September 2025, which heralded GST 2.0 and much-reduced sticker prices for the bulk of the mass-market passenger cars, sedans, SUVs and MPVs, saw two of India’s top six passenger vehicle (PV) manufacturers achieve their best-ever monthly wholesales. While Tata Motors sold 59,667 units (up 45% YoY) to take the No. 2 PV OEM rank, Mahindra & Mahindra sold 56,233 SUVs (up 10% YoY) last month to be ranked third, pushing Hyundai Motor India (51,547 units, up 1% YoY) to the No. 4 position in September. Maruti Suzuki remains the ‘big boss’ with 132,820 units (down 8% YoY).

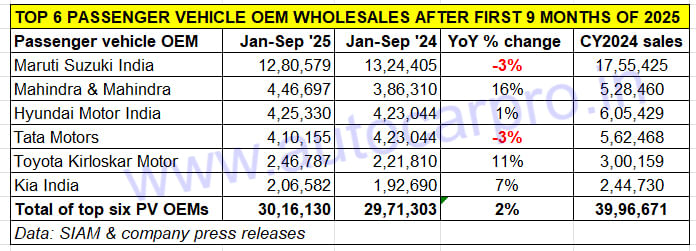

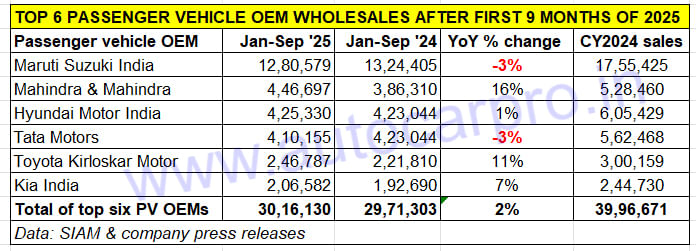

However, when the cumulative wholesales for the first nine months of CY2025 are chalked out, Mahindra & Mahindra is ahead of both Hyundai Motor India and Tata Motors. Between January and September 2025, M&M dispatched 446,697 SUVs to its dealers across India, up 16% YoY. This total is 21,367 units more than Hyundai Motor India, thereby giving M&M the No. 2 rank on the podium, after market leader Maruti Suzuki.

What has helped M&M drive ahead is its better performance than Hyundai and Tata in the second and third quarters of this year. After clocking 149,127 SUVs in Q1 (January-March), factory dispatches rose 2% QoQ in April-June (152,067 units) but dropped by 4% in July-September (145,503 units) which, nevertheless, were better numbers than Tata (140,189 units) and Hyundai (139,521 units) in Q3 CY2025.

While Maruti Suzuki remains unassailable with 1.28 million units, Mahindra with 446,697 vehicles sold in January-September 2025 leads both Hyundai (425,330 units) and Tata Motors (410,155 units).

As a result, Hyundai Motor India, with factory dispatches of 425,330 cars, sedans and SUVs, up 1% YoY, sees its ranking drop to No. 3. The company has been impacted by slower growth right from January – after eight straight months of sales decline, wholesales rose by 1% in September 2025. Interestingly, In Q1 CY2025 (January-March: 153,550 units), Hyundai was ahead of both Mahindra (149,127 units) and Tata Motors (146,127 units) but lost that lead to M&M in both the second and third quarters of this calendar year.

Tata Motors takes No. 4 position in PV wholesales with 410,155 units, down 3% YoY. Q1 (January-March 2025: 146,127 units) was its best quarter, ahead of Q2 (123,839 units) and Q3 (140,189 units). What has helped the company’s numbers is the revival of demand for its EVs (57,022 units, up 8% YoY) which have a penetration level of 14%, up marginally on the year-ago 13 percent.

Toyota Kirloskar Motor, which is witnessing strong demand for most of its SUVs and MPVs, retains its fifth rank with factory dispatches of 246,787 PVs in the January-September 2025 period, up 11% YoY.

And Kia India, with 206,582 units, registered YoY growth of 7% in the first nine months of this year.

With the automotive industry across segments being one of the biggest gainers of the GST reforms, which have helped reduce vehicle sticker prices substantially, every day from September 22 when GST 2.0 kicked in and the Navratri festival also opened brings news of record daily bookings and sales. During the nine-day fest, market leader Maruti Suzuki had forecast total deliveries to have crossed a record 200,000 units up 135% over Navratri 2024 sales of 85,000 units.

With the other movers and shakers of the PV industry also reporting robust sales in September and also ramped-up production to cater to demand in the coming months of the year, will Mahindra keep Tata Motors and Hyundai at bay to maintain its No. 2 position till December 31, 2025? Watch this space for regular in-depth industry sales updates.