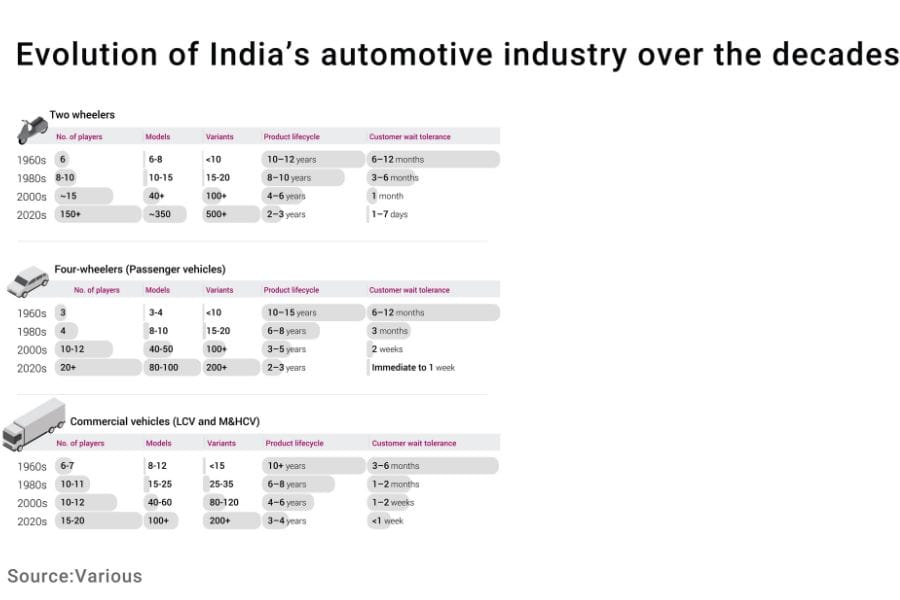

India’s automotive industry has transformed from a limited, tightly controlled market into a highly competitive, multi-fuel and variant-rich landscape. Rising competition, rapid technology shifts, and higher customer expectations have made an already complex supply chain even more dynamic.

Liberalisation and the growth of EVs, hybrids, and alternative fuel platforms have opened the market to numerous new players, creating a crowded and fast-moving environment. To compete, OEMs now offer a wider range of models and configurations, but this variant expansion drastically reduces production volume per SKU and increases operational and inventory complexity.

At the same time, vehicle lifecycles have shortened significantly, with frequent updates becoming the norm. Customers now expect immediate availability and are unwilling to wait, putting pressure on OEMs and suppliers to respond rapidly. Predicting demand at an SKU level has become increasingly unreliable, leading to significant mismatches between production and actual consumption.

Without agility, the industry is caught between excess inventory and stockouts, resulting in delays, lost sales, and dissatisfaction in a market driven by speed and choice. The Push Toward Digitisation

The Push Toward Digitisation

To overcome these challenges, automakers turned to digitisation. Real-time visibility across the value chain, knowing what is ordered, where inventory is placed, and how consumption is changing, became critical for improving agility. In response, automakers invested heavily in digital systems to enhance transparency and coordination across internal teams and external partners such as suppliers, dealers, and logistics.

Tools like ERP, DMS, CRM, MES, and supplier portals were introduced to streamline operations and support faster, data-driven decisions, based on the belief that greater visibility would improve agility.

However, most digitisation has focused on automating transactions, not decisions. While systems now track enquiries, bookings, orders, production, advanced shipment notifications and dispatches in real time, decisions about what to produce and when still rely on forecasts and manual judgement. Planning remains tied to rigid monthly cycles. Visibility has increased, but responsiveness has not; the organisation sees more, yet reacts late.

This creates a dangerous illusion: real-time dashboards may make the organisation appear agile, but decisions still lag behind ground reality. Firefighting continues, and gaps between supply and actual consumption widen in a fragmented, high-SKU, short-lifecycle environment.

In short, visibility has improved, but true agility is still missing.

The Unresolved Conflict

Some companies tried shifting to agile, demand-triggered planning promises for better responsiveness, but it created more instability, frequent schedule changes, supplier volatility, production disruptions, and execution challenges.

On the other hand, monthly planning creates a perception of stability through fixed schedules and predictable operations, but in most cases, companies can never adhere to the rigid schedule in the face of changes in market demand.

Thus, the industry is trapped between two extremes: A monthly system, which promises to cushion the customer experience, but compromises adaptability; agile/responsive systems try to improve alignment with demand but make internal execution highly unstable.

To succeed amid fragmented preferences and short product lifecycles, companies must move beyond either of the approaches and build a planning model that adapts to real-world complexity without imposing chaos in supply chains.

A Practical Path

True agility requires balancing demand uncertainty while providing stability across the supply chain. Forecasting cannot accurately predict demand due to frequent model refreshes and rapidly shifting customer preferences. Hence, supply chains need a way to absorb the variability in demand and unreliability of supply rather than attempting to eliminate it, and this is where buffers become essential.

Unlike conventional inventory, which is a result of poor planning, buffers are strategic stock positions designed to protect flow and ensure availability. They will act as shock absorbers, providing stability without sacrificing responsiveness, when the supply chain is designed to respond to the changes in inventory level against buffers.

The buffers provide stability to the supply chain to the extent of protection they provide, while the response to the inventory level against buffer makes it dynamic to actual consumption. This is a shift from either reacting to every change (agile planning) or delayed response (monthly planning) to a clear replenishment signal to ensure availability. This makes the supply chain more predictable and self-regulating. This approach aligns all the stakeholders in the supply chain to one goal, simplifies execution and reduces firefighting.

Buffers at right locations enable proactive planning even for seasonal peaks or promotions and prevent last-minute disruptions. Ultimately, they absorb demand variability, improve supply reliability, and allow operations to run with stability and agility simultaneously.

Achieving Flexible Stability Through Buffers

Protective buffers enable a major breakthrough by separating unpredictable demand from rigid supply operations. They allow sales teams to respond quickly to market shifts without waiting for long lead times, reducing lost sales and improving responsiveness.

For supply functions, buffers provide time to respond and predictability of urgencies. Clear visual signals guide priorities, making the system largely self-regulating and keeping inventory at optimal levels.

Digitisation alone increases visibility but cannot resolve variability. Real agility comes when digital tools are combined with buffer-driven, flow-based planning that balances responsiveness with stability, turning firefighting into controlled, reliable execution.

Ravindra Patki is Managing Partner at Vector Consulting Group. Views expressed are the author’s personal.