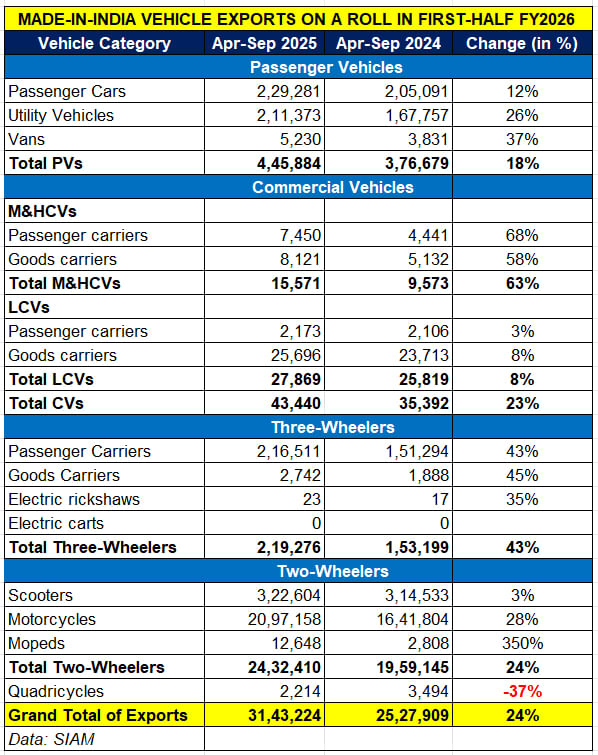

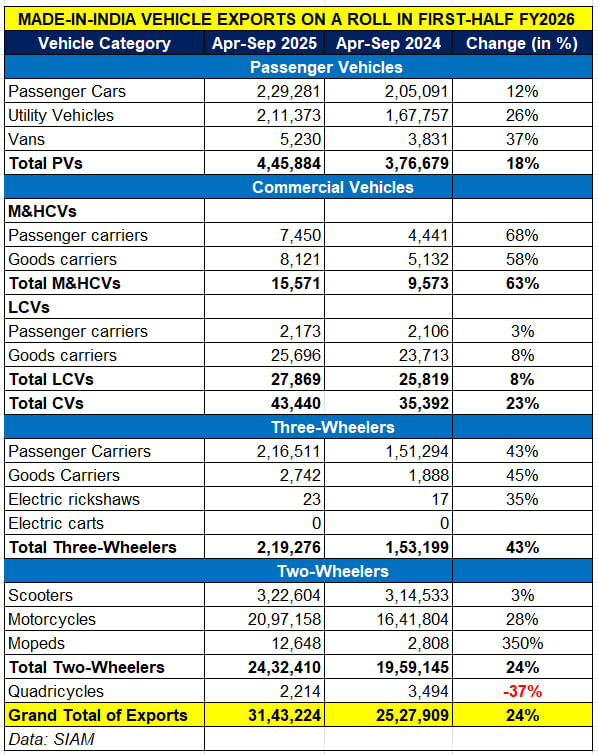

While the domestic market saw sales of 1,31,45,677 vehicles and tepid 0.6% growth on a large year-ago base in the past six months (April-September 2025), demand for made-in-India vehicles in export markets rose strongly by 24% YoY to 3.14 million units in first-half FY2025. Importantly, this growth is democratised across all four vehicle sub-segments with each registering high double-digit increases year on year.

Halfway into FY2026, India Auto Inc is well set to achieve best-ever exports for a fiscal year. FY2025 saw export of 5.36 million vehicles, up 19% YoY and the second best after FY2022’s 5.61 million units. With six months left in the current fiscal, the automobile industry has already achieved 59% of the FY2025 total and puts it in line for going past the record FY2022 exports.

Let us take a quick look at each of the four vehicle segments’ performance in the export market.

PASSENGER VEHICLES

H1 FY2026: 445,884 units, up 18%

FY2025: 770,364 units, up 14.60%

The passenger vehicle market has delivered a strong performance with shipments of 445,884 units, up 18% YoY, which is 56% of FY2025 exports of 770,364 units. While car shipments have risen 12% to 229,281 units, utility vehicles account for 211,373 units, up 26%, and vans for 5,230 units, up 37 percent.

Maruti Suzuki India, India’s No. 1 passenger vehicle exporter for the past four fiscals, has taken a strong lead in FY2026 with shipments of 205,763 units, up 40% YoY (H1 FY2025: 147,063 units). The car, SUV and MPV manufacturer, which exported a record 330,081 vehicles in FY2025, has already achieved 62% of that in the first six months of the current fiscal. Maruti Suzuki is targeting 400,000 vehicle exports in FY2026, according to Rahul Bharti, executive director, Corporate Affairs. The company has begun export of the e-Vitara, its global EV manufactured only in India and which is expected to add even more fizz to export sales.

The only other OEM to achieve 100,000-plus exports in H1 FY2026 is Hyundai Motor India, the No. 2 PV exporter which has shipped 99,540 vehicles, up 17% YoY.

TWO-WHEELERS

H1 FY2026: 24,32,410 units, up 24%

FY2025: 41,98,403 units, up 21.40%

The two-wheeler segment is the volume driver of the India export growth story. And it is firing on all cylinders in the current fiscal. At 2.4 million units, exports of scooters, motorcycles and mopeds have jumped 21% YoY (H1 FY2025: 1.95 million units) and are 58% of FY2025’s 4.19 million units.

Demand for made-in-India motorcycles has risen strongly by 28% to 2.09 million units which comprise 86% of total 2W exports in H1 FY2026, up from the 83% they commanded a year ago. 2W export market leader Bajaj Auto, which has a 37% share of exports, shipped 891,648 motorcycles and 210 Chetak e-scooters, up 17% YoY. TVS Motor Co too has done well – the 680,888 units exported are a smart 35% YoY increase and comprise 610,642 motorcycles (up 36%), 57,598 scooters (up 5%) and 12,648 mopeds (up 350%).

Honda is ranked No. 3 on the export scale with 311,517 units, up 12% YoY. The shipments comprise 178,977 scooters and 132,540 motorcycles. Hero MotoCorp has had a stellar first-half – the 176,000 units exported – 161,282 bikes (up 63%) and 14,718 scooters – represent 54% YoY growth.

India Yamaha Motor exported 171,147 two-wheelers, up 25% and Suzuki shipped 70,41 units, up 60% YoY.

In FY2025, total 2W exports were 4.19 million units comprising 3.62 million bikes, 306,914 scooters and 8,424 mopeds. H1 FY2025 exports at 2.43 million units are 58% of that total. And they include 4,282 EVs comprising TVS (2,296 iQubes and BMW EV), Ather Energy (1,776 units) and Bajaj Auto (210 Chetaks).

THREE-WHEELERS

H1 FY2026: 219,276 units, up 43%

FY2025: 306,914 units, up 2%

The three-wheeler industry has clocked exports of 219,276 units in H1 FY2026, marking handsome 43% YoY growth (H1 FY2025: 153,199 units) and achieving 71% of FY2025’s 306,914 exports. Passenger-transporting 3Ws with 216,511 units account for 99% of the sales, with goods carriers chipping in with 2,742 units and e-rikshaws and carts for 23 units.

3W market leader Bajaj Auto continues its strong showing with 135,684 units, up 54% YoY. Of this, 133,795 units comprise passenger carriers and 1,889 Maxima cargo carriers. This gives the company a 62% share of 3W exports.

TVS Motor Co is ranked No. 2 with 71,678 units, up by 27 percent. This total includes 56,070 people-transporting 3Ws and 219 units of the King Kargo cargo carrier.

Piaggio Vehicles is ranked No. 3 with 9,371 units, up 40% YoY. This includes 6,314 passenger carriers, up 265%, and 356 cargo 3Ws.

COMMERCIAL VEHICLES

H1 FY2026: 43,440 units, up 23%

FY2025: 80,986 units, up 23%

The commercial vehicle segment, which is split into medium and heavy CVs and light CVs, exported a total of 43,440 units, up 23% YoY (H1 FY2025: 35,392 units). This constitutes 54% of this segment’s exports of 80,986 units in FY2025.

The bulk of the demand in the current fiscal’s first-half is for LCVs which, at 27,869 units (up 8%) accounts for 64% of the CV exports. The M&HCVs (15,571 units) though have a much better growth rate of 63% albeit on much-lower year-ago sales of 9,573 units.

Mahindra & Mahindra is the CV export leader with 8,860 units (up 4%) and a 20% share of total shipments.

However, it is Ashok Leyland which has stolen the march in H1 FY2025. The Chennai-based manufacturer shipped 7,795 CVs to overseas markets, up 38%, and a strong performance which gives it an 18% share of CV exports.

Isuzu Motors India, the other big exporter, though has witnessed a sales decline. The 7,459 units exported in H1 FY2026 are down 21% YoY (H1 FY2025: 9,403 units), which sees its market share fall to 17% from a market leading 27% in H1 FY2025.

Speaking at SIAM Convention 2025 held last month, Dr Pawan Goenka, chairman of INSPACe and former Managing Director of Mahindra & Mahindra said: “The time for Indian OEMs to aggressively move towards exports has now arrived. If the passenger vehicle industry has to grow 10-12%, then exports must grow at 20 percent.”

SEE VIDEO:‘Exports must grow 20% annually to power auto industry’s momentum’: Dr Pawan Goenka