India’s electric vehicle market regained momentum in October 2025, driven by strong double-digit growth across commercial, passenger, and three-wheeler segments, even as electric two-wheelers saw a rebound from September lows to grow in the low single digits in October.

Electric Two-Wheelers: Bajaj and TVS Drive Rebound

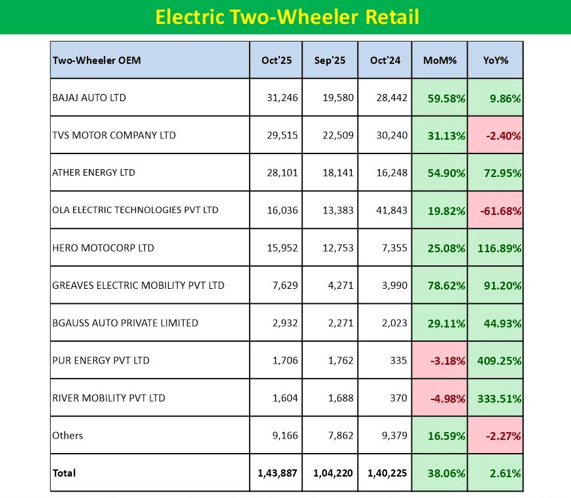

After a sharp slowdown in September, electric two-wheeler (E2W) retails rose 38% month-on-month to 1,43,887 units, though the segment’s market share slipped to 4.6% from 8.1% last month.

• Bajaj Auto led the rebound with 31,246 units, up 60% MoM.

• TVS Motor followed at 29,515 units (+31%).

• Ather Energy clocked 28,101 units (+55%), while Hero MotoCorp doubled volumes YoY (+117%).

• Ola Electric, however, remained under pressure with a 62% YoY decline.

Analysts attribute the surge to restocking post-subsidy rationalisation and early festive buying, though YoY growth remained muted at +2.6%.

Electric Three-Wheelers: Mahindra Extends Dominance

The electric three-wheeler (E3W) segment remained the workhorse of India’s EV transition, clocking 70,604 units, up 15.7% MoM and 5.1% YoY, with an impressive 54.5% market share.

• Mahindra Group, led by Mahindra Last Mile Mobility (MLML), topped the charts with 11,860 units, growing 59% YoY.

• Bajaj Auto followed with 8,033 units, maintaining steady double-digit growth.

• TVS Motor saw exponential gains (+3820%) from a small base.

The E3W segment continues to be India’s most electrified category, underscoring the rising penetration of shared and last-mile electric mobility.

Electric Passenger Vehicles: Tata Holds Lead, Mahindra Surges

The electric passenger vehicle (EPV) market saw a robust 17.8% MoM and 57.5% YoY jump to 18,055 units, even as EV market share eased to 3.2% from 5.1% in September.

• Tata Motors consolidated its lead with 7,239 units, growing 9.5% YoY.

• MG Motor and Mahindra surged over 60% and 300% YoY respectively, reflecting widening model availability.

• Kia India and Hyundai Motor posted triple-digit YoY growth, signalling deeper mainstream adoption.

• Premium brands like BMW and BYD sustained healthy momentum, while Mercedes-Benz and Tesla posted declines.

Electric Commercial Vehicles: Gradual Build-up Continues

The electric commercial vehicle (ECV) segment grew 12% MoM to 1,767 units, marking a 106% YoY increase.

• Tata Motors led with 603 units, while Mahindra Group followed at 306 units, both reflecting steady scaling in electric cargo and last-mile fleets.

• Switch Mobility, Euler Motors, and PMI Electro Mobility sustained growth, though Olectra Greentech and VE Commercial faced some month-on-month correction.

The ECV segment’s market share stood at 1.64%, underscoring its gradual but steady electrification curve driven by public transport and e-commerce logistics.

India’s EV retail market showed a broad recovery in October 2025, led by strong gains in the two-wheeler, passenger vehicle, and three-wheeler segments. While month-on-month growth was visible across most categories, EV market share moderated from September highs, indicating a stabilisation phase after the subsidy-driven spike.

Tata Motors, Mahindra, Bajaj, and TVS remained key growth drivers, even as newer entrants like Kia, Hyundai, and VinFast expanded volumes. Analysts expect the momentum to sustain into the festive quarter, supported by new launches, improved supply chains, and rising fleet electrification.