Having already charged past 2 million annual sales for the first time in the 11th month itself, India’s electric vehicle industry is on a roll this year. Importantly, for this vehicle segment, all four sub-segments – 2- and 3-wheelers, passenger and commercial vehicles – have already achieved their highest-ever annual sales and will go on to further improve their score in December.

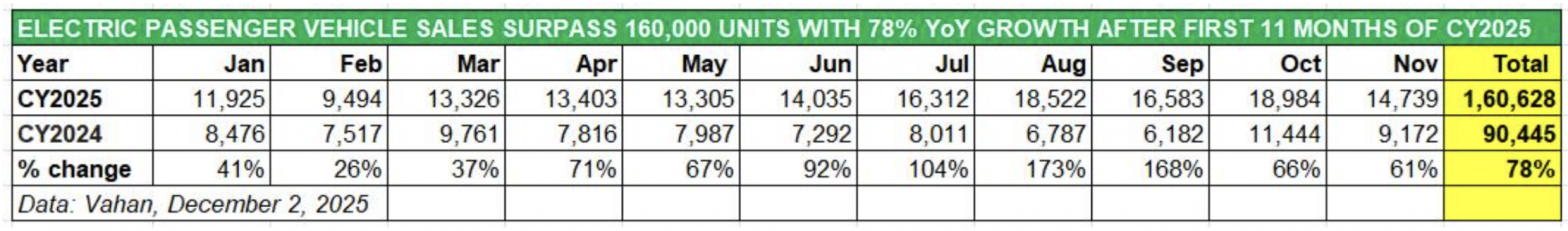

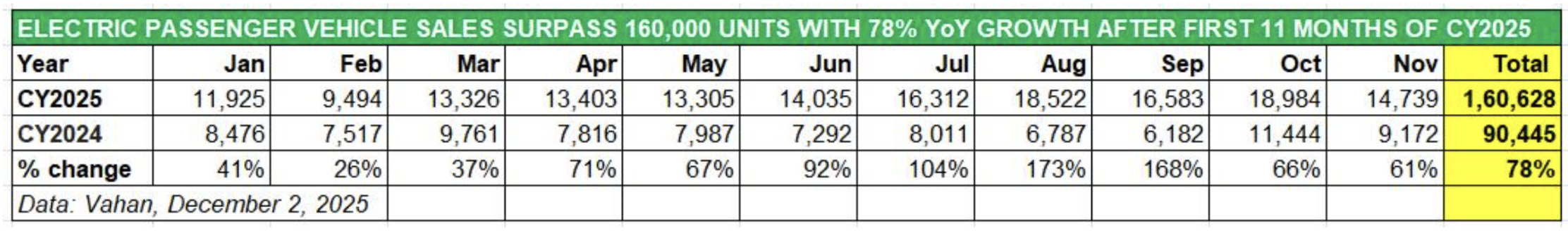

The electric passenger vehicle (e-PV) industry, which comprises zero-emission hatchbacks, sedans, SUVs and MPVs, has delivered a record 160,740 units between January and November 2025. This marks handsome 78% YoY growth (January-November 2024: 90,445 units) and translates into an additional 61,046 e-PVs with December retail sales yet to be counted.

Between January and November, the e-PV industry has already sold an additional 61,046 e-PVs over CY2024 sales (99,694 units) with December retail sales yet to be counted.

Cumulative e-PV industry sales in the first 11 months of CY2025 at 160,628 units have raced past entire CY2024 sales of 99,694 units. Given the current sales momentum driven by a flurry of new products over the past 10 months, expect this zero-emission vehicle segment to register record retail sales of around 175,000-180,000 units this calendar year, setting a new benchmark for the e-PV industry in India.

Let’s take a quick look at how the major players as well as the luxury e-PV OEMs have fared over the past 11 months and their performance versus their CY2024 sales. A clue to the robust growth of this segment is the fact that barring the three new players – Vinfast, Tesla and Maruti Suzuki – nine of the 14 e-PV OEMs have already registered their highest annual sales in the first 11 months of CY2025.

Market leader Tata Motors, with 63,046 electric cars and SUVs and 10% YoY growth, has surpassed its CY2024 total of 61,747 units. This gives the maker of the electric Nexon, Punch, Harrier, Curvv, Tiago and Tigor a current market share of 39% as compared to 62% in CY2024. The launch of the Harrier EV has revived demand and the company has registered monthly retail sales of 6,000-plus e-PVs for five months running. Tata Motors’ markedly lower YoY market share is due to the advance of its two key rivals – JSW MG Motor India and Mahindra & Mahindra which have grabbed a good slice of the e-PV market this year with their new products.

JSW MG Motor India is the aggressive No. 2, hard on the heels of the market leader. From a 20% share in CY2024, the company’s share has jumped to nearly 30% – the 47,574 units in the past 11 months are a handsome 165% YoY increase and mainly attributed to the launch of the Windsor EV which has consistently been the best-selling e-PV for months, energised by the BaaS option. This year has also seen the company, which also sells the ZS EV and Comet EV, expand its portfolio with the M9 MPV and Cyberster roadster.

New products have also powered growth for Mahindra & Mahindra. The launch of its first two electric origin SUVs – BE 6 and XEV 9e – early this year have helped the company achieve sales 30,191 units from January to November. This constitutes 347% YoY growth over the low year-ago base of 6,757 XUV400s and gives M&M a current market share of 19%, which is a near-three-fold increase over the 7% share it had a year ago. The company, which has just launched the new XEV 9S three-row, born-electric SUV had sold 7,153 units in CY2024, is expected to sell a record 34,000 units in this calendar year.

Hyundai Motor India takes fourth rank in the 17-OEM listing with 6,435 units, up 621% YoY (January-November 2024: 893 Ioniq 5s) which gives it a 4% share of the e-PV market. Following the launch of the Creta Electric in January 2025, combined sales of the Creta Electric and Ioniq 5 had risen from 775 units in February to 905 units in March but since then demand has tapered for the zero-emission avatar of India’s best-selling midsize SUV which accounts for the bulk of the monthly deliveries.

BYD India, the local arm of China’s and the world’s largest e-PV OEM, is at No. 5 position with 5,122 units, having doubled its year-ago sales of 2,561 units with the Sealion 7 SUV being a recent growth accelerator. BYD’s Indian arm, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, is set to increase the price of the Sealion 7 from January. BYD India has a current market share of 3% which is the same as in CY2024.

Luxury e-PV market leader BMW India has registered record sales of 2,837 units in the first 11 months of this year. The company, whose portfolio includes the i7, iX, i5, i4, iX1 Long Wheelbase, and Mini Countryman E, has clocked robust 164% YoY growth and is ranked sixth amongst the 17 OEMs.

Kia India, ranked 10th in CY2024 with 415 units, has risen smartly up the ranks to be the No. 7 e-PV OEM in the year to date. Cumulative January-November sales this year at 2,398 units are up 620% YoY and give it a market share of 1.5% versus 0.41% in CY2024. The growth driver has been the made-in-India Carens Clavis MPV which has drawn local buyers, far more than the expensive and imported EV6 and EV9.

Mercedes-Benz India with 1,087 units (up 28% YoY) sold in the past 11 months has also hit a new calendar year high with December sales yet to be factored in. The company’s strong BEV portfolio includes the EQS 580 sedan, EQS 580 SUV and 450 SUV, along with the EQA 250+, EQB SUV, Mercedes-Maybach EQS 680 SUV and G580 with EQ technology.

Vietnamese EV manufacturer Vinfast with 429 units of the locally assembled VF6 and VF7 e-SUVs is ranked No. 10 in just three months after kicking off sales. The company, which has partnered with the State Bank of India and ICICI Bank for EV customer financing, has opened 24 dealerships in major Indian cities with plans to add another 11 by the end of this year. Recognising the potential of the growing market for electric MPVs and the demand for the Kia Carens Clavis EV and the BYD eMax 7, Vinfast India has confirmed plans to launch its third premium EV – the seven-seater Limo Green electric MPV – in February 2026.

The market response to the other recent and far more well-known OEM – Tesla – has been far more subdued. Tesla India has sold a total of 157 units of the Model Y SUV, comprising 69 units in September, 40 in October and 48 in November. The Model Y is imported into India as a CBU product.

The eight luxury e-PV makers between them have sold 4,558 units in the past 11 months, which marks 77% YoY growth (January-November 2024: 2,570 units. Total luxury e-PV sales in CY2024 were 2,869 units.

While CY2025 will set a new sales benchmark for the e-PV industry, CY2026 promises to be even better. Maruti Suzuki India, which has unveiled its first electric vehicle – the e-Vitara – is set to open bookings soon and will launch the zero-emission SUV in early 2026. Considering the e-Vitara was unveiled on January 17, 2025 at the Bharat Mobility Global Expo, it could be expected that the official launch just might happen a year after that event.