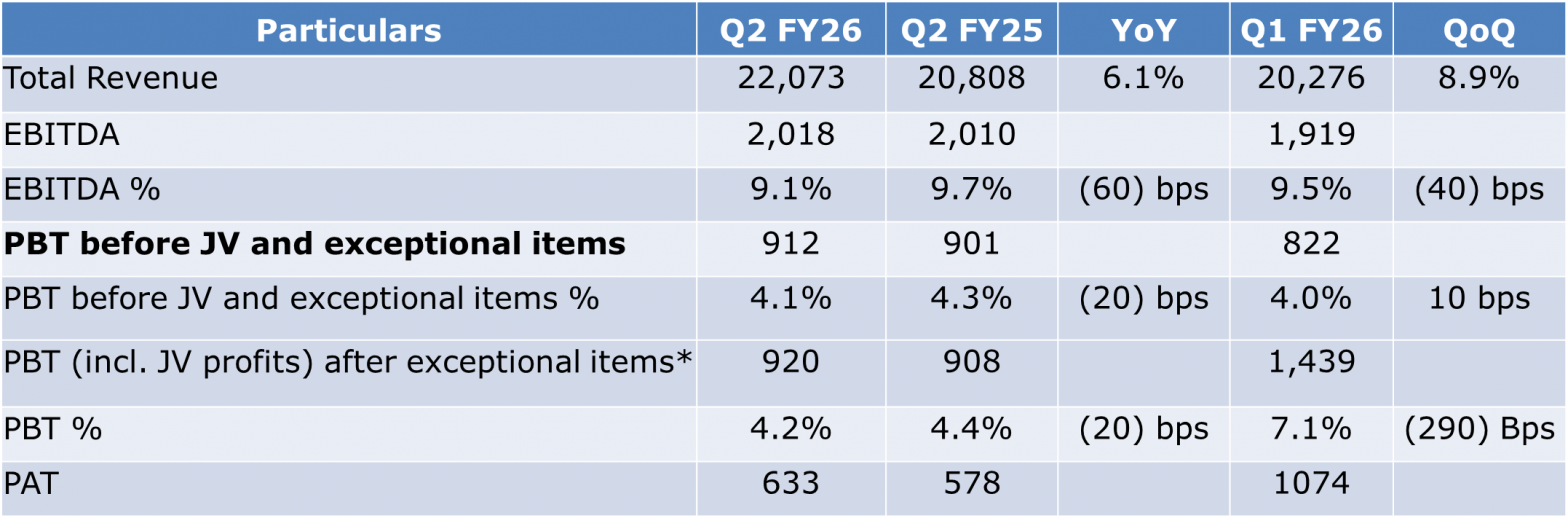

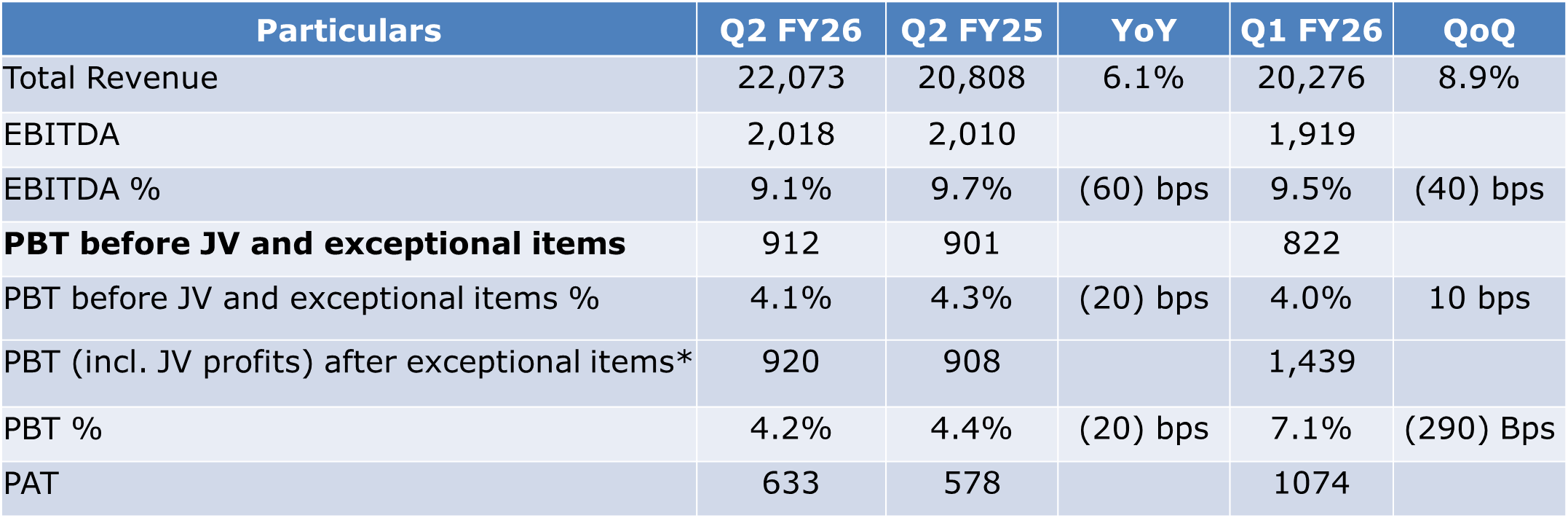

Varroc Engineering Ltd., a global tier-I auto components group, announced its financial results for the quarter ended September 30, 2025, reporting consolidated revenue from operations of ₹22,073 million. This represents a year-on-year growth of 6.1 percent compared to the corresponding period last year.

The company’s profit before tax, excluding joint venture contributions, stood at ₹912 million for Q2 FY26, marginally higher than the ₹901 million recorded in Q2 FY25.

The company’s Indian operations grew by 7 percent during the quarter, though performance was affected by an industry-wide rare-earth supply issue. This constraint resulted in an estimated revenue loss of approximately ₹750 million. Without this disruption, the company’s Indian operations would have registered growth of 11.8 percent, according to the announcement.

Tarang Jain, Chairman and Managing Director, noted that the company has been focused on financial discipline and operational efficiency since completing its divestment exercise three years ago. The company has reduced its net debt-to-EBITDA ratio from over 2x in FY23 to below 0.3x currently. Interest costs as a percentage of revenue have declined from nearly 3 percent in Q2 FY23 to below 1.5 percent in the latest quarter.

Tarang Jain, Chairman and Managing Director, noted that the company has been focused on financial discipline and operational efficiency since completing its divestment exercise three years ago. The company has reduced its net debt-to-EBITDA ratio from over 2x in FY23 to below 0.3x currently. Interest costs as a percentage of revenue have declined from nearly 3 percent in Q2 FY23 to below 1.5 percent in the latest quarter.

The automotive production environment in India remained favorable during Q2 FY26. Two-wheeler production increased by 10.6 percent, three-wheelers by 18.3 percent, passenger vehicles by 4.2 percent, and commercial vehicles by 11.8 percent on a year-on-year basis. Sequential growth was even more pronounced across most segments due to early festive season demand.

The company’s EBITDA margin for the quarter was 9.1 percent compared to 9.7 percent in the previous year. This decline was attributed to higher employee costs stemming from the establishment of an overseas R&D center to support its four-wheeler lighting and electronics businesses. However, the Indian operations maintained stronger margins, with EBITDA at 11.5 percent and PBT exceeding 7 percent.

Varroc has been expanding its presence in the electric vehicle segment, which now accounts for more than 11 percent of total revenue. The company reduced its net debt by ₹3,680 million in the first half of FY26, bringing its net debt-to-equity ratio below 0.22x. The absolute net debt figure stood at ₹3,800 million.

During the first half of FY26, Varroc secured new business wins with annualized peak revenues of ₹8,928 million. These include four-wheeler lighting contracts for passenger vehicles and additional orders from existing electric vehicle customers. The company’s return on capital employed improved to 23.6 percent in Q2 FY26 from 12 percent in FY23.

The company has been implementing several strategic initiatives, including the establishment of an R&D facility in China, a new manufacturing location in Thailand following a decision to exit manufacturing operations in China, and organizational restructuring to reduce fixed costs. Jain indicated that the company is exploring voluntary retirement schemes to rationalize fixed manpower costs while prioritizing long-term growth objectives.