The Indian electric two-wheeler industry is headed for its best monthly sales in the year to date this October. In the first 15 days of October 2025, as per the latest retail statistics on the Vahan portal, 67,328 units have been delivered to customers. With Diwali coming up on the 20th, expect accelerated new EV buying, which would mean a doubling of sales in the October 16-31 period. March 2025 (131,434 units) has been the best month for e-2W retail sales this year.

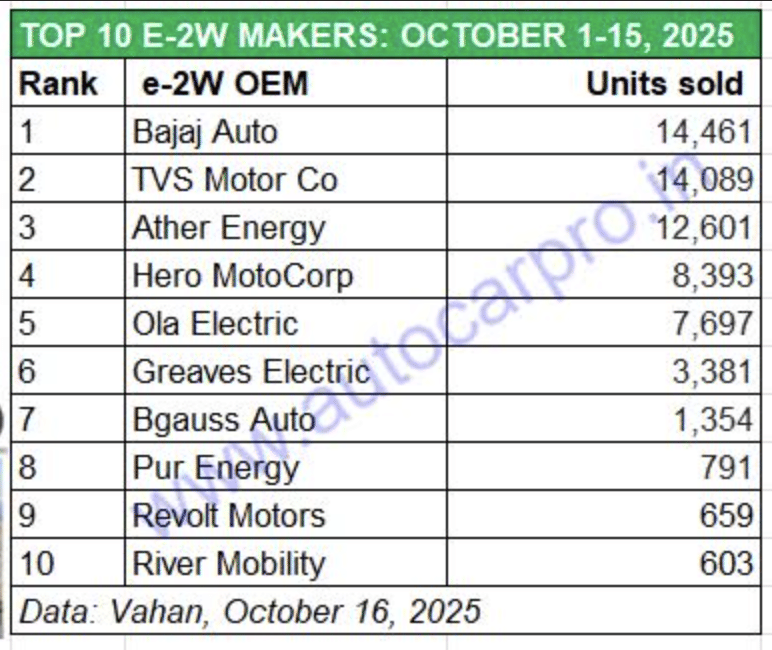

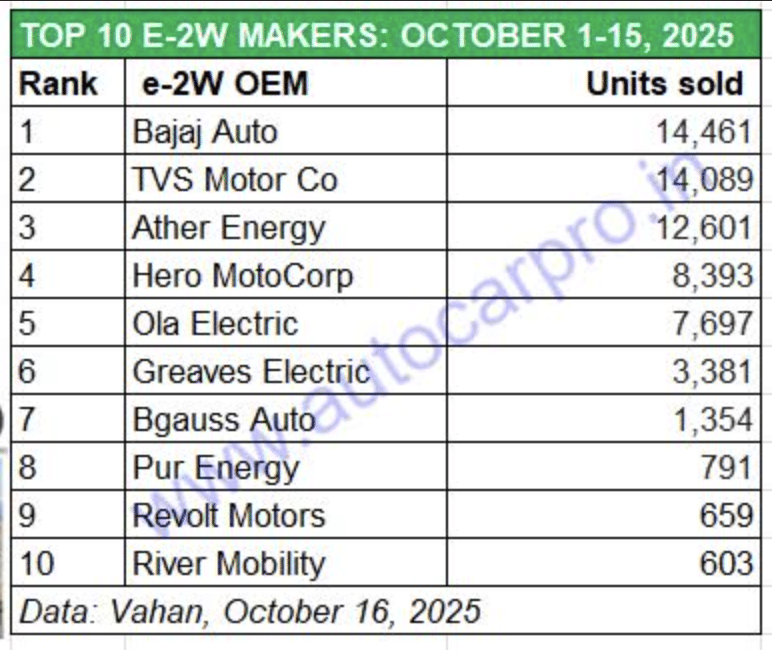

The top six OEMs – Bajaj Auto, TVS Motor Co, Ather Energy, Hero MotoCorp, Ola Electric and Greaves Electric Mobility – have together sold 60,622 units, accounting for 90% of the total e-2W sales in first-half October, leaving the balance 10% to be fought over by 190 other players.

Bajaj Auto has bounced back into the lead after a gap of six months and is currently ahead of market leader TVS Motor Co.

The big news is that Bajaj Auto has bounced back into the lead after a gap of six months, and is currently ahead of market leader TVS Motor Co. The Pune-based manufacturer of the Chetak has sold 14,461 units to be ahead of its Chennai-based rival by a slender margin of 372 units. Bajaj Auto, which had last topped the monthly e-2W sales in February (21,570 units) and March (35,214 units), has been in the No. 2 slot right since April and had dropped to No. 5 in July due to production constraints. It remains to be seen if Bajaj can maintain the lead over the next fortnight.

TVS Motor Co, which has topped the e-2W market for six months in a row from April 2025, is currently in No. 2 position with 14,089 units. The company, whose main growth driver till now has been the iQube, recently launched the Orbiter e-scooter at Rs 99,900 (ex-showroom Bengaluru), inclusive of PM E-Drive Scheme subsidies. This prices the Orbiter — which has a 3.1 kWh battery pack — on par with the base iQube variant that features a smaller 2.2 kWh battery pack. The Orbiter, which has a top speed of 68kph, is designed for urban commuting and has an IDC range of 158 km per charge. The second half of this month will decide whether TVS has held onto its crown or its long-time ICE and EV rival Bajaj Auto has surged ahead.

Ather Energy is maintaining its strong growth that it has displayed from the start of the year. The smart e-scooter OEM as delivered 12,601 units between October 1-15 and is less than 2,000 units way from both Bajaj Auto and TVS. Its flagship premium Rizta family e-scooter, which surpassed 100,000 wholesales 13 months after launch in April, remains Ather’s key growth driver and currently contributes over 60% of its sales each month.

Hero MotoCorp, the world’s largest two-wheeler manufacturer, continues to be in the news with robust demand for its new Vida VX2 model. The world’s largest two-wheeler manufacturer has sold 8,393 Vida e-scooters in first-half October, which will make this month the fourth in a row when it will have surpassed sales of 10,000 units. The strong run is due to the robust consumer demand for the new Vida VX2.

The strong showing of the top four e-2W OEMs means that Ola Electric, the e-2W market leader not very long ago, is currently ranked fifth amongst the 220 players in this segment. Between October 1-15, as per Vahan data, Ola delivered 7,697 EVs comprising both e-scooters and e-motorcycles. The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price points — from entry-level mass mobility through to premium. The S1 Pro, equipped with a 4 kWh battery, has a claimed 142 km range on a single charge. Ola also manufactures and sells the Roadster X electric motorcycle, which develops peak power of 11 kW, a top speed of 125 kph, and has a range of 501 km.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, which markets the Ampere brand of e-scooters, is ranked sixth with 3,381 units. The company has three key e-scooter brands: Nexus (EX and ST), Magnus (Neo and EX), and Reo (80 and Li Plus). On September 18, Ampere Vehicles launched its latest product, the Magnus Grand family scooter priced at Rs 89,999 (ex-showroom). The flagship Nexus remains the best-selling product for GEM and Ampere Vehicles, even as it witnesses demand for the Ampere Reo 80, launched in April at Rs 59,900.

At No. 7 position is Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel. Bgauss has sold 1,354 units of its e-2Ws comprising the RUV 350 and Max C12.

Pur Energy, the Hyderabad-based EV startup incubated from the i-TIC at IIT Hyderabad, is now a regular entry in the monthly Top 10 e-2W OEM list. The company, which has a five-model portfolio, has clocked sales of 791 units to take eighth rank.

Electric motorcycle manufacturer Revolt Motors, with 659 units, is ranked No. 9 in this Top 10 listing. The company, which was amongst the earliest to launch an electric motorcycle in India in CY2019, has expanded its portfolio to five products with the RV BlazeX. It also has an aggressive localization programme and uses EV components from Sona Comstar, Uno Minda, Rockman, FIEM and JBM.

Another startup which is fast becoming a monthly Top 10 regular is the Bengaluru-based River Mobility, which has a single product – the River Indie. In first-half October, the company has delivered 603 units to customers.

India’s e-2W market is the largest contributor to India EV Inc and between January 1 and October 15 has registered retails sales of 986,739 units which constitutes 86% of the segment’s record retail sales of 1.14 million units in CY2024. This segment, which has plenty of products on offer – more scooters, a growing number of motorcycles and some mopeds, is set to register strong double-digit gains thanks to the Diwali festival, and in a way shrugging off any impact from the GST-driven price cuts on its IC-engine cousins.