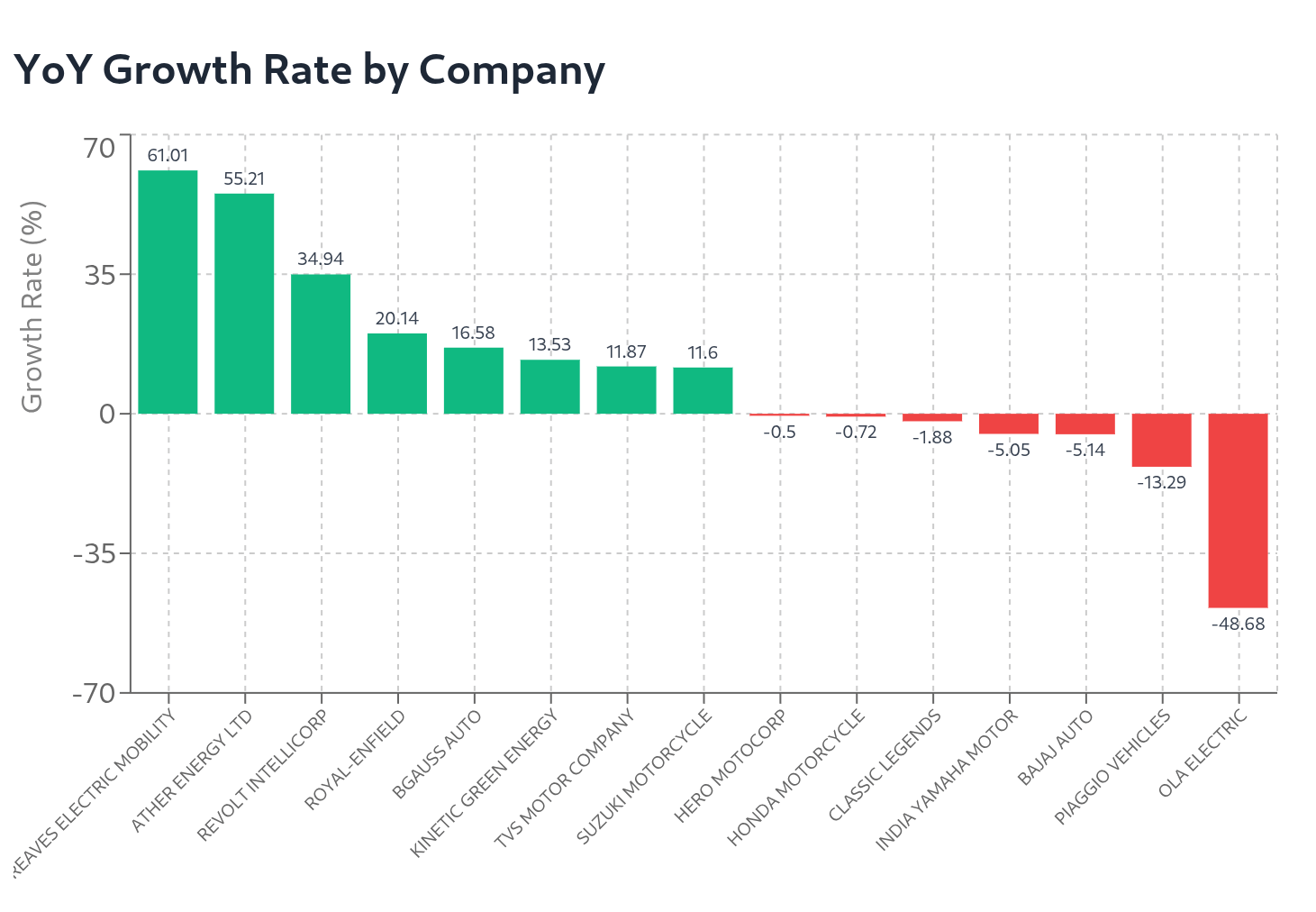

As the 2025 festive season gets underway, a look at the two-wheeler industry over the past one year shows some surprising trends – indicating that while some players’ strategies have borne fruit, most of the plans by various OEMs have not.

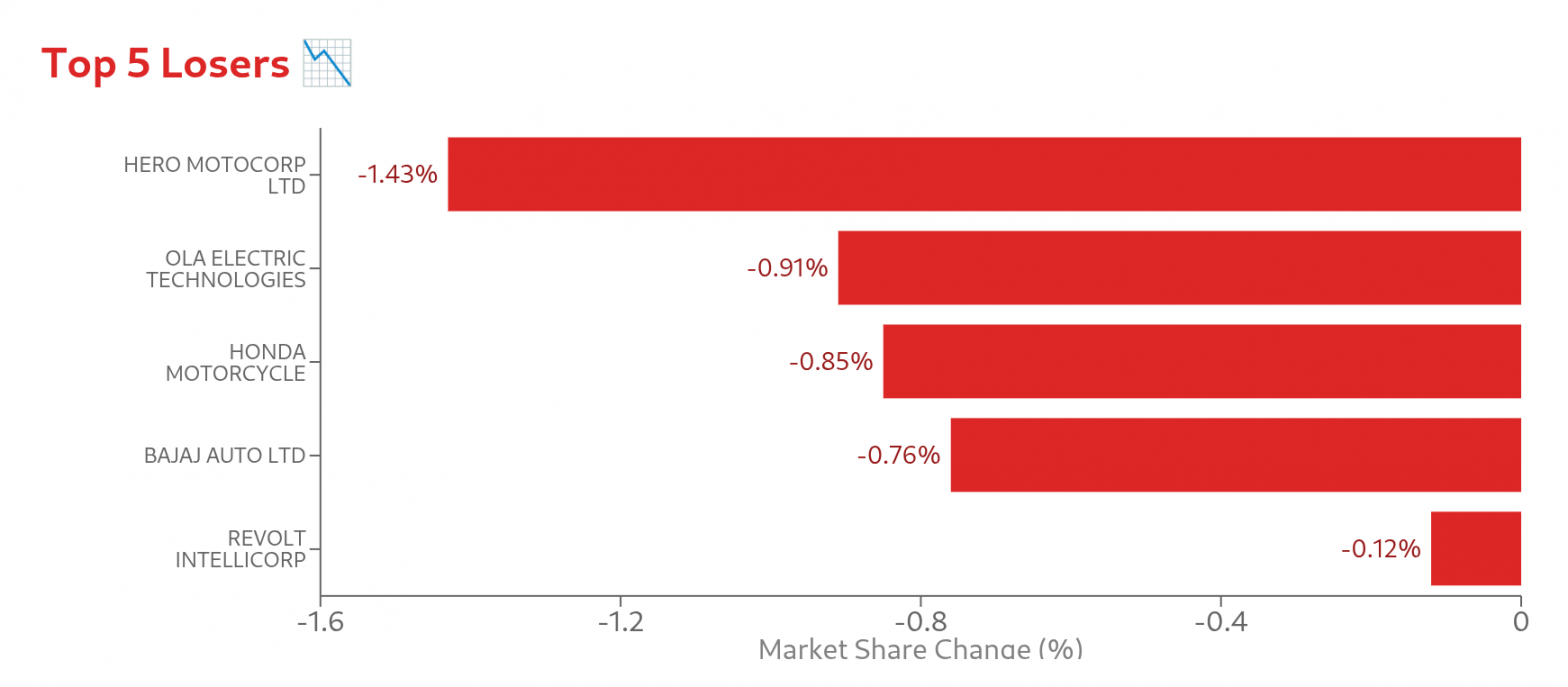

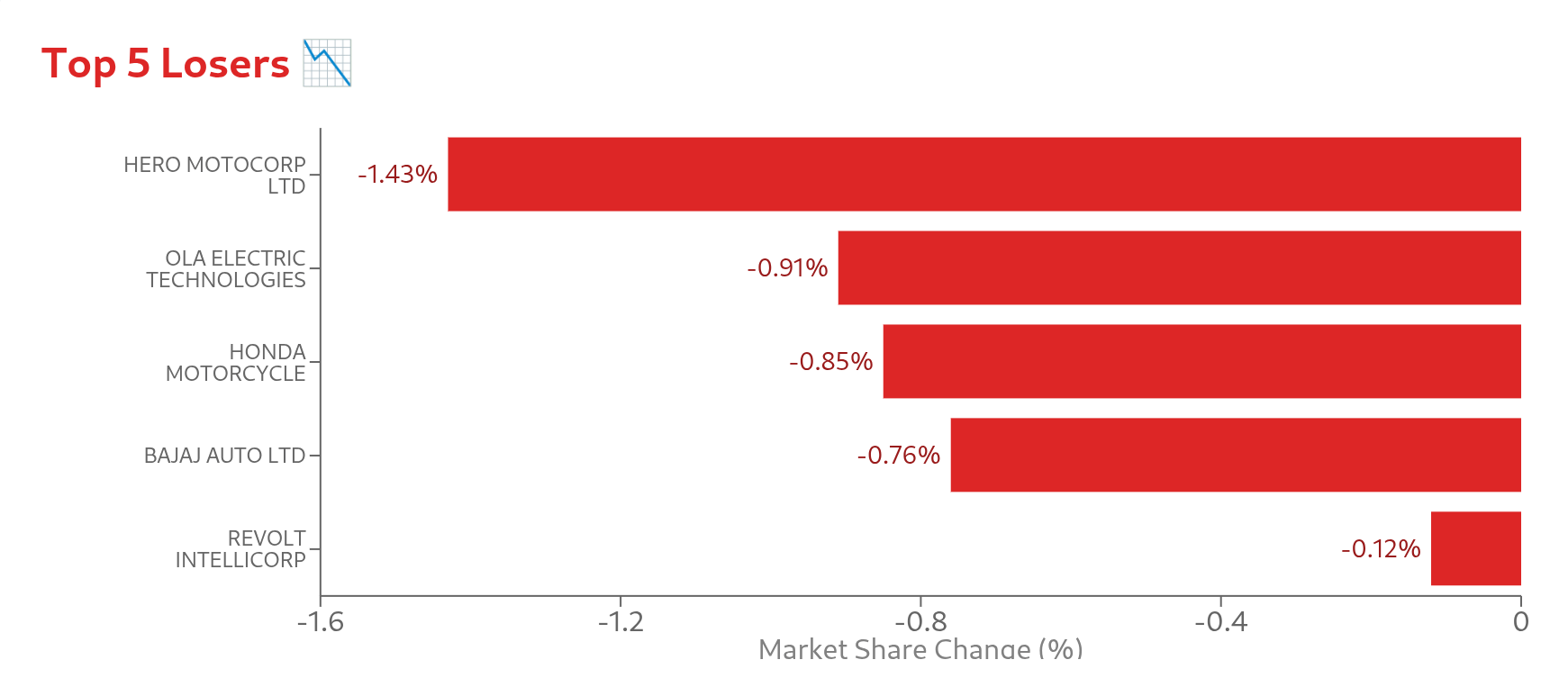

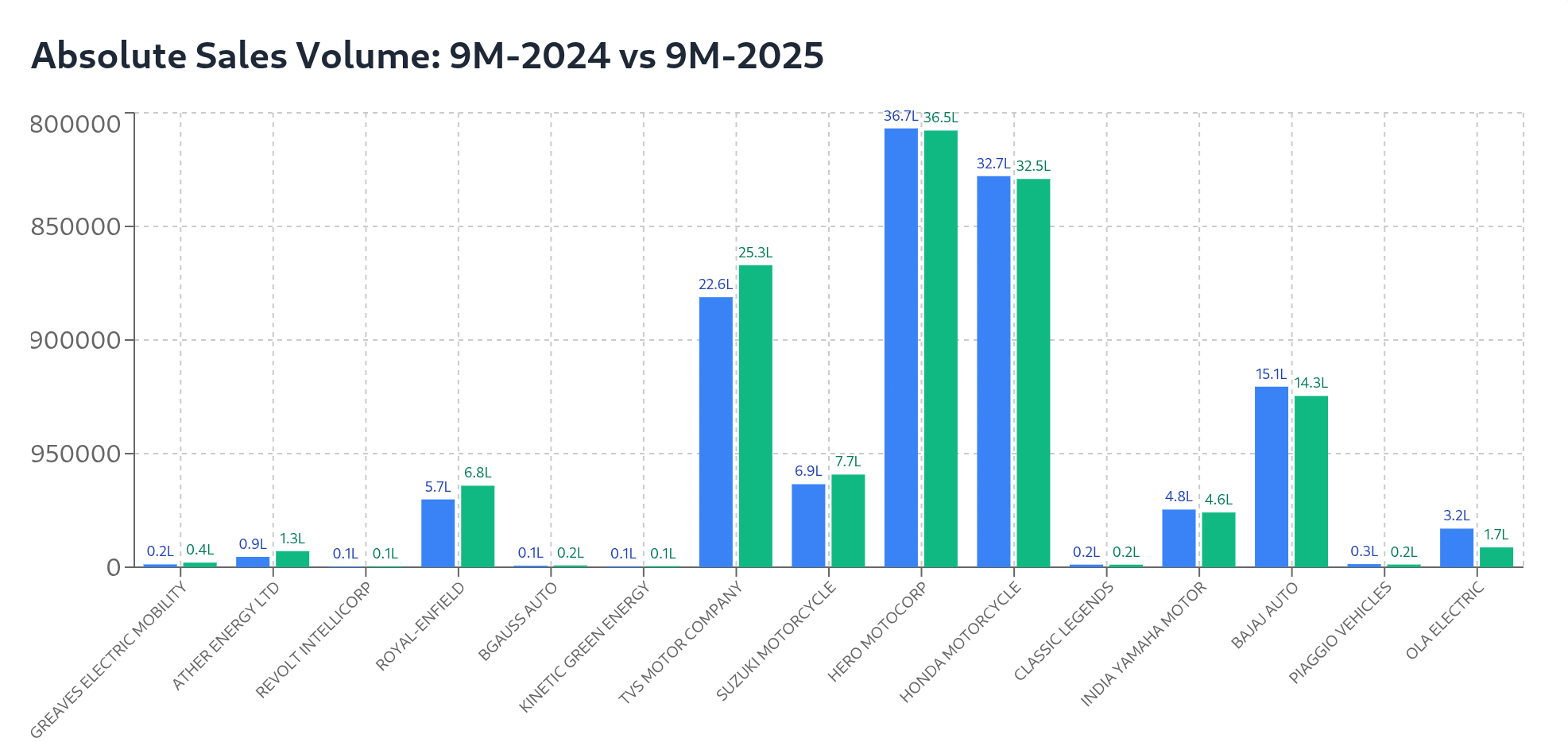

Data comparing the first nine months of 2025 with full-year 2024 figures reveals that four major players—Hero MotoCorp, Ola Electric, Honda Motorcycle & Scooter India, and Bajaj Auto—have collectively shed significant market share, signaling a fundamental transformation in consumer preferences and competitive dynamics in the world’s largest two-wheeler market.

In the first nine months of 2025, Hero MotoCorp’s market share has declined to 27.58% from 29.01% in full-year 2024, a drop of 1.43 percentage points.

Ola Electric has experienced an even steeper decline, with its market share falling to just 1.24% in the nine-month period from 2.15% in 2024. Similarly, Honda’s share dropped to 24.50% from 25.35%, while Bajaj Auto fell to 10.78% from 11.54%.

These year-to-date losses aren’t isolated incidents but part of a broader market reconfiguration that’s reshaping India’s mobility sector. The shift toward electric vehicles has disrupted traditional market dynamics.

Legacy players like Honda have struggled to establish a meaningful presence in the electric segment, while early mover, pure-play EV companies like Ola have failed to maintain their early advantage against traditional manufacturers entering the space.

By July 2025, electric two-wheelers had achieved 7.6% market penetration in registrations and 6.1% in retail sales, but the distribution of this growth has been uneven, with traditional players like TVS and Bajaj successfully leveraging their existing networks while startups struggle with service and quality issues.

The second major reason for the somewhat rapid realignment in market share is the continuing bifurcation between price-conscious consumers and buyers seeking premium features. The upper-middle and affluent classes increased their spending on higher-value goods, while the lower-middle and working classes remained under significant economic pressure.

This trend has particularly impacted Hero MotoCorp, whose strength in entry-level motorcycles has become a liability as market growth shifts to higher-margin premium segments. Meanwhile, companies like TVS and Royal Enfield have successfully captured this premiumization wave.

In this context, the pace of product innovation has become a critical differentiator. Companies that have failed to refresh their portfolios or introduce compelling new technologies have lost ground rapidly.

Hero MotoCorp

For decades, Hero MotoCorp has been synonymous with two-wheeler dominance in India. However, the first nine months of 2025 shows the company has not been able to reverse the slide in its market share seen in recent years. Comparing nine-month 2025 performance against full-year 2024, Hero has lost 1.43 percentage points of market share, with its YTD market share standing at 27.58% versus 29.01% for all of 2024.

The company recently saw churn at the top, with Niranjan Gupta and Ranjivjit Singh resigning as chief executive officer (CEO) and chief business officer. Executive Chairman Pawan Munjal recently stated that underperformance would not be tolerated.

The numbers paint a stark picture of Hero’s struggles. New models account for relatively lower share of Hero’s sales compared to competitors like TVS. This innovation gap has proven costly in a market increasingly driven by technology and premium features.

Moreover, Hero’s heavy reliance on rural markets and commuter models has become a double-edged sword, leaving Hero vulnerable as urban consumers increasingly drive market trends toward premiumization and electrification.

Ola Electric

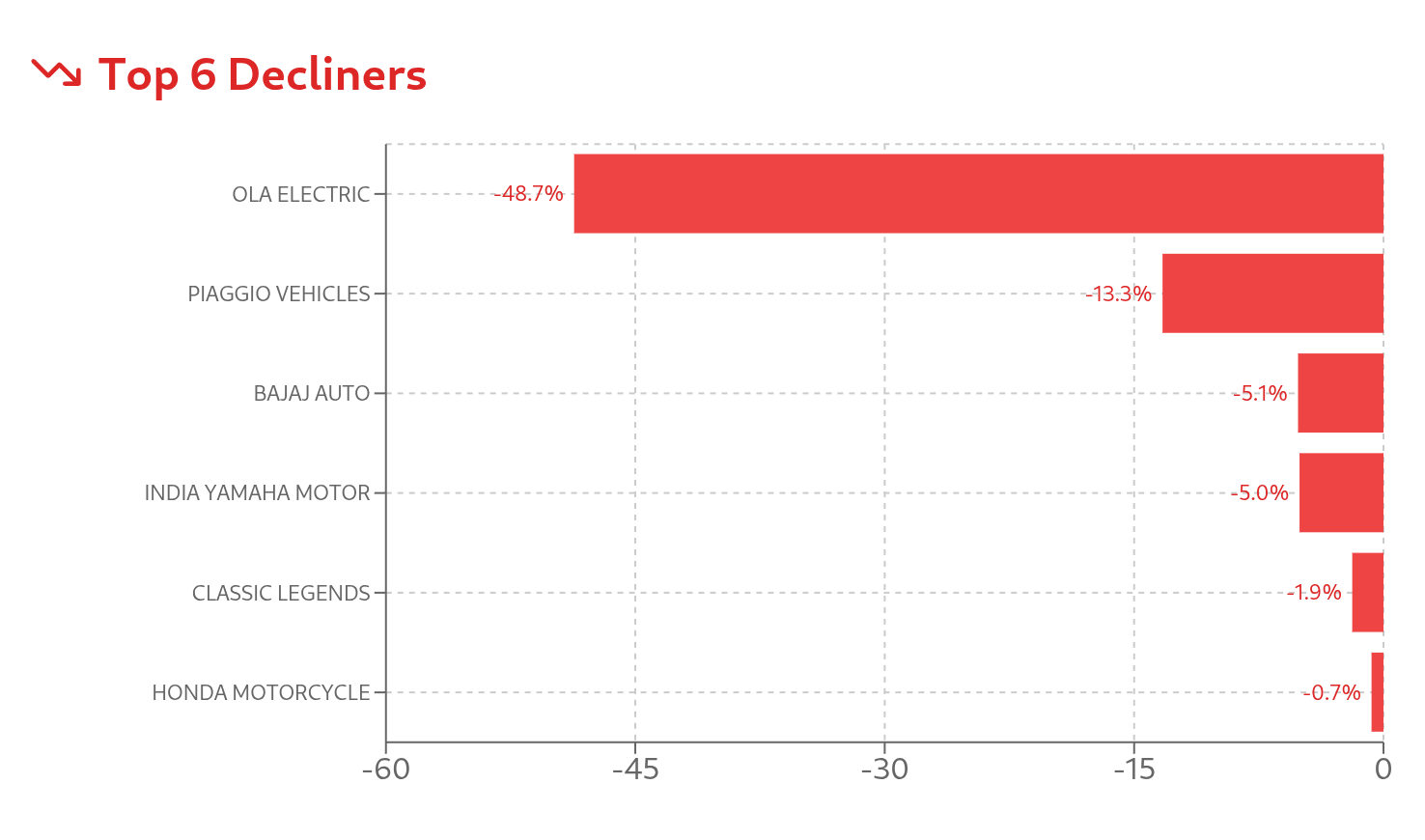

Perhaps no company’s fall from grace has been as dramatic as Ola Electric’s. Once hailed as the poster child of India’s electric vehicle revolution, the company has seen its market share evaporate at an alarming rate. In the first nine months of 2025, Ola’s market share has collapsed to just 1.24%, down from 2.15% in full-year 2024—a decline that becomes even more stark when considering the company once commanded over 50% of the electric two-wheeler market.

Ola Electric Mobility shares hit an all-time low on March 3, 2025—down more than 60% from its peak in August 2024. The market share collapse has been equally severe: In May 2025, Ola Electric’s market share stood at 20%, a dramatic fall from 49.2% a year ago, with vehicle registrations at just 15,221 units.

The root causes of Ola’s decline are multifaceted. Market analysts say the company faces tough competition from legacy two-wheeler giants like Bajaj Auto and TVS Motor, as well as the promising startup Ather, while piling customer complaints against Ola’s scooters are adding to the company’s woes and leading to a rapid fall in sales.

Honda Motorcycle and Scooter

Honda’s situation presents an interesting paradox. Data shows a 0.85% market share decline when comparing nine-month 2025 figures (24.50%) to full-year 2024 (25.35%). However, the No.2 player in India has, at the same time, been able to reduce the distance between itself and No.1 Hero.

Despite short-term challenges, Honda remains bullish on the Indian market. The Japanese automaker plans to secure a 30% market share in India’s two-wheeler sector by 2030. The company is particularly focused on the electric segment, with plans to begin operating a dedicated electric two-wheeler production plant in India in 2028.

Bajaj Auto

Bajaj Auto, arguably India’s biggest export success story, has nevertheless seen its domestic market share decline from 11.54% in full-year 2024 to 10.78% in the first nine months of 2025, a drop of 0.76 percentage points.

Part of the decline may be because it is transitioning from a volume player to a premium-focused manufacturer. The company’s focus on premium motorcycles through brands like Pulsar has yielded mixed results, with overall market share continuing to erode.

In 2025, while international sales grew, Indian sales declined. This domestic weakness has offset gains in export markets, where Bajaj has traditionally been strong.

The recent GST restructuring has created both opportunities and challenges for Bajaj. While the GST reduction from 28% to 18% on motorcycles under 350cc benefits its mass-market models, the 40% GST hike on motorcycles above 350cc has created a regulatory headwind for premium models like the Dominar 400 and KTM 390 Duke.