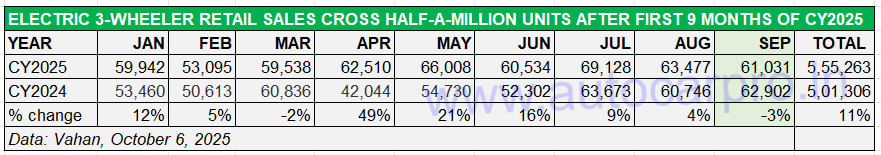

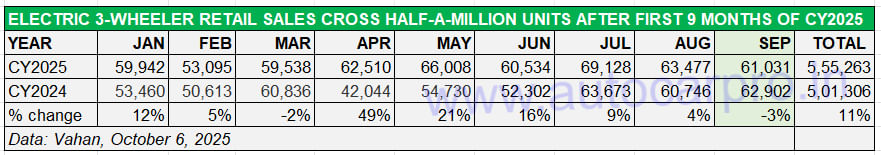

With three months left to go in CY2025, the electric three-wheeler industry, the second-largest contributor to EV sales in the country after two-wheelers, is well set to achieve its best-ever calendar-year sales this year. As per retail sales statistics on the Vahan portal, a total of 555,263 units were delivered between January and September, up 11% YoY (January-September 2024: 501,306 units).

With this, this vehicle segment has already reached 80% of its record full-year CY2024 volume of 691,302 units. If it maintains the current growth trajectory, the industry will surpass the 700,000-unit milestone for the first time in a calendar year, which it narrowly missed in CY2024.

Admittedly, sales have been somewhat slower in August and September, particularly when compared to July 2025 when the e-3W industry registered its best-ever monthly sales of 69,128 units.

At 555,263 units in January-September, the e-3W industry is well set to achieve record 700,000 sales in CY2025.

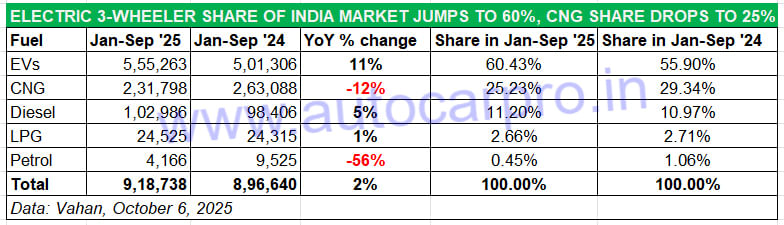

Of the total 918,738 3Ws sold in the January-September period, e-3Ws registered 11% growth and grew their market share to 60 percent. In comparison, CNG 3W sales are down 12% to 231,798 units and market share reduced to 25% from 29% a year ago.

ELECTRIC 3-WHEELERS EAT INTO CNG MARKET

Of the total 918,738 three-wheelers sold across all powertrains in India (other than Telangana for which Vahan does not provide the retail data) in the first nine months of CY2025, electric three-wheelers account for the bulk of them – 60% – clearly establishing their stranglehold over this vehicle segment. Furthermore, it is also the one to register the highest YoY growth (see data table above). The 11% YoY increase in sales has given it an additional 4% market share, increasing from the 56% it had a year ago and has taken away sales from the CNG 3W market whose share of the overall 3W market has dropped by 4% YoY.

January-September 2025 retails of CNG-powered 3Ws (231,798 units) are down 12% YoY (January-September 2024: 263,088 units). This translates into 31,290 fewer units sold, with one of the sales impediments being the recent price hikes of this fuel which increase the total cost of vehicle ownership, which is critical in this segment. Despite the recent GST price reduction, demand has yet to pick up.

Meanwhile, diesel 3W sales, at 102,986 units, rose 5% YoY while LPG-fuelled 3Ws (24,525 units) increased by 1 percent. And only 4,166 petrol-engine 3Ws, down 56% YoY, were sold in the last nine months.

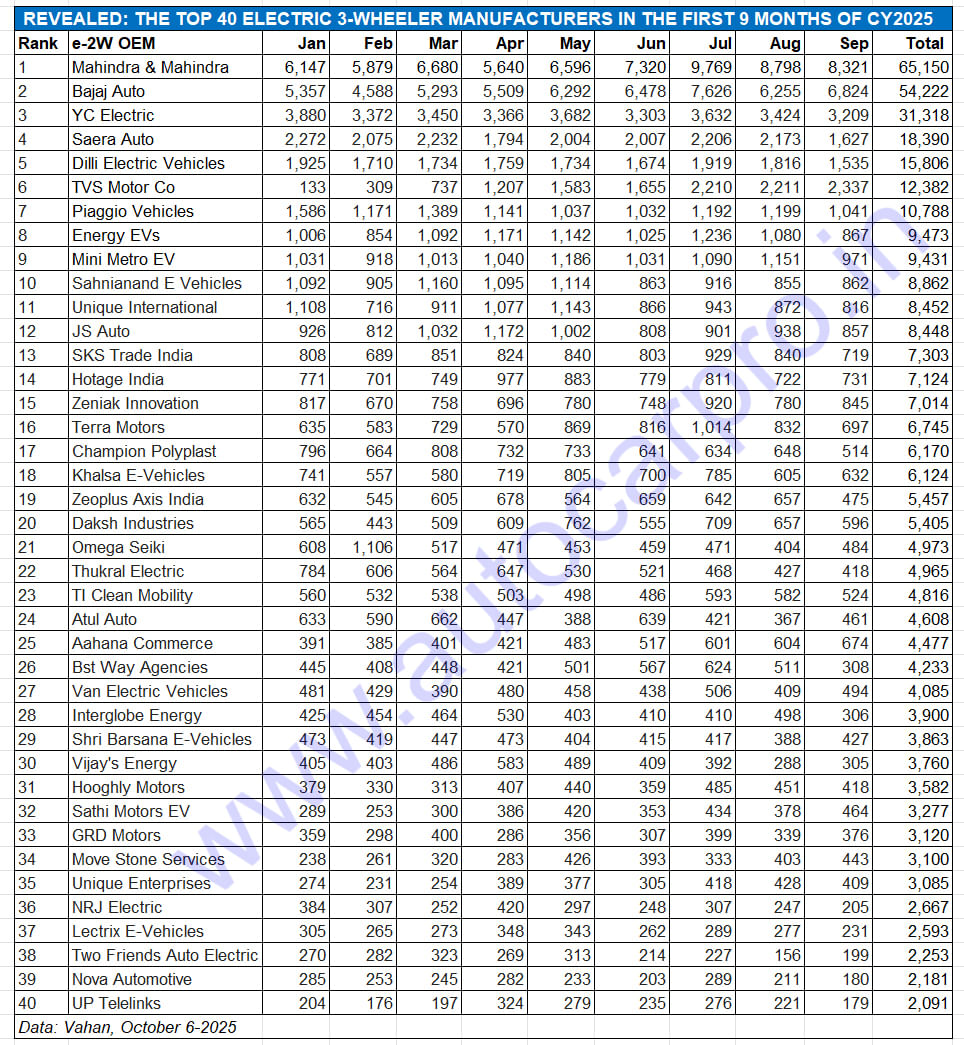

The scenario in the 620-player-strong e-3W industry is akin to the e-2W industry, where a shakeout is underway between the legacy OEMs and a host of startups. The Top 40 e-3W OEMs (see data sheet below) has seven legacy players – Mahindra & Mahindra, Bajaj Auto, TVS Motor Co, Piaggio Vehicles, Omega Seiki, Murugappa Group company TI Mobility, and Atul Auto. These seven OEMs have sold 156,939 units which makes for a 28% market share.

Electric 3W market leader Mahindra Last Mile Mobility (65,150 units, 12% share) is followed by Bajaj Auto (54,222 units, 10% share), TVS Motor Co (12,382 units, 2% share, ranked No. 6), Piaggio Vehicles (ranked No. 7 with 10,788 units, 2% share), Omega Seiki (4,973 units, 1% share and ranked No. 21), TI Mobility (4,816 units, 1% share and ranked No. 23) and Atul Auto (4,608 units, 1% share, ranked No. 24).

With the seven legacy OEMs accounting for 156,939 units of the 555,263 e-3Ws sold in the first nine months of this year, the other 398,994 units delivered to buyers are split between 613 other players, mainly comprising start-ups and SMEs. This not only reflects the intense competition is this segment of the EV industry but also the growing consumer transition towards buying towards better-built and safer vehicles from the well-established legacy players who also benefit from a widespread sales and service network across the country.