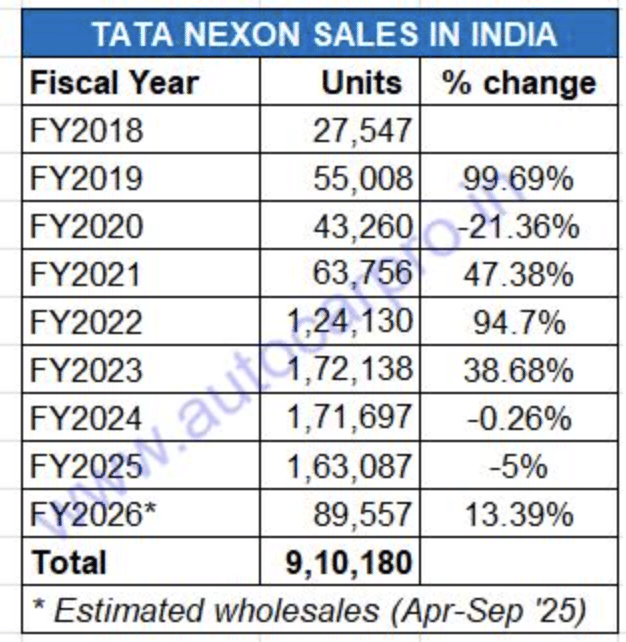

With best-ever monthly sales of 22,573 units in September 2025, the Tata Nexon has driven past the 900,000 sales milestone in the domestic market, as accurately forecast in Autocar Professional’s sales analysis a month ago. Launched on September 21, 2017, Tata Motors’ first compact SUV, which is sold with petrol, diesel, electric and CNG powertrains, has clocked total wholesales of 910,181 units to date and becomes the first Tata SUV to clock 900,000 sales.

The milestone comes eight years and a month after the Tata Nexon was launched on September 21, 2017. The compact SUV can be credited with having enabled Tata Motors’ resurgence in the SUV and passenger vehicle market.

While the Nexon crossed 200,000 sales in June 2021, 45 months after launch, the next 200,000 units were sold in barely 16 months – October 2022 – when the 400,000 milestone was surpassed. The run from 400,000 units to 500,000 units took a scant six months, and from half-a-million to 600,000 units came in seven months. It took another seven months to hit the 700,000 sales mark in July 2024. The 800,000 mark was crossed eight months later in February 2025. And the 900,000 milestone has been surpassed last month (September 2025).

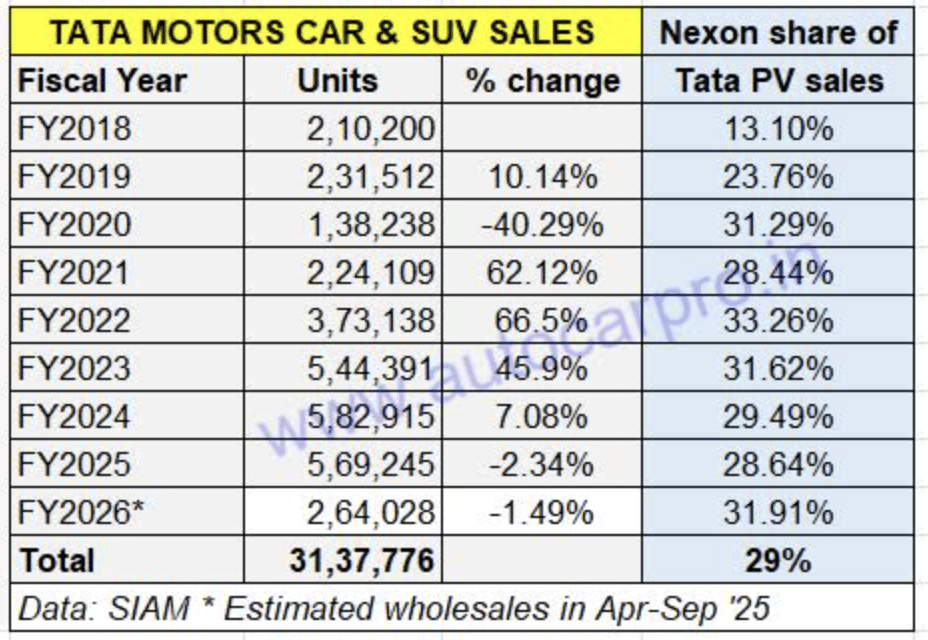

In the current fiscal year’s first six months, the Tata Nexon is India’s No. 1 best-selling SUV with 89,557 units, up 24% YoY (H1 FY2025: 72,350 units). Also, the No. 1 model for Tata Motors which has clocked wholesales of 273,688 PVs, the Nexon accounts for the bulk – 33% – of the eight-model PV portfolio which includes the Punch (73,455 units), Tiago (39,863 units), Altroz (20,957 units), Curvv (13,546 units), Harrier (12,649 units), Safari (8,102 units) and Tigor (5,899 units).

FY2023 with 172,138 units was the Nexon’s best fiscal to date. With 89,557 Nexons dispatched to dealers in India in the last six months and 13% growth, FY2026 could set a new benchmark.

The Nexon was crowned India’s best-selling SUV for three fiscals in a row – FY2022, FY2023 and FY2024. Its best fiscal performance was in FY2023 with 172,138 units, up 39% YoY (FY2022: 124,130 units) when it accounted for 33% of the company’s 373,138 passenger vehicle sales.

Since then, demand has slowed down, as can be seen from the wholesales data table above. FY2024’s 171,697 units made for flat sales but contributed 29% to Tata Motors’ highest-ever passenger vehicle wholesales of 582,915 units. In FY2025, demand fell 5% YoY to 163,087 units. As a result, the Nexon’s ranking in the Top 10 SUVs fell sharply by six ranks to No. 7, losing the India No. 1 SUV title to sibling Punch. The Nexon is fighting back in FY2026 and with 89,557 units in H1 FY2026 (up 13% YoY), it is 16,102 units ahead of the Tata Punch.

Over the years, the competition in the compact SUV segment, which accounts for the bulk of the sales in the utility segment that includes midsize SUVs and MPVs, has intensified. In FY2018, the main rival to the Nexon was the Maruti Brezza launched in March 2016 (which has accumulated sales of 1.32 million units to date). Now, in FY2026, the Nexon’s rivals include its sibling Punch, Hyundai Venue, Kia Sonet, Mahindra 3XO, Skoda Kylaq and the Kia Syros.

From launch in September 2017 till-end September 2025, the Nexon has contributed 29% to Tata Motors’ sales of 3.13 million passenger vehicles. The Nexon’s market performance is reflected in its growing contribution to Tata Motors’ overall passenger vehicle sales. From a 13% share in FY2018, the Nexon’s share rose to 24% in FY2019, crossed the 30% mark in FY2020, hit 33% in FY2022. However, since then, with the rollout of sibling Punch and continuing demand for the Altroz and Tiago hatchbacks, its share has reduced marginally. In FY2023, the Nexon (172,138 units) had a share of 31%, which dropped to 29% in FY2024 (171,929 units). In FY2025, with 163,087 units (down 5% YoY), the Nexon’s share of Tata Motors’ total PV sales remained 29 percent. In FY2026’s first six months, the Nexon’s much-improved sales sees its share of Tata PV wholesales rise to 32 percent.

If the Nexon maintains the same growth trajectory, and there is no reason why it shouldn’t, considering the recent GST 2.0-driven price cuts – up to Rs 155,000 and the highest on a Tata PV– the Nexon could well reclaim the No. 1 SUV crown in FY2026.

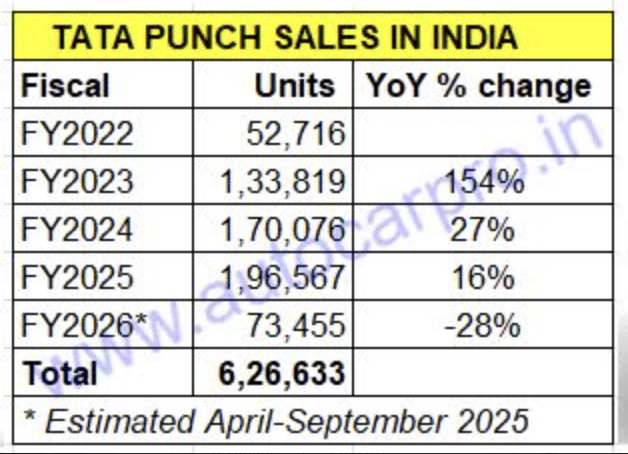

TATA PUNCH PUNCHES PAST 600,000 SALES IN LESS THAN 4 YEARS

Tata Motors’ second compact SUV is also clocking big numbers. Launched four years after the Nexon, the Punch, whose fifth anniversary comes up on October 18, has sold a total of 626,633 units in the domestic market till end-September 2025. The Punch drove past the 600,000 sales milestone in July 2025 – 47 months or just a little less than four years after launch. This pace is much faster than ‘big brother’ Nexon which took 74 months or a little over six years to cross 600,000 sales in the domestic market.

Having identified a ‘white space’ in the Indian PV market, Tata Motors had launched the Punch with an aggressive pricing strategy starting at Rs 549,000 (ex-showroom) in October 2021. The compact SUV is currently available in 33 variants – 18 petrol, 7 CNG and 8 electric. After GST 2.0 kicked in, Punch prices have reduced by up to Rs 85,000. The starting price is now Rs 549,000 (ex-showroom Mumba) – the same as at launch five years ago.

The Punch mini-SUV was positioned as a compelling and affordable model – an entry level SUV that could challenge even premium hatchbacks, tall-boy hatchbacks and also compact sedans in the value-conscious Indian passenger vehicle market. The Punch’s USP has been its compelling SUV attributes such as a high unladen ground clearance, high seating for a commanding view of the road and also a tall stance for easy ingress and egress. Clearly, the strategy seems to have paid off in spades.

The sharp focus on vehicle safety has also paid dividends in a market which was becoming aware of the need to buy high-on-safety passenger cars, SUVs and MPVs. On October 18, 2021, four days before its launch, the Tata Punch aced the Global NCAP crash test with a top five-star rating. In June 2024, the Tata Punch EV has also scored a 5-star rating in the Bharat NCAP crash test.

FY2025, with 196,567 units and 16% YoY growth, was the Tata Punch’s best fiscal to date. Sales are likely to pick after the new Punch is launched later this year.

As the data table above depicts, FY2025 with 196,567 units and 16% YoY growth was the Tata Punch’s best fiscal and gave it India’s No. 1 SUV title for the first time since its launch, narrowly beating the Hyundai Creta, which remains India’s best-selling midsize SUV. The Punch was also the No. 1 SUV in CY2024 when it sold 202,031 units.

The Punch has raised the sales bar with every 100,000 units. In August 2022, it became the first SUV in India to achieve the 100,000 wholesales milestone in just 10 months, crossed the 150,000 mark in 15 months after launch, 200,000 in 20 months, 300,000 in 28 months, and 400,000 in June 2024, just 32 months after launch. The run from 400,000 to 500,000 wholesales took a scant six months or 38 months after launch, reflecting the continuing demand for the compact SUV. However, with 73,455 units in the first six months of FY2026, sales are down 28% YoY (H1 FY2025: 101,820 units). This translates into 28,365 fewer units YoY. However, one of the reasons for the slower sales could be that the new Punch is slated for launch very soon.

Nevertheless, the Tata Punch remains a top choice for first-time car buyers and nearly 70% of Punch ICE (petrol and CNG) owners are first-time car buyers. Interestingly, the compact SUV has gained strong traction amongst women drivers, which is reflected in the fact that 25% of Punch EV owners are women. As per the company, the Punch’s appeal cuts across India’s urban and rural landscapes, proving its versatility in diverse terrains and lifestyles.

ALSO READ: Tata Motors on course to achieve record annual EV sales in CY2025