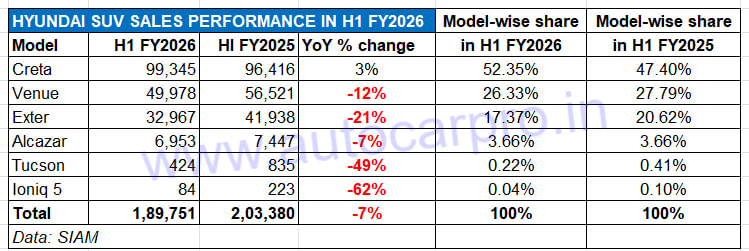

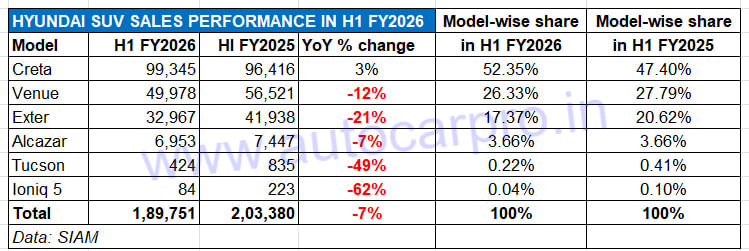

With 99,345 units and a 36% contribution, India’s No. 1 midsize SUV provided the bulk of Hyundai Motor India’s 189,751 SUVs wholesales or factory dispatches to dealers in the first-half of the current fiscal year (April-September 2025). The Creta, which clocked its best-ever monthly wholesales of 18,861 units in September, is also the sole model in the company’s six-SUV portfolio to register a YoY sales increase.

Hyundai Motor India’s SUV sales of 189,751 units, down 7% YoY, translate into a 70% share of its total passenger vehicle wholesales of 271,780 units, down 9% YoY (H1 FY2025: 299,094 PVs). As a result of the Creta hitting record sales in September, the SUV share of PV sales rose to a record monthly high of 72% (37,313 SUVs: 51,547 PVs)

Hyundai’s first-half FY2026 performance sees the Creta achieve 51% of its FY2025 sales of 194,871 units, its highest fiscal year sales since launch in July 2015. The Creta currently has a strong lead of 14,711 units over its immediate rival – Mahindra Scorpio N and Scorpio Classic (84,634 units).

As a result of its sustained growth in the past six months, the Creta’s share of Hyundai SUV sales has risen to 52% from 47% a year ago (see Hyundai SUV sales data table below).

The Creta’s share of Hyundai India’s SUV sales has risen to 52% in first-half FY2026 from 47% in April-September 2024.

The IC engine Creta, which remains a popular buy, has earlier this year been joined by its zero-emission avatar, the Creta Electric. Hyundai’s strategy to remain bullish on diesel, compared to some of rivals in India, is paying off. The Creta’s pack of powertrains comprises 1.5-litre petrol, 1.5-litre diesel and a 1.5-litre turbocharged petrol engine options. In terms of market pull, the new BS VI-compliant diesel motor is keeping pace with the other two powerplants. It is understood that demand continues to be strong for the Creta’s diesel variants, particularly those equipped with automatic transmissions.

The Venue compact SUV is Hyundai’s second best-selling SUV with 49,978 units (down 12% YoY) and a 26% share of the company’s UV sales. Demand has slowed down for this model, which surpassed cumulative 700,000 sales recently. As a result, the Venue’s share of Hyundai SUV sales has reduced to 26% from 28% a year ago in what is one of the most competitive UV segments. September (11,484 units) though were the highest monthly factory dispatches for this model in the past 20 months.

The current urban-friendly, high-on-fuel efficiency Venue is set to be replaced by a brand-new model on November 4, which will continue to target the Tata Nexon, Maruti Brezza, Mahindra XUV 3XO and the Kia Sonet.Production of the new Venue has begun at Hyundai India’s new plant in Talegaon, Pune and the company should see monthly numbers for this model rev up once again.

The Exter, Hyundai Motor India’s second compact SUV after the Venue, is ranked No. 3 with 32,967 units, down 21% YoY (H1 FY2025: 41,938 units). This is clearly the impact of the much-increased competition in this ultra-competitive sub-segment of the SUV market. The Exter, which drove past the 150,000 domestic market sales in April, has clocked cumulative sales of 181,608 since its July 2023 launch. Its share of Hyundai SUV sales has fallen to 17% in H1 FY2026 from 20% n H1 FY2025.

The Alcazar, Hyundai Motor India’s flagship SUV, takes fourth rank amongst the six Hyundai SUVs. The three-row, well-appointed midsize SUV, which is based on the Creta and packs the strengths of India’s No. 1 midsize SUV along with the flexibility of six or seven seats, has clocked wholesales of 6,952 units in H1 FY2026, down 7% YoY. The Alcazar’s model-wise share at 3.66% remains unchanged.

While the Tucson premium executive SUV, now in its fourth generation, sold 424 units, down 49% on the year-ago 835 units, the Ioniq 5 EV which is locally assembled wraps up this listing with sales of 84 units in H1 FY2026, down 62% YoY.

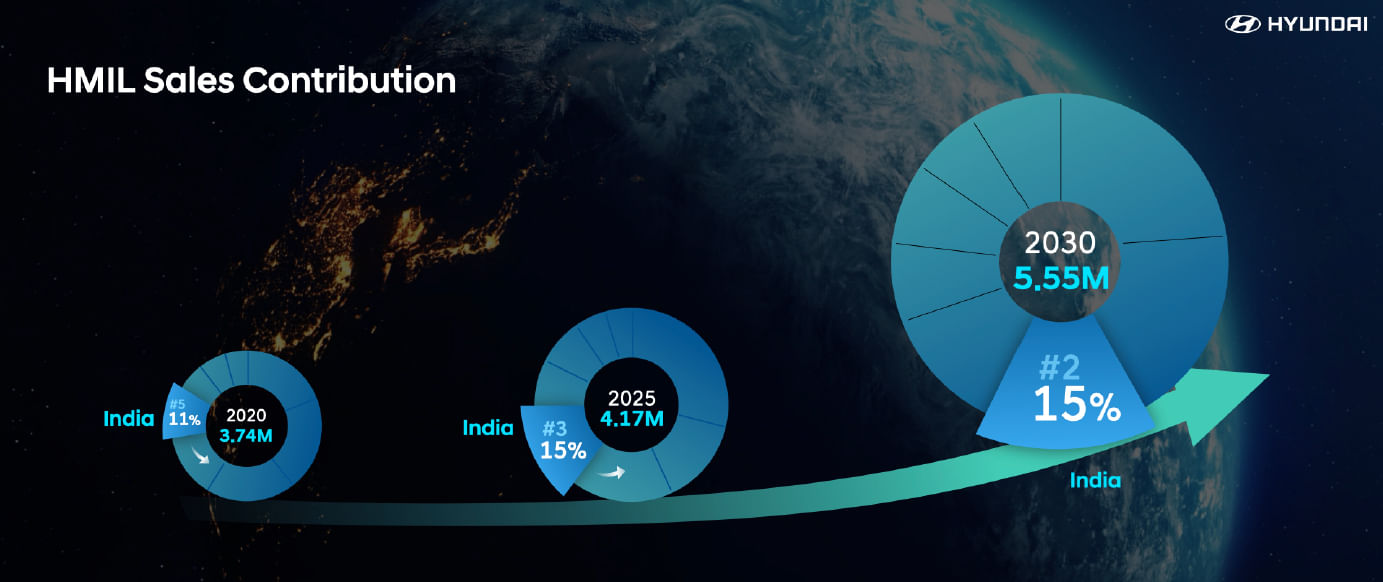

Hyundai India’s future growth strategy involves 26 product launches till FY2030, with a sharp focus on SUVs, crossovers, and electrified vehicles, making India its second largest market in the world.

Hyundai India’s future growth strategy involves 26 product launches till FY2030, with a sharp focus on SUVs, crossovers, and electrified vehicles, making India its second largest market in the world.

Hyundai Bets Big on India With 26-Product Offensive

In FY2026’s first six months, Hyundai Motor India is among the 11 of 16 utility vehicle manufacturers which registered a sales decline. With 189,751 SUVs sold, Hyundai’s UV market share has reduced marginally to 14% from 15% in April-September 2024. Now, with its new Talegaon plant beginning production of the soon-to-be-launched new Venue and facilitating new manufacturing capacity of 170,000 units and to be augmented to 250,000 units per annum in the near future, the company which is India’s No. 2 PV exporter, will be better equipped to take on the UV competition.

On October 15, Hyundai India hosted its first-ever Investor Day, presenting a comprehensive strategic roadmap that includes India-centric product expansion plans, advanced manufacturing, deep localisation and key financial guidance to support its growth trajectory through FY2030. This includes 26 product launches by FY2030, comprising seven brand-new models, six full model changes, six derivatives, and seven facelifts or refreshes. This will include entry into the MPV and off-road SUV segments and also Hyundai’s first locally manufactured dedicated electric SUV (by 2027).

Hyundai Motor India has announced a target of achieving 15% domestic market share with UV and eco-friendly powertrain (CNG + EV + Hybrid) contribution to reach over 80% and 50% respectively by FY2030.

This aggressive growth strategy is aimed to drive the India market into becoming Hyundai’s second-largest region globally and also accelerate the made-in-India vehicle export programme as a vital export hub contributing up to 30% of its global sales.

ALSO READ:Top 10 Compact SUVs in H1 FY2026: Tata Nexon to Mahindra Thar

Maruti Suzuki’s UV share falls to 23% in H1 FY2026, Mahindra’s rises to 22%