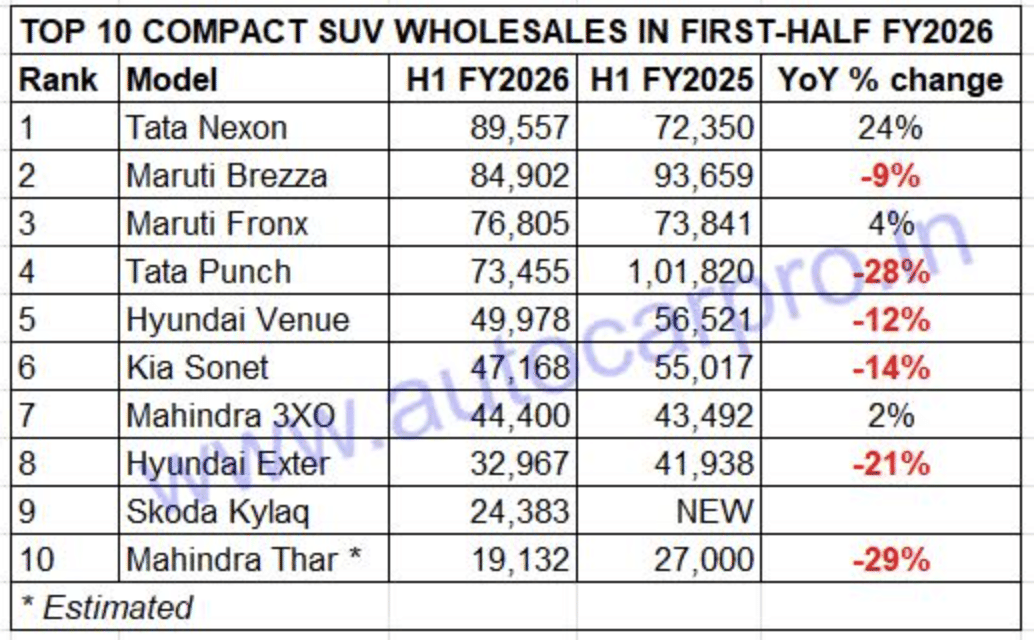

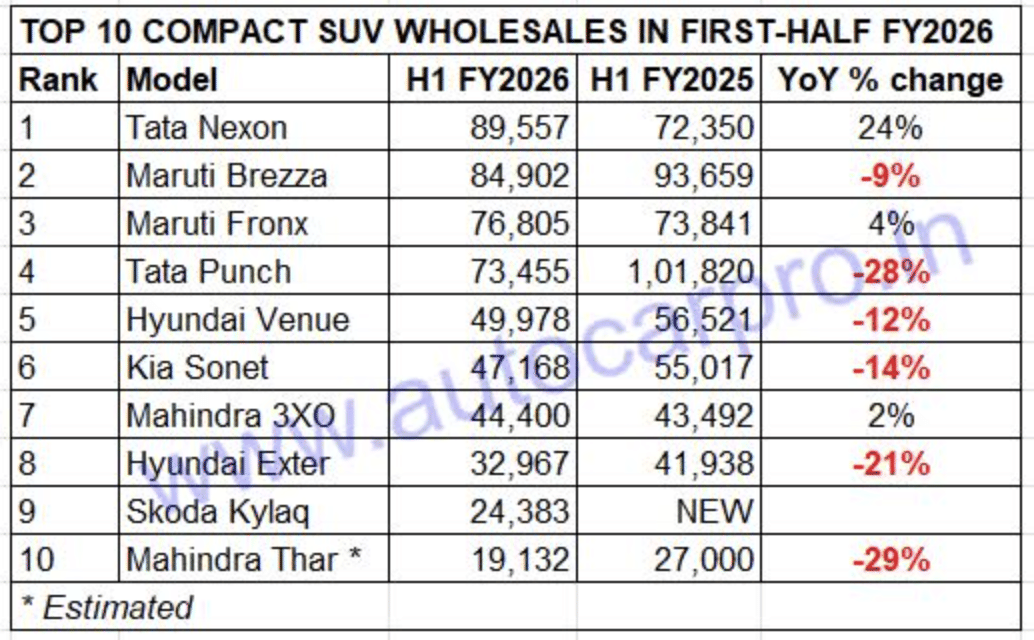

Small can also be big in the Indian SUV market. Of the nearly 100 utility vehicles and 1,000-plus variants in the domestic market, compact SUVs account for 21 models and a humongous number of variants. Of these models, 10 have made their mark in the first six months of the current fiscal year 2025, accounting for an estimated 542,747 units or 85% of the total 634,300 compact SUVs sold in April-September 2025.

The 634,000 compact SUVs sold in H1 FY2026 are, however, down 5.56% YoY (H1 FY2025: 671,674 units). Nevertheless, they account for 47% of the total 1.35 million (13,53,270 UVs) sold in H1 FY2026.

Let’s take a closer look at the Top 10 movers and shakers in this sub-segment where the SUVs are less than 4,000mm long.

These Top 10 models account for 85% of the 634,300 compact SUVs sold in first half of the current fiscal year.

The Tata Nexon, which is sold with petrol, diesel, electric and CNG powertrains, is currently India’s best-selling SUV per se and also the No. 1 compact SUV. Tata Motors’ first-ever compact SUV, which has crossed cumulative sales of 900,000 units since its September 2017 launch, has registered wholesales of 89,557 units, up 24% YoY (H1 FY2025: 72,350 units), which gives it a 14% share of the compact SUV market in first-half FY2026.

The Nexon is 4,655 units ahead of the Maruti Brezza, which is thanks to its best-ever monthly sales of 22,573 units in September 2025. Last month’s record sales could be attributed to the Nexon hugely benefitting from the recent GST 2.0-driven price cuts which apply to compact SUVs (below 4000mm length) with petrol engines below 1200cc and diesel engines below 1500cc, And, with Tata Motors offering GST price reductions of up to Rs 155,000 – the highest on a Tata passenger vehicle – the Nexon could well maintain its lead through FY2026 and reclaim the No. 1 SUV crown it lost to sibling Punch in FY2025.

The Maruti Brezza, which is a Maruti Arena model, is ranked No. 2 with 84,902 units, down 9% YoY (H1 FY2025: 93,659 units). In fact, the Brezza, which is currently Maruti’s second-best-selling UV after the Ertiga MPV (93,235 units), was well ahead of the Tata Nexon till August – by 7,745 units – but lost out in September with 10,173 units versus the Nexon’s 22,573 units. The 1.5-litre Brezza, whose pricing now starts at Rs 825,900, received a GST price cut of up to Rs 112,700 (much lower than the 1.2-litre Nexon) and is available only in petrol and CNG versus the Nexon which has petrol, diesel, CNG and electric powertrains.

The Maruti Fronx, a premium Nexa model, is ranked No. 3 in the Top 10 Compact SUV list with 76,805 units, up 4% YoY (H1 FY2025: 73,841 units). The Fronx, which is available with petrol (1.0 and 1.2-litre engines) and CNG power (1.2-litre engine) accounts for 9.65% of the 795,446 UVs Maruti Suzuki sold in the past six months, down 6% YoY.

The Tata Punch, FY2025’s best-selling SUV, is currently ranked fourth with 73,455 units, down by a substantial 28% YoY (H1 FY2025: 101,820 units) – a difference of fewer 28,365 units YoY. However, one of the reasons for the slower sales could be that the new Punch is slated for launch very soon. Nevertheless, the Tata Punch remains a top choice for first-time car buyers and nearly 70% of Punch ICE (petrol and CNG) owners are first-time car buyers. Interestingly, the compact SUV has gained strong traction amongst women drivers,

The Hyundai Venue, Hyundai Motor India’s first-ever compact SUV and the company’s second best-selling SUV after the Creta midsize SUV, has sold 49,978 units (down 12% YoY) to be ranked No. 5. Demand has slowed down for this model, which surpassed cumulative 700,000 sales last month. The current urban-friendly, high-on-fuel efficiency Venue is set to be replaced by a brand-new model on November 4, which is why sales have been tepid. Production of the new Venue has begun at Hyundai India’s new plant in Talegaon, Pune.

The Sonet, Kia India’s first compact SUV and its best-selling UV since January 2024, has clocked six-month wholesales of 47,168 units, down 1% YoY, and accounted for 36% of the company’s sales of 131,006 UVs in H1 FY2026. Launched in January 2024, the feature-laden SUV has clocked cumulative sales of 460,034 units to date.

The Mahindra XUV 3XO, which is squarely aimed at the Tata Nexon, Maruti Brezza as well as the Skoda Kylaq, is ranked seventh with 44,400 units, up 2% YoY (H1 FY2025: 43,492 units). In the first half of FY2026, it is M&M’s third best-selling model after the Scorpio twins (84,634 units) and the Thar and Thar Roxx (59,322 units) and accounts for 15% of the company’s total SUV sales of 297,570 units. In FY2025, this model had sold 100,905 units and accounted for 18% of M&M’s record 551,487 units. In fact, it was Mahindra’s second best-selling SUV in FY2025 after the Scorpio twins.

The Hyundai Exter, Hyundai Motor India’s second compact SUV after the Venue, is ranked No. 8 with 32,967 units, down 21% YoY (H1 FY2025: 41,938 units). This is clearly the impact of the much-increased competition in this ultra-competitive sub-segment of the SUV market.A highlight of its April sales is that the Exter, launched in July 10, drove past the 150,000 domestic market sales. However, sales have slowed down for the Exter – while the first 100,000 units were sold in 13 months, the next 50,000 units have taken 8 months.

The Skoda Kylaq, Skoda India’s vehicle of entry into the booming compact SUV market, is the sole new model in the Top 10 compact SUVs list. The Kylaq, which has become the growth accelerator for Skoda India since its launch in January 2025, is ranked No. 9 with 24,383 units, which makes for an 82% share of the company’s UV sales of 29,817 UVs in H1 FY2026. Since February, it has become the company’s best-selling locally produced vehicle, ahead of the Kushaq SUV and Slavia sedan. The most dynamically sorted compact SUV, as Autocar India calls it, the Kylaq’s highlights are space, performance and handling.

The three-door Mahindra Thar, with an estimated 19,132 units, is ranked No. 10. On October 3, M&M launched the facelifted Thar with prices starting at Rs 999,000 (ex-showroom). The Thar brand, which comprises the three-door Thar and the more mainstream five-door Thar, recently surpassed the 300,000 cumulative sales milestone.

ALSO READ: Tata Nexon surpasses 900,000 sales, Punch punches past 600,000 units