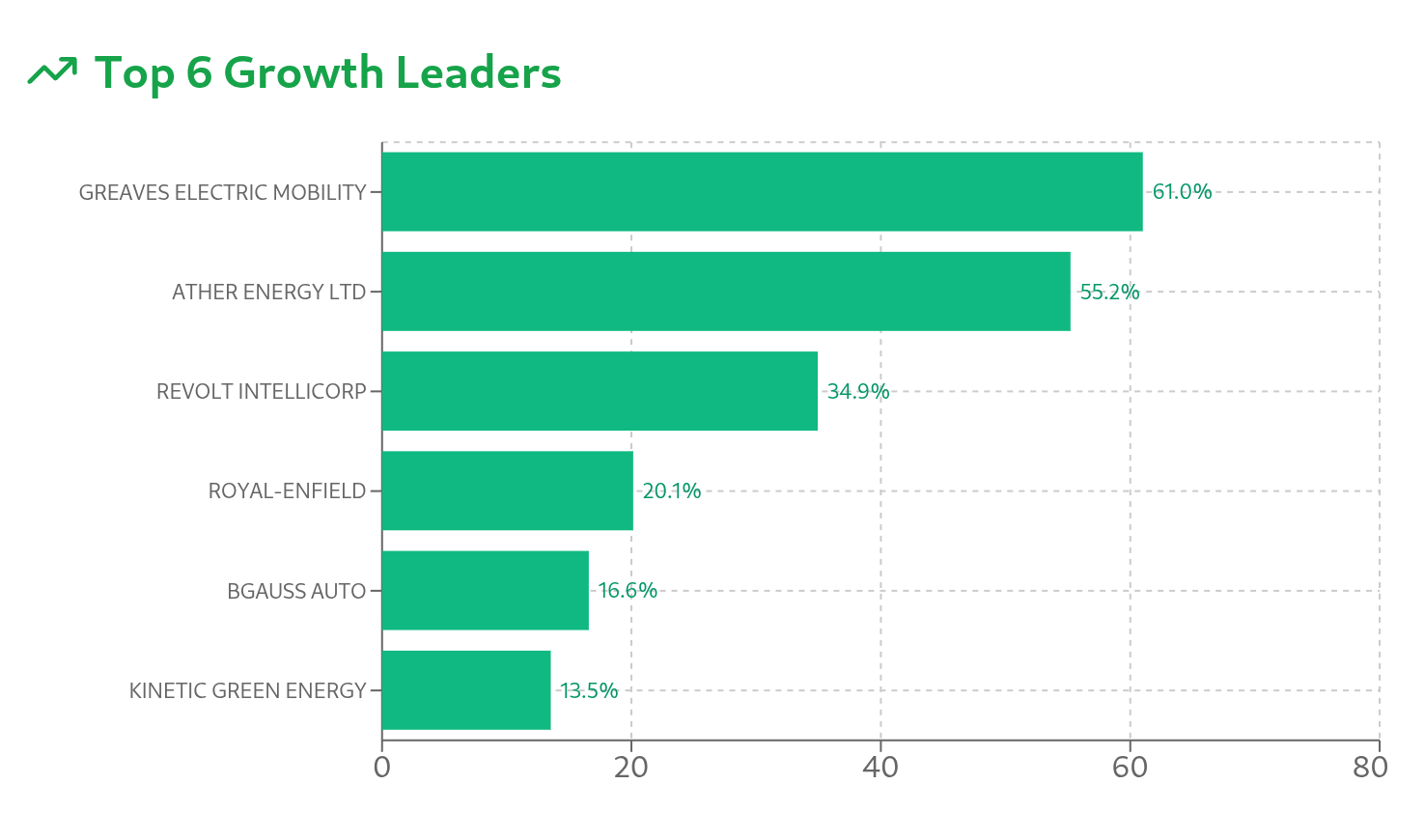

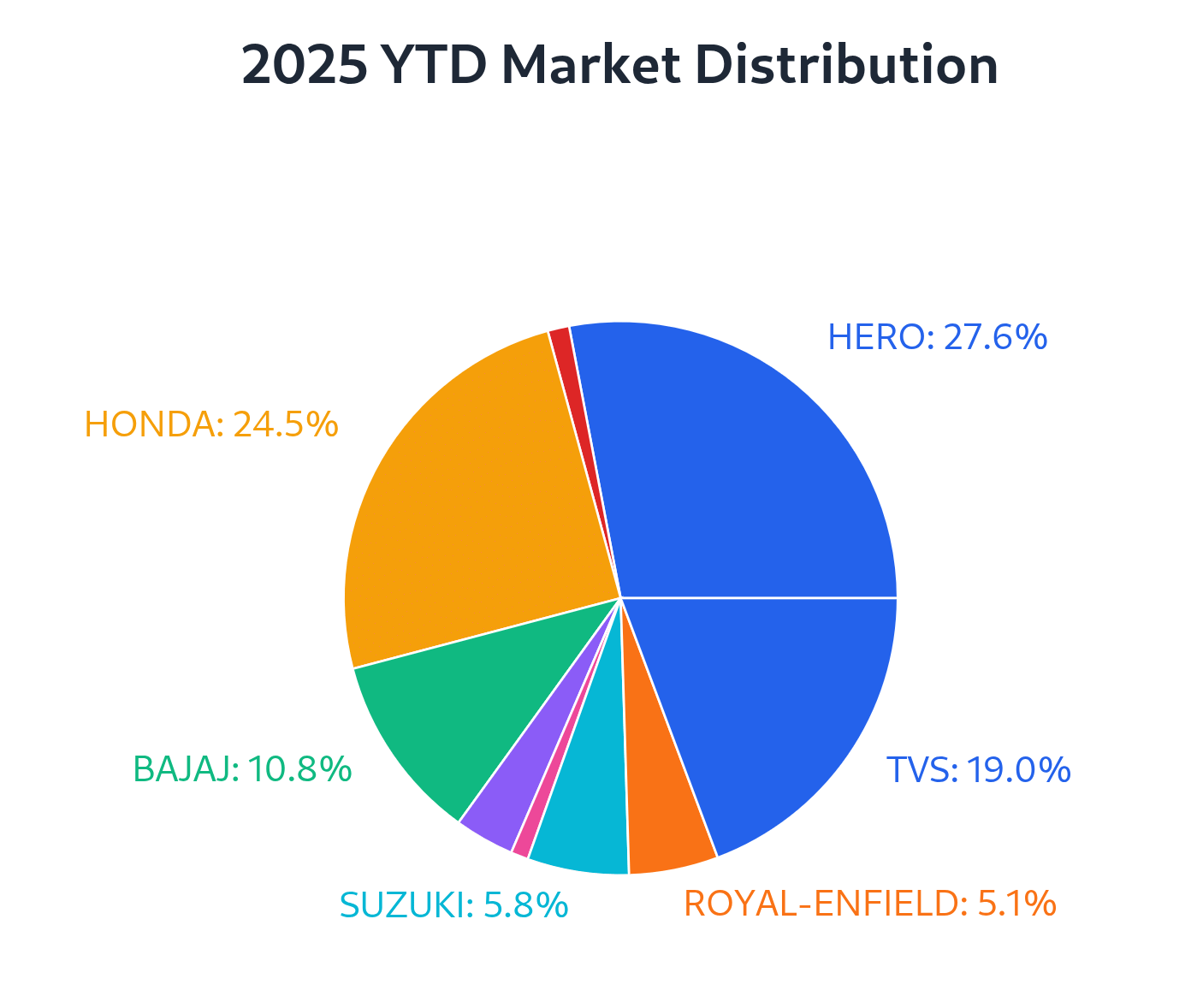

While established giants still get to grips with market changes, smaller, more agile players are taking advantage of shifts in consumer behavior to race ahead. TVS Motor Company, Royal Enfield, Suzuki Motorcycle India, and electric vehicle specialist Ather Energy have collectively gained significant market share when comparing their first nine months of 2025 performance to full-year 2024 figures, capitalizing on shifting consumer preferences toward premiumization, electrification, and technological innovation.

TVS Motor has emerged as the biggest gainer with a remarkable 1.86% increase in market share, expanding from 17.16% in full-year 2024 to 19.02% in the first nine months of 2025.

Royal Enfield follows with a 0.82% gain (from 4.31% to 5.14%), while Suzuki adds 0.78% to its market position (from 5.05% to 5.84%). These gains, achieved in just nine months versus full-year comparisons, represent millions of additional vehicles sold and billions in incremental revenue, fundamentally altering the competitive landscape of the world’s largest two-wheeler market.

All four gainers share a common thread: aggressive innovation and technology adoption. TVS’s ₹1,000 crore EV R&D investment, Royal Enfield’s continuous product updates, Suzuki’s electric scooter development, and Ather’s technology-first approach demonstrate that innovation is no longer optional but essential for market share growth.

They have built diversified portfolios addressing multiple market segments. TVS spans from affordable scooters to premium motorcycles and electric vehicles. Royal Enfield covers the entire 350cc to 650cc spectrum. Suzuki offers both commuter and premium products. This diversification provides resilience against segment-specific downturns.

Each gainer has cultivated a distinct brand identity that resonates with specific consumer segments. Royal Enfield owns the modern classic space, TVS represents sporty performance and innovation, Suzuki stands for reliability and value, while Ather embodies premium electric mobility. Clear brand positioning helps these companies command premium pricing and customer loyalty.

TVS Motor

TVS Motor Company’s ascent to become the primary beneficiary of market share redistribution in the first nine months of 2025 is no accident. The Chennai-based manufacturer has emerged as the only company among India’s top four two-wheeler brands to gain market share when comparing YTD 2025 performance against full-year 2024, leveraging its strong performance in the electric segment and expanding premium business.

TVS’s market share expansion from 17.16% in full-year 2024 to 19.02% in just nine months of 2025—a significant gain of 1.86 percentage points—means the company could exceed 20% market share by year-end if current trends continue.

Driving this growth is TVS’s electric vehicle business, as well as its scooter lineup. In May 2025, TVS achieved strong 50% growth in electric vehicle sales, increasing from 18,674 units in May 2024 to 27,976 units in May 2025. The company dominates India’s fast-growing electric two-wheeler market with a 24.8% share in August 2025, driven by aggressive innovation and deep local consumer insights.

The iQube electric scooter has become a cornerstone of TVS’s electric strategy. The company has allocated ₹1,000 crore for EV R&D, signaling long-term commitment to innovation, while its proactive approach to supply chain risks, including exploring rare-earth magnet alternatives, insulates it from global material shortages.

TVS Motor Company set a record by selling 15.07 lakh units (including three-wheelers) during the second quarter of FY 2025-26, achieving an all-time high quarterly milestone. The two-wheeler segment saw a significant increase, with sales rising by 22% from 11.90 lakh units in Q2FY25 to 14.54 lakh units in Q2FY26.

Total exports registered robust growth of 30%, rising from 3.09 lakh units in Q2FY25 to 4.00 lakh units in Q2FY26, providing TVS with diversified revenue streams and reduced dependence on the domestic market alone. The three-wheeler segment excelled with an impressive 60% growth, demonstrating the company’s ability to capture opportunities across multiple vehicle categories.

Royal Enfield

Royal Enfield has expanded its market share from 4.31% in full-year 2024 to 5.14% in the first nine months of 2025, a gain of 0.82 percentage points. This growth is particularly impressive when considering it’s being achieved in a compressed timeframe. The company has emerged as India’s fastest-growing traditional motorcycle brand among established players, recording exceptional sales growth in 2025.

September 2025 marked a historic moment as Royal Enfield registered its highest-ever monthly sales by retailing 1,24,328 motorcycles—the highest monthly sales figures in the brand’s history. The company recorded 43% year-on-year growth, translating to an increase of 37,350 units compared to September 2024.

More significantly, Royal Enfield has achieved a major milestone by selling over 10 lakh motorcycles in a single financial year for the first time in its history. The company recorded total sales of 10,09,900 units for the 2025 financial year, marking an 11% increase and demonstrating sustained growth momentum.

Royal Enfield’s success reflects its dominant position in India’s premium motorcycle segment, where it maintains over 80% market share in the 250cc+ category. The brand’s iconic retro styling combined with modern engineering has solidified its leadership in the mid-size motorcycle category, particularly with flagship models like the Classic 350 and Hunter 350.

The 350cc portfolio continues to be the volume driver, contributing approximately 86% of total sales. The recent GST reduction from 28% to 18% on motorcycles under 350cc has made Royal Enfield’s core products even more accessible, with price reductions of up to ₹22,000 on some models.

In the 500-800cc segment, Royal Enfield commands an impressive 96% market share with its 650cc motorcycles, having sold 42,258 units in the past 11 months with robust 41% year-on-year growth. This near-monopolistic position in the premium segment provides Royal Enfield with pricing power and margin advantages unavailable to competitors.

Export performance has been a standout for Royal Enfield, with year-to-date exports reaching 70,421 units—a substantial 60% increase over 43,936 units in the first half of the previous fiscal year. The brand operates through nearly 850 stores in over 60 countries globally, supported by state-of-the-art manufacturing facilities and technical centers.

Suzuki

Suzuki Motorcycle India’s market share has grown from 5.05% in full-year 2024 to 5.84% in the first nine months of 2025, a gain of 0.78 percentage points. This growth reflects a strategy of consistent execution and strategic positioning. The company has achieved record annual sales of 12.56 lakh units for the financial year 2024-25, marking an 11% growth compared to the previous year, with sales doubling in just four years.

Suzuki registered its highest-ever monthly sales in March 2025, selling 1.25 lakh units, a 21% increase from March 2024. The momentum continued through the year, with September 2025 sales reaching 1,23,550 units, representing a 25% year-over-year increase, attributed to festive season demand and recent GST 2.0 reforms.

The company’s domestic market performance has been particularly strong, with sales reaching 10.45 lakh units in FY2024-25, up 14% from the previous year. Export performance has also contributed to growth, with August 2025 seeing exports grow by 29%, with 22,307 units shipped compared to 17,320 units in August 2024.

Suzuki’s planned entry into the electric scooter market with the e-ACCESS positions the company to capture growth in the rapidly expanding EV segment. The company began production of the e-Access electric scooter at its Gurgaon facility in May 2025, equipped with a 3.07kWh Lithium Iron Phosphate battery and modern features.

Strengthening its after-sales operations, Suzuki achieved its highest-ever spare parts sales worth INR 881 million in September 2025, marking the third consecutive month of record performance in this segment with 17% year-over-year growth. This focus on service excellence helps build customer loyalty and generates recurring revenue streams.

Ather Energy

While smaller in absolute terms, Ather Energy’s market share gain from 0.67% in full-year 2024 to 1.01% in the first nine months of 2025 represents a 0.35 percentage point increase. More impressively, this represents a 50% increase in its market position when comparing nine months to a full year, making it one of the fastest-growing companies in percentage terms. The company climbed to third place in September 2025 electric two-wheeler registrations with 16,558 units, demonstrating its growing influence in the premium electric scooter segment.

Ather has successfully positioned itself as a premium, technology-focused brand in the electric two-wheeler space. Unlike competitors chasing volume through aggressive pricing, Ather has focused on product quality, advanced features, and superior customer experience.

Innovation and Agility

India’s two-wheeler market is undergoing a fundamental transformation, with TVS Motor, Royal Enfield, Suzuki, and Ather Energy emerging as clear winners in the first nine months of 2025. These four companies have achieved remarkable market share gains that signal shifting consumer preferences and industry dynamics.

These gains reflect several critical trends reshaping the industry. Premiumization is accelerating as consumers increasingly prioritize features, performance, and brand appeal over basic transportation. The electric transition, though still at 7-8% penetration, is rewarding early movers who have developed credible electric offerings. Service quality has become a key differentiator, with Suzuki’s record spare parts sales and Ather’s customer experience focus exemplifying this shift. Technology integration is now essential, as features once considered premium—connectivity, navigation, LED lighting—become standard expectations, particularly among younger urban consumers.

The outlook remains optimistic, supported by favorable government policies on electrification and reduced GST rates for sub-350cc motorcycles. India’s projected 6.6% economic growth in 2025 will drive increased demand, especially in premium segments. With the festive season typically accounting for 30-40% of annual sales, these companies’ strong performance positions them well for continued gains.

However, challenges persist. Supply chain disruptions, particularly rare earth magnet availability for electric motors, could constrain growth. Intensifying competition in attractive segments may compress margins, while economic uncertainty could impact discretionary spending on premium products.

The success of these four companies provides a clear roadmap for the industry: invest in innovation, build strong brands, diversify portfolios, excel at service, and embrace electrification. Their nine-month achievements suggest full-year 2025 results could show even more dramatic shifts. As India’s two-wheeler market evolves, technology, sustainability, and premiumization will increasingly define success. For TVS, Royal Enfield, Suzuki, and Ather, the challenge now is consolidating their gains and building lasting competitive advantages in this dynamic, rapidly transforming market landscape.