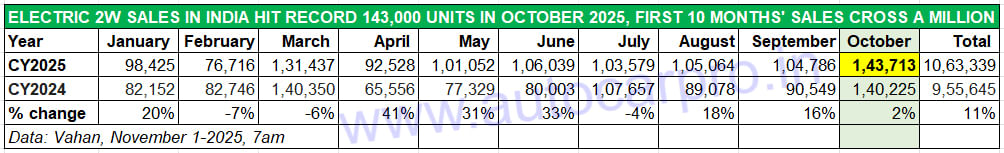

As accurately forecast a fortnight ago in the mid-month sales analysis on October 16, retail sales of electric two-wheelers in India have registered their best-ever monthly numbers in October 2025. As per the latest retails sales data on the Vahan portal (7am, November 1, 2025), 143,713 zero-emission scooters, motorcycles and mopeds were delivered to customers in October 2025.

This makes for 2% year-on-year growth on a large year-ago base (October 2024: 140,225 units) and translates into over 4,635 e-2Ws sold every day last month. Daily sales peaked at the end of the month what with 6,329 e-2Ws sold on October 30 and 7,737 units on October 31.

October 2025’s record sales, which are the highest in the current calendar year, take it ahead of the previous monthly best – March 2024 (140,350 units) and October 2024 (140,225 units). These three months are the only ones when India e-2W Inc has surpassed 140,000 retail sales.

October 2025’s record e-2W retail sales (143,713 units) beat the previous best of March 2024 (140,350 units) and October 2024 (140,225 units).

While 67,328 e-2Ws were sold in the first 15 days of last month, the remaining 16 days saw record deliveries of 76,385 e-scooters, bikes and mopeds. What also lit up sales was the Diwali festival which opened on the 20th and turned out to be a demand accelerator for the top e-2W manufacturers.

Importantly, what makes October 2025 stand out from the other two big-sales months is that it comes after GST 2.0, which has helped reduce prices of IC engine two-wheelers, made them more affordable and also shrunk the gap between them and electric two-wheelers. Nevertheless, last month’s stellar market performance proves that the e-2W industry has little to fear about sales being eaten into by its fossil-fuelled brethren.

Combined sales of the top six OEMs – Bajaj Auto, TVS Motor Co, Ather Energy, Hero MotoCorp, Ola Electric and Greaves Electric Mobility – at 128,310 units – account for 89% of the total e-2W sales across India (barring Telangana for which Vahan data is not available), leaving the balance 10% to be fought over by 190 other e-2W players.

Three’s company: Bajaj Auto sold 1,684 more e-2Ws than TVS which sold 1,423 more e-scooters than Ather Energy in October.

BAJAJ AUTO TRUMPS TVS

The big news coming from the e-2W industry is that Bajaj Auto has regained the No. 1 title it lost to TVS Motor Co in April this year. Having been in the lead halfway into the month, Bajaj maintained its steady pace of sales in the second half. October saw the Pune-based manufacturer of the Chetak sell 31,168 units to ride ahead of its Chennai-based rival by 1,684 units. This marks a 10% YoY increase (October 2024: 28,442 units) and gives it a 22% e-2W market-leading share. Bajaj Auto, which had last topped the monthly e-2W sales in February (21,570 units) and March (35,214 units), had been in the No. 2 slot right since April and seven dropped to No. 5 rank in July due to production constraints. Bajaj Auto’s strong October 2025 sales are its second-best monthly sales – March 2025 (35,215 Chetaks) is the best yet for the company.

TVS Motor Co, which has topped the e-2W market for six months in a row from April 2025, sold 29,484 units last month, down 3% YoY (October 2024: 30,240 units) for a 21% market share. Having sold 14,089 units in the first-half of October, the iQube manufacturer sold another 15,395 EVs in the next fortnight but that wasn’t enough to get it past arch rival Bajaj Auto. TVS’ slower sales in October can be attributed to iQube production constraints – speaking to analysts recently after announcing the H1 FY2026 results, the company management said “there has been a shortage of production and supplies into the market, primarily because of availability of the (rare earth) magnets.” Once this issue is resolved, expect TVS Motor to bounce back with vigour.

TVS, whose main growth driver till now has been the iQube, recently launched the Orbiter e-scooter at Rs 99,900 (ex-showroom Bengaluru), inclusive of PM E-Drive Scheme subsidies. This prices the Orbiter — which has a 3.1 kWh battery pack — on par with the base iQube variant that features a smaller 2.2 kWh battery pack. The Orbiter, which has a top speed of 68kph, is designed for urban commuting and has an IDC range of 158 km per charge. Orbiter sales have commenced in Karnataka and the company is now expanding into Maharashtra.

Another October news-making OEM is Ather Energy which is on a roll this year. Having begun CY2025 on a strong note, sales have risen month on month and October 2025 (28,061 units, up 73% YoY) is its best month yet, which gives the startup a best-ever market share of nearly 20 percent. October 2025 beats its previous best (August 2025: 18,105 units) and marks the first time that the Bengaluru-based smart electric scooter OEM has raced past both 20,000 and 25,000 retail sales in a single month. Importantly, it is just 1,423 units behind TVS and 3,107 units behind Bajaj Auto. Will Ather, at some stage in the future, upset the two legacy OEMs?

The growth accelerator for Ather has been its flagship product, the Rizta family scooter which has joined the 450 and 450 Apex performance scooters in its EV portfolio. The Rizta, which has an IDC range of 159km per charge, has marked a strategic product shift for Ather. Designed and developed with a focus on practicality – and also to take on the competition in the form of the TVS iQube, Bajaj Chetak and Hero Vida – the Rizta’s highlights include the largest two-wheeler seat in India, ample storage space and a host of user-friendly features.

The Rizta, which has sold an estimated 152,477 units from launch in April 2024 till end-August 2025, remains Ather’s key growth driver and currently accounts for the bulk of its sales. This is noteworthy given that the three-variant flagship scooter is a premium product that stands out from the crowd.

What has drawn buyers to Ather products is its Battery As A Service (BaaS) business model which, by separating the cost of the battery ownership from e-2W ownership, makes EVs more affordable and competitive with ICE rivals. With BaaS, e-2W buyers pay only for battery usage via subscription or per kilometre ridden. Ather Energy has also enhanced its brand equity by expanding its Assured Buyback programme, offering enhanced peace of mind to the consumer.

Ola Electric, which was the e-2W market leader not very long ago, is ranked fourth in the Top 10 listing and narrowly missed being fifth. In October 2025, as per Vahan data, Ola delivered 16,034 e-2Ws comprising both e-scooters and e-motorcycles – just 100 units more than Hero MotoCorp. Ola’s October 2025 sales are down 62% YoY (October 2024: 41,843 units). The year-ago sales were the second-highest monthly score for an Indian e-2W OEM. The highest total also belongs to Ola — 53,647 units in March 2024. Between January and October 2025, Ola has retailed a total of 181,752 units, which means it will be among the top five OEMs to cross the 200,000 annual sales mark

The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price points — from entry-level mass mobility through to premium. The S1 Pro, equipped with a 4kWh battery, has a claimed 142 km range on a single charge. Ola also manufactures and sells the Roadster X electric motorcycle, which develops peak power of 11 kW, a top speed of 125 kph, and has a range of 501 km.

Hero MotoCorp, the world’s largest two-wheeler manufacturer, continues to be in the news with robust demand for its new Vida VX2 model. Last month, the world’s largest two-wheeler manufacturer registered its best-ever electric scooter monthly sales – 15,934 units – and highest market share yet – 11 percent. The October 2025 sales are a 117% YoY increase (October 2024: 7,355 units) and beats the previous monthly best of 13,380 units in August 2025. over the 10,537 EVs sold in July 2025. This is the fourth month in a row that company has surpassed the 10,000-unit monthly sales mark since it entered the electric two-wheeler industry in October 2022. What’s more, it is set to achieve the 100,000-unit annual sales milestone for the first time in CY2025.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, which markets the Ampere brand of e-scooters, is sixth on the OEM ranking list with a stellar performance – 7,629 units. This marks strong 91% YoY growth (October 2024: 3,990 units) and is the best monthly retail sales total for GEM which has a 5% e-2W share in October.

GEM and Ampere have three key e-scooter brands: Nexus (EX and ST), Magnus (Neo and EX), and Reo (80 and Li Plus). On September 18, Ampere Vehicles launched its latest product, the Magnus Grand family scooter priced at Rs 89,999 (ex-showroom). The flagship Nexus remains the best-selling product for GEM and Ampere Vehicles, even as it witnesses demand for the Ampere Reo 80, launched in April at Rs 59,900.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is ranked seventh amongst the Top 10 e-2W OEMs. Bgauss sold 2,932 units of its e-2Ws comprising the RUV 350 and Max C12 last month.

Pur Energy, the Hyderabad-based EV startup incubated from the i-TIC at IIT Hyderabad, is now a regular entry in the monthly Top 10 e-2W OEM list. The company, which has a five-model portfolio, has clocked sales of 1,706 units to take eighth rank.

Another startup which is a Top 10 regular is the Bengaluru-based River Mobility, which has a single product – the River Indie. In October, the company has delivered 1,601 units to customers.

Electric motorcycle manufacturer Revolt Motors, with 1,345 units, is ranked tenth in this Top 10 listing. The company, which was amongst the earliest to launch an electric motorcycle in India in CY2019, has expanded its portfolio to five products with the RV BlazeX. It also has an aggressive localization programme and uses EV components from Sona Comstar, Uno Minda, Rockman, FIEM and JBM.

E-2W Industry Rides Towards Record Sales of 1.25 Million Units in CY2025

India’s e-2W market is the largest contributor to India EV Inc and between January 1 and October 31 has clocked retail sales of 1.06 units, up 11% YoY, which constitutes 92% of the segment’s record retail sales of 1.14 million units (11,49,399 units) in CY2024. Now, the e-2W industry needs to sell another 86,061 units to surpass that total. With an additional 200,000-plus e-2Ws likely to be sold in the November-December 2025 period, expect CY2025 retail sales to be in the region of 1.25 million units.

This segment, which has plenty of products on offer – more scooters, a growing number of motorcycles and some mopeds, has shrugged off any impact from the GST-driven price cuts on its IC-engine cousins. Unlike the electric passenger vehicle as well as the e-3-wheeler industry, which have felt some of the impact of the surge in demand for ICE models after GST 2.0, the e-2W segment has been far more resilient. This can be attributed to the long-term, wallet-friendly benefits of e-mobility on two wheels particularly in view of high petrol and CNG prices. And the fact that now there is a wide choice of products, at multiple price-points to choose from.