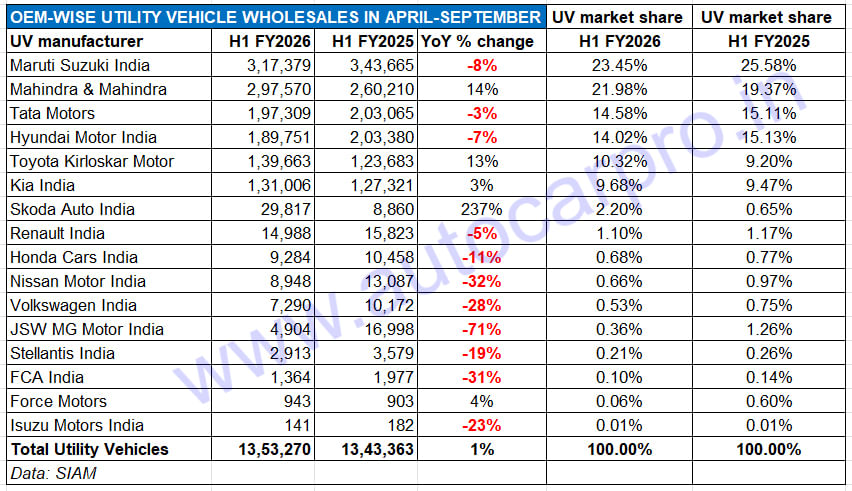

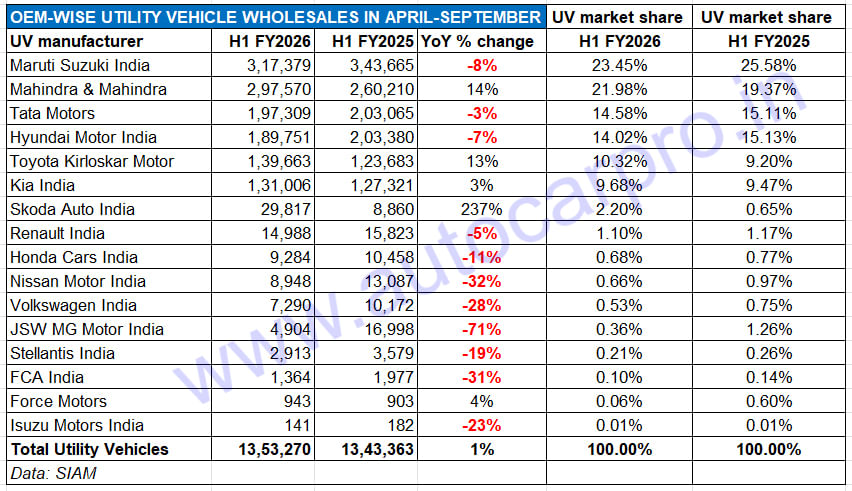

The first half of FY2026 is over, one which saw the passenger vehicle industry register wholesales of 2.05 million units, down 1.4% YoY. Of this, utility vehicles (UVs) accounted for 353,270 units, up 0.7% and 66% of PV sales, up from the 64% share they had a year ago. The latest wholesales data from apex industry body SIAM reveals that the battle between the top two UV manufacturers – Maruti Suzuki and Mahindra & Mahindra – has turned intense and, halfway into the current fiscal, are separated by only 1.47% in terms of UV market share.

While Maruti Suzuki has clocked factory dispatches of 317,379 UVs in the past six months, M&M has registered wholesales of 297,570 units. The key difference is that while UV market leader Maruti Suzuki has witnessed a 9% YoY decline (H1 FY2024: 343,66 UVs), Mahindra has posted strong14% YoY growth (H1 FY2025: 260,210 units).

Both companies had exited FY2025 on a stellar note, each having achieved their best-ever UV wholesales. Maruti Suzuki had sold 720,186 units and 12% YoY growth (FY2024: 642,296 units) and Mahindra had sold 551,487 units, a 20% YoY increase (FY2024: 459,864 units). This meant Maruti Suzuki had a market-leading 26% share of the record 2.79 million UVs sold in India last fiscal. In comparison, M&M – the No. 2 UV OEM – had a 20% share, behind by 168,699 units from Maruti Suzuki.

Now, after the first six months in the current fiscal, the UV wholesale difference between the two OEMs is 19,809 UVs. While Maruti Suzuki’s UV market share has reduced by 2.13% to 23.45% in H1 FY2026, M&M’s market share has risen by 2.61% to 21.98 percent (see 16 UV OEM sales data table below).

While Maruti (317,379 UVs) sold 26,286 fewer units YoY, Mahindra (297,570 UVs) sold 37,360 more SUVs YoY. As a result, Maruti’s UV share has fallen to 23% while M&M’s has increased to 22 percent.

THE MOVERS AND SHAKERS FOR MARUTI AND MAHINDRA

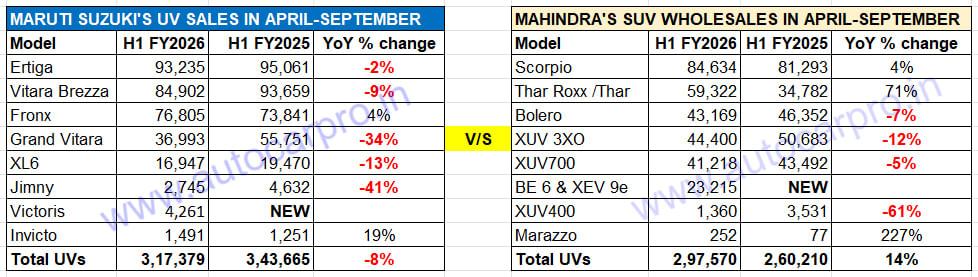

A deep dive into the model-wise wholesales for both rivals reveals some interesting takeaways. Of Maruti Suzuki’s eight-model stable of UVs, five (Ertiga, Brezza, Grand Vitara, XL6 and Jimny) have registered a YoY sales decline (see data table above). The Fronx, Invicto and the recently launched Victoris are in growth territory.

Of the eight Maruti UVs, five – Fronx, Grand Vitara, XL6, Jimny and Invicto – are premium Nexa models, of which only the Fronx has registered YoY growth.

However, Maruti Suzuki, which would be aware of the looming threat from M&M, has already made strategic moves to protect its UV crown. The company has launched the Victoris midsize SUV from the mass-market Maruti Arena channel, aiming to make inroads into the midsize SUV market and particularly targets the leader, Hyundai Creta and the Kia Seltos. And, Maruti is getting ready to launch its first electric vehicle – the e-Vitara – in December 2025. The much-awaited e-Vitara, which is based on a platform co-developed with Toyota, will be offered with two battery options – a 49kWh and a 61kWh LFP blade-cell battery pack, both supplied by BYD. Maruti claims the 61kWh version will offer an MIDC-rated range of over 500km. The e-Vitara, which will take on the Hyundai Creta EV, Tata Curvv EV, and MG ZS EV, will give the PV and UV market leader a shot at the growing EV market, one in which Mahindra already has an advantage with three products. Maruti Suzuki is also expected to introduce a seven-seater, three-row Grand Vitara by end-CY2025.

The Victoris, Maruti Suzuki’s latest UV, has sold 4,261 units in its first month. In early October, the company had received over 25,000 bookings for the midsize SUV which has been launched from the mass-market Maruti Arena sales channel as part of a strategic move to target a wider segment of buyers. Maruti Suzuki is understood to be targeting monthly production of over 8,000 units of the Victoris to cater to growing demand. But the company will need all of its other seven UVs to fare better than they did in H1 FY2026 if it is to stave off the potential threat from an aggressive, fast-growing Mahindra which is hot on its heels.

Other than the Fronx and Invicto, the six other Maruti UVs have seen their sales decline YoY. The Scorpio twins, Thar and Thar Roxx along the BE 6 and XEV 9e, have given M&M sales a boost.

Mahindra & Mahindra, which achieved the 500,000 annual sales milestone for the first time in CY2024, and went on to improve upon that score in FY2025 with 551,487 SUVs, is driving towards another record calendar year and fiscal. The company is well set to register over 600,000 SUV sales in CY2025 and FY2026.

Of the company’s eight model lines, four – Bolero, XUV 3X0, XUV700 and the electric XUV400 – have witnessed a YoY sales decline. While the Scorpio N and Classic remain the best-selling M&M model line with sales of 84,634 units and a 28% share, the star performer is the Thar brand, mainly due to the robust demand for the five-door Thar Roxx. Total Thar wholesales at 59,322 units are up 71% YoY and account for a 20% share compared to a 13% share a year ago.

In fact, September which saw M&M achieve its best-ever factory dispatches of 56,233 units was thanks to both the Scorpio twins (18,372 units) and the 3-door Thar and 5-door Thar Roxx (11,846 units) hitting record monthly wholesales.

The indefatigable Bolero soldiers on with 43,169 units sold, albeit sales are down 7% YoY. In an effort to rev up demand for the ageing SUV, M&M recently launched the refreshed MY2025 Bolero and Bolero Neo, introducing updated styling, new features, and better-equipped variants.

The XUV 3XO compact SUV is ranked third in M&M’s model raking with 44,400 units, down 12% YoY. The flagship XUV700 midsize SUV with 41,218 units is also down YoY.

M&M’s SUV score is also receiving a boost from growing demand for the two electric-origin SUVs which have sold 23,215 units in the past six months. In September, the BE 6 and XEV 9e registered their highest production, domestic wholesales and also exports.

While the XUV400, the other e-SUV in Mahindra’s portfolio, clocked sales of 1,360 units, down 61% YoY, the Marazzo MPV sold 252 units, up 227% on a low year-ago base of 77 units.

IS THE UV SEGMENT HEADED FOR RECORD SALES IN FY2026?

Meanwhile for the UV industry per se, total wholesales in the April-July 2025 period at 892,092 units are up marginally by 3% YoY (April-July 2024: 868,134 units) – an addition of just 23,958 units over four months. As the SIAM-sourced 16-OEM sales data table below depicts, only five UV manufacturers – Mahindra & Mahindra, Toyota Kirloskar Motor, Kia India, Skoda Auto India and PCA Motors – have increased their sales year on year.

India’s utility vehicle manufacturers had a record year in FY2025 with total sales of 2.79 million units, up 11% YoY. In the first-half of FY2026, total UV sales at 1.35 million units and with a slower 0.7 YoY growth rate are 48% of FY2025 sales. Following the recent rationalisation of the GST rate structure, sales of passenger vehicles including UVs have zoomed and most vehicle OEMs have been hard-pressed to cater to demand and have ramped up production of their key models. The surge in sales during Navratri and Dhanteras (October 18) is ample proof of the pent-up demand coming to the fore.

As the 16 OEM wholesales table for H1 FY2026 (far above) depicts, only five UV OEMs – Mahindra, Toyota, Kia, Skoda and Force Motors – have registered sales increases year on year. The stellar festive season should see some of the other players return to the black. India UV Inc needs to sell another 1.44 million units to surpass the record FY2025 total of 27,97,229 UVs. This translates into 240,659 UVs being sold every month in the second half of FY2026. Will FY2026 see record UV sales? While October and November should be months of high double-digit growth, a lot depends whether the current sales momentum extends into the last quarter (January-March 2026) of FY2026.

ALSO READ: Top 10 Compact SUVs in H1 FY2026: Tata Nexon to Mahindra Thar