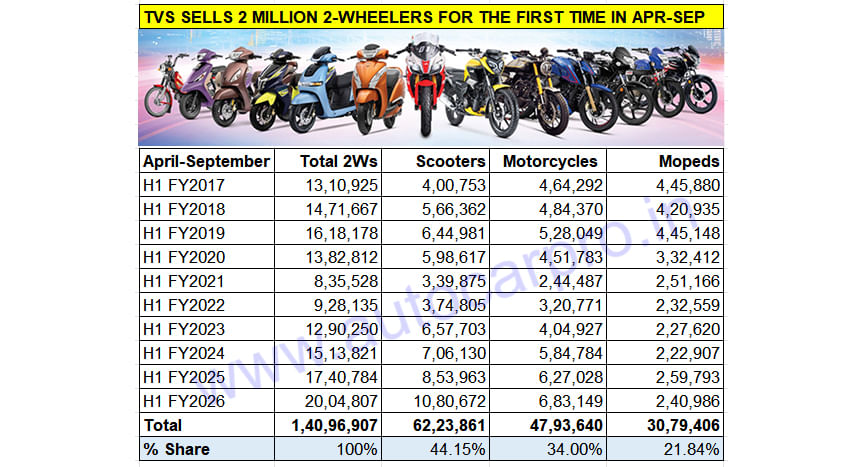

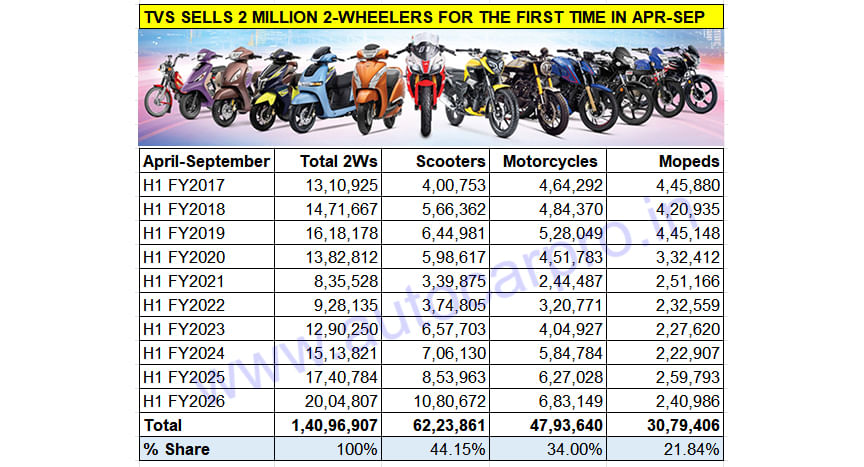

TVS Motor Co is on a roll in the current fiscal year. The Chennai-based two-wheeler major, which manufactures scooters, motorcycles and mopeds, has registered wholesales of 2 million units for the first time ever in the first-half of a fiscal year (April-September). As per the latest two-wheeler industry data, TVS sold 20,04,807 scooters, bikes and mopeds in April-September 2025, up 15% YoY (H1 FY2025: 17,40,784 units).

TVS’ strong double-digit growth comes at a time when the Indian 2W industry per se has posted 0.7% YoY growth (1,02,36,639 two-wheelers), and reflects the company’s growing grip on the market. A deep dive into decadal sales (see data table below) reveals that TVS Motor Co has, in the first six months of FY2026, achieved its best-ever scooter as well as motorcycle sales, albeit its moped sales are down.

Scooter share jumps to 54% from 30% in H1 FY2017

Of the three 2W sub-segments, scooters are the growth accelerator for TVS. Over the past decade, their share of the company’s 2W sales have jumped from 30% in H1 FY2017 to 54% in H1 FY2026, and in turn propelled TVS’ fortunes. In H1 FY2026, TVS scooter sales crossed the 1-million mark for the first time and accounted for 54% of TVS’ record 2-million 2W sales compared to motorcycles (34% share) and mopeds (12% share).

In first-half FY2026, TVS scooter sales crossed the 1-million mark for the first time and accounted for 54% of the company’s record 2-million two-wheeler wholesales.

The company, which has the Jupiter, NTorq and Zest in its ICE scooter stable along with the iQube and recently launched Orbiter electric scooters, sold a total of 1.08 million scooters in H1 FY2026, up 27% YoY (H1 FY2025: 853,963 units), which translates into an additional 226,709 units YoY. This gives TVS a current scooter market share of 29%, a marked increase over the 24% in H1 FY2025. While the three petrol-engined scooters have sold 932,899 units, up 28% YoY, the TVS iQube electric scooter with 147,773 units has clocked 20% YoY growth (H1 FY2024: 122,793 iQubes). TVS’ 29% scooter market share is the highest yet for the company. In FY2025, TVS had sold 1.81 million scooters for a 26% market share, up from 25% in FY2024.

With TVS scooter sales on a high, the Indian scooter industry, which clocked record wholesales of 6.85 million units in FY2025, seems well set for another mega fiscal in FY2026. Halfway into the current fiscal year, as per SIAM data, scooter makers have clocked sales of 37,21,709 units, up 6.42% YoY (H1 FY2025: 34,97,300 units). If this segment, which is also benefiting from demand for electric scooters, maintains the same growth trajectory, it will surpass the 7 million sales mark for the first time. And TVS could well sell over 2 million scooters in FY2026 in the process.

Motorcycle sales clock best-ever first-half sales too

Compared to the stellar growth of TVS scooters, demand for its motorcycles has been more circumspect. Over a decade, the share of motorcycles in TVS’ overall 2W sales has fallen from 35% in H1 FY2017 (464,292 units from 1.31 million 2Ws) to 34% in H1 FY2026 (683,149 units from 2.04 million 2Ws).

Between April and September 2025, the company sold 683,149 bikes, up 9% YoY (H1 FY2025: 627,028 units), which gives this sub-segment a 34% share of TVS 2-million 2W sales. This 9% increase though looks good considering the overall motorcycle market’s sales are down 2% in H1 FY2026.

TVS motorcycle sales are led by the Apache series which, with 272,048 units is currently the best-selling model and up 22% YoY (H1 FY2025: 222,947 units). The Raider 125, with 205,608 units (down 3% YoY) is the second best-seller. While the Radeon and Sport at 168,209 units are down 5% YoY, the Ronin has seen strong growth – 34,152 units, up 183% YoY. The RR310 has sold 3,132 units, up 47% YoY.

Moped share slides to 12% from 34% over 10 years

The humble moped, in the form of the 99cc TVS XL100 priced at Rs 43,900, continues to soldier on. Fifteen years ago, mopeds were TVS’ best-selling product and accounted for 41% of its sales but BS VI and changing market and consumer dynamics have tilted the balance towards scooters and motorcycles. As a result, the moped share of TVS’ overall 2W sales has fallen sharply.

Ten years ago, in H1 FY2017, the company had clocked sales of 445,880 units – more than its scooters (400,753 units) and a tad less than TVS motorcycles (464,292 units). At the time, the moped share of TVS 2W sales was 34% when sales of this sub-segment were at their highest in the past decade. In H1 FY2026, moped sales at 240,946 units are down 7% YoY (H1 FY2025: 259,793 units) and their share of TVS’ overall 2W sales just 12 percent, down 22% from what they commanded in FY2017.

At present, TVS is having a strong run and bids fair to register new sales highs in the current fiscal. In FY2025, the company had sold a record 3.51 million two-wheelers, up 11% YoY (FY2024: 3.15 million units). Having clocked record sales of over 2 million two-wheelers in April-September 2025, will TVS Motor Co achieve the 4 million milestone for the first time ever in FY2026? Watch this space for such exclusive sales analyses and forecasts.

ALSO READ: Honda Scooter Market Share Falls to 39%, TVS’ Rises to 29% in First-Half FY2026