If India’s electric vehicle (EV) industry achieved a new annual retail sales record of 2.27 million units in CY2025, having crossed the 2 million milestone for the first time in November, it’s thanks to the big volumes provided by the most affordable sub-segment – electric two-wheelers.

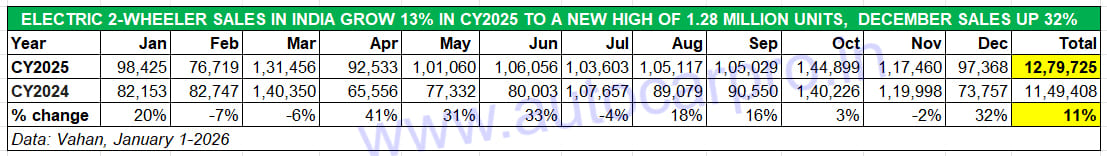

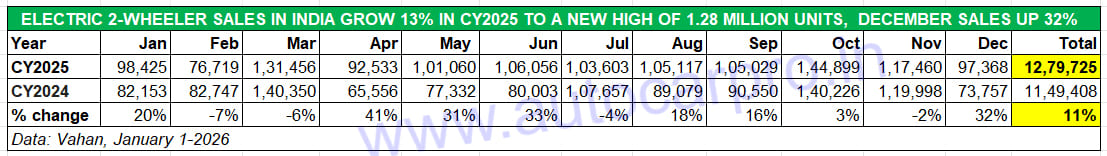

Of the total 22,70,425 EVs sold across four zero-emission vehicle sub-segments in India in CY2025 (up 00% YoY), electric scooters, motorcycles and mopeds accounted for nearly 1.28 million units (up 11% YoY) or 56 percent.

While this is down from the 59% share the e-2W segment had in CY2024 when it accounted for 1.14 million of the total 1.95 million EVs across all segments, the fact is that each of the other three sub-segments have also hit their best-ever annual sales in CY2025.

Importantly, the 11% YoY growth has come on a high base (1.14 million e-2Ws in CY2024) and in the face of the reduced price gap between IC engine two-wheelers and EVs as a result of the sharp reduction in GST from September. With a record 20.29 million two-wheelers sold across India in CY2025, the e-2W penetration last year was 6.30% compared to 6.07% in CY2024 (18.92 million two-wheelers).

India e-2W Inc’s performance in CY2025 would have been better if it weren’t dragged down by the lacklustre performance of last year’s market leader – Ola Electric (407,700 units) – whose sales fell sharply by 51%, to less than 200,000 units.

Festive October 2025 saw India e-2W Inc set a new benchmark for monthly sales: 144,899 units.

The growth of the e-2W market in India since the past three years has been rapid. However, in comparison to over 33% growth in CY2023 and CY2024, CY2025’s 11% is somewhat tepid.

While the initial cost of an electric two-wheeler typically remains higher than its petrol-engine sibling, the promise of wallet-friendliness with long-term ownership as well as a much wider e-2W portfolio continues to draw buyers albeit at a slower pace than expected, more so after GST 2.0. Stiff petrol prices (Rs 103.54 a litre on December 31 in Mumbai) continue to burn a hole in motorists’ pockets.

Along with the demand for personal mobility, e-2W manufacturers are also benefiting from sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for e-two-wheelers deployed for e-commerce and food deliveries. This is thanks to the key advantage stemming from TCO (Total Cost of Ownership), particularly for fleet operators who clock plenty of kilometres each day.

Like the aircraft industry, e-vehicles used for fleet operations make money the more they are on the road. It’s a plug-in-plug-out seamless operation for them – while 50% of the fleet would be out on the job, the other half is getting charged, ready to replace their parched brethren when they come in for their ‘juice’ of electricity.

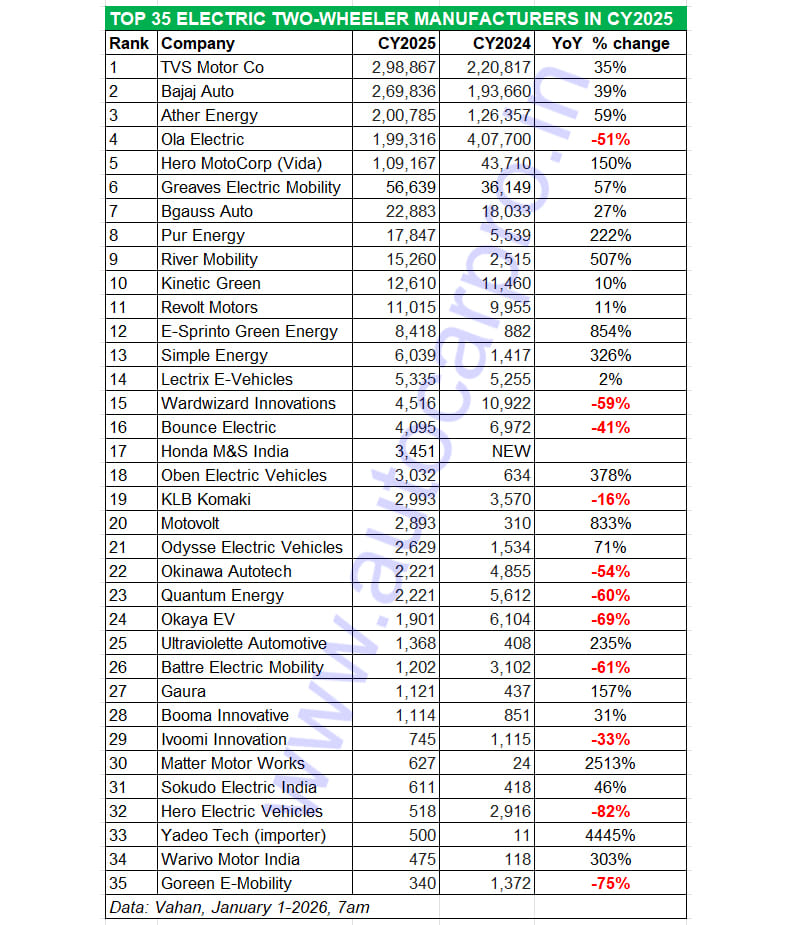

In a field comprising 231 players – up from 180 in CY2023 – there are six OEMs which have had the giant’s share of the market in CY2025. Five of them have each registered six-figure sales and five, barring Ola Electric, have clocked their best-ever annual retail sales.

Combined sales of this six-pack at 11,34,610 units accounts for 89% of India’s total e-2W sales in CY2025, leaving the balance 11% to the other 262 players in the e-2W arena. Here’s taking a closer look at the top six OEMs who were the movers and shakers of the Indian e-two-wheeler industry in CY2024.

TVS MOTOR CO

CY2025: 298,867 units, up 35% / Market share: 23%

CY2024: 220,817 units, up 32% YoY / Market share: 19%

CY2023: 166,580 units, up 252% / Market share: 19%

TVS Motor Co, which topped the monthly sales chart eight times last year, is the new e-2W market leader, wresting the crown from Ola Electric which was the No. 1 OEM for three straight years from CY2022 to CY2024. TVS had a straight run at the top right from April to September, losing the crown in October to Bajaj Auto, but regaining it in November and holding onto it in December. Last year saw TVS surpass the 30,000-unit mark twice: March (30,772 units) and November (30,584 units). October 2024 (30,240 units) is the only other month when the 30k monthly mark was exceeded after its entry into the e-2W market in January 2020.

The manufacturer of the iQube and the recently launched Orbiter e-scooters delivered 298,867 units to consumers last year, but narrowly missed the 300,000 milestone – by just 1,133 units. This marks strong 35% YoY growth (CY2024: 220,817 units) and gives it a market-leading share of 23%, well over the 19% it had in CY2024 and CY2023. Last year’s monthly sales average was 24,905 units, much better than the 18,401 units in CY2024.

BAJAJ AUTO

CY2025: 269,836 units, up 39% / Market share: 21%

CY2024: 193,660 units, up 169% YoY / Market share: 17%

CY2023: 71,941 units, up 235% / Market share: 8%

The Pune-based manufacturer of the Chetak and Yulu e-scooters has moved up to No. 2 position from No. 3 in CY2024. Bajaj Auto sold 269,836 units in CY2025, up 39% YoY (CY2024: 193,660 units), surpassing both the 200,000 and 250,000 milestones for the first time annually. This gives the company a 21% market share, rising strongly from the 17% in CY2024 and 8% in CY2023.

Bajaj Auto wore the No. 1 e-2W OEM crown for the first time in February 2025 and followed it up with its best-ever monthly sales in March 2025 (35,214 units). The company’s 12-month total would have been a lot better if it weren’t for the slowed-down production of the Chetak in July and August due to a hampered supply chain for critical rare earth magnets, which in turn impacted retail sales.

The company is readying the launch of a brand-new model early in CY2026, which could mean potential Chetak buyers would be awaiting that model. Bajaj Auto continues to expand its Chetak network which now stands at 390 exclusive stores and 4,000 points of sale in 800 cities.

ATHER ENERGY

CY2025: 200,785 units, up 59% / Market share: 16%

CY2024: 126,357 units, up 20% YoY / Market share: 11%

CY2023: 104,736 units, up 101% / Market share: 12%

Bengaluru-based smart electric scooter startup Ather Energy, which was listed on the bourses last year, had had a stellar run in CY2025. The company, which produces the 450X, 450S, 450 Apex and Rizta, sold 200,785 units last year. This is a handsome 59% YoY increase (CY2024: 126,357 units), which gives it a market share of 15.68%, improving upon CY2024’s 11% share and CY2023’s 12 percent. The Diwali month of October (28,475 units) delivered the best-ever sales for Ather.

The growth accelerator has been the premium Rizta family scooter which accounts for around 70% of its sales. The Rizta, with an IDC range of 159km per charge, has marked a strategic product shift for Ather. Designed and developed with a focus on practicality – and also to take on the competition in the form of the TVS iQube, Bajaj Chetak and Hero Vida – the Rizta’s highlights include the largest two-wheeler seat in India, ample storage space and a host of user-friendly features.

What has also drawn buyers to Ather products is its Battery As A Service (BaaS) business model which, by separating the cost of the battery ownership from e-2W ownership, makes EVs more affordable and competitive with ICE rivals. The BaaS option has enabled a reduction of the upfront price of the Rizta S to Rs 76,000, making the premium family scooter far more affordable.

Ather is set to expand its manufacturing capacity from the current 420,000 units per annum from its two plants – one each for e-2W assembly and battery production. A third plant in Maharashtra, with annual capacity of a million units, will expand capacity to 1.42 million units. The first phase of this upcoming high-tech facility is slated to go on stream in the second half of CY2026.

Will the startup, at some stage in the future, upset the two legacy OEMs? That remains to be seen but the fact of the matter is that with a growing sales network and expanding reach into Tier 2 and 3 markets, the start-up is taking the battle into the top two legacy players’ camp.

OLA ELECTRIC

CY2025: 199,316 units, down 51% YoY / Market share: 15.57%

CY2024: 407,700 units, up 52% YoY / Market share: 35%

CY2023: 267,376 units, up 143% / Market share: 31%

CY2025 has been a year that Ola Electric would like to forget in a hurry. The 199,316 e-scooters and e-motorcycles the company sold in CY2025 are a massive 51% YoY decline (CY2024: 407,700 units) and 208,384 fewer EVs than a year ago. This is a huge climbdown for Ola, which was the first Indian e-2W OEM to sell over 400,000 units in a single calendar year and also impacted overall industry numbers because of the much-reduced sales volume.

As a result, the company, the market leader for three straight years – CY2024, CY2023 and CY2022 – now finds itself at No. 4 position for the first time. Ola’s market share is now down to 15.57%, having more than halved from the commanding 35% it had in CY2024 when it was the Maruti Suzuki of the e-2W industry.

Ola opened CY2025 with 24,411 units in January, which remained its highest monthly sales last year, with each month witnessing a high double-digit sales fall. November (8,436 units, down 71% YoY, which was its lowest score in CY2025, saw it slip even further to No. 5 with a market share of 7 percent.

Among the few positives for the company was Ola commencing mass deliveries of e-2Ws equipped with its indigenously manufactured 4680 Bharat Cell battery packs in early December and receiving Rs 366.78 crore under the PLI-Auto Scheme.

It is imperative that Ola Electric will have to come up with an aggressive sales and product strategy if it is to regain the vigour and shine it had displayed not very long ago as the e-2W market leader.

HERO MOTOCORP

CY2025: 109,167 units, up 150% / Market share: 8.53%

CY2024: 43,710 units, up 292% YoY / Market share: 4%

CY2023: 11,141 units, up 101% / Market share: 1%

Hero MotoCorp has been the newsmaker of the e-2W world in CY2025 as a result of the robust demand for its new Vida VX2 model. The company registered retail sales of 109,167 e-scooters, up 150% YoY (CY2024: 43,710 units) and crossed the 100,000 units in a single year for the first time.

While CY2025 opened on a tepid note with 1,626 units in January, monthly sales crossed 6,000 units for four straight months (March-June) and then crossed the 10,000-units mark for the first time in July (10,547 units) and maintained that momentum for six straight months. October (16,027 units) remains its best month to date.

The company’s robust performance in a competitive market is amply reflected in the monthly Top 10 e-2W OEM listing where it has been a consistent entry this year. Ranked No. 7 in January, Hero MotoCorp rose to sixth in February, maintained its No. 5 position in March, April, May, June, July, August, September, and October and then wrested No. 4 rank from Ola Electric in November.

GREAVES ELECTRIC MOBILITY

CY2025: 56,639 units, up 57% / Market share: 4%

CY2024: 36,148 units, up 46% YoY / Market share: 3%

CY2023: 24,042 units, up 45% / Market share: 2.79%

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, remains the firm No. 6 on the OEM ranking list with retail sales of 56,639 units (up 57% YoY) and a 4% market share. This is GEM’s highest annual retail sales after CY2024 (36,148 units). GEM and Ampere Vehicles, which are witnessing a revival of demand driven by new products like the Nexus, Magnus Neo and the Grand, has surpassed cumulative retail sales of 250,000 units since market entry in CY2019.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is ranked seventh amongst the Top 10 e-2W OEMs. Bgauss sold 22,883 units of its e-2Ws comprising the RUV 350 and Max C12 last year, up 27% YoY (CY2024: 18,033 units).

Pur Energy or Pure EV takes eighth rank with 17,847 units, which constitutes 222% YoY growth (CY2024: 5,539 units).

Bengaluru-based River Mobility, now rebranded River EV, which has a single product – the River Indie – is now a regular fixture in the Top 10 e-2W listing and the No. 9 OEM in CY2025. The company sold 15,260 Indie e-scooters, a five-fold increase (CY2024: 2,515 units). While November (1,821 units) was its best month, December (1,795 units) made it six straight months of River EV surpassing the 1,500-unit sales.

The company, which bagged the Red Dot Product Design Award 2025, rolled out the Indie Gen 3 in September and is fast expanding its sales network. Plans are to grow its dealer footprint from the existing 35-odd showrooms to 80 across India by March 2026 with a focus on Punjab, Rajasthan, Madhya Pradesh, Uttar Pradesh, and Gujarat.

Kinetic Green, which sells the E-Zulu, Zing, and the E-Luna, is ranked 10th with 12,610 units, up 10% YoY. The company had hit its highest monthly sales in August (1,514 units). Kinetic plans to up the ante with the launch of a new premium family scooter in CY2026, the first of three models to be launched over the next 18 months. Given that it has a strong manufacturing infrastructure and a 400-strong network of exclusive e-2W dealers across the country, the company is looking to aggressively expand this business operation.

Revolt Motors, which was amongst the earliest to launch an electric motorcycle in India in CY2019, is ranked No. 11 amongst the 268 e-2W OEMs. Revolt sold a total of 11,015 e-bikes in CY2025, up 11% YoY (CY2024: 9,995 units). The company, which has a five-model portfolio comprising the RV1, RV1+, RV BlazeX, RV 400BRZ and RV400 with ex-showroom prices starting from Rs 100,000 to Rs 139,950, claims annual savings of Rs 26,544 when compared to a conventional petrol-engine bike’s fuel cost of Rs 2,500 per month.

Ultraviolette Automotive, the TVS-backed e-motorcycle start-up, sold 1,368 units and is ranked No. 25 (see Top 25 e-2W OEMs in CY2025 listing below). Honda Motorcycle & Scooter India, which entered the EV market with its Activa E and QC 1 scooters, sold 3,451 units to take No. 17 position.

GROWTH OUTLOOK FOR CY2026

GROWTH OUTLOOK FOR CY2026

Having set a new annual sales benchmark of nearly 1.28 million units, where does the e-2W industry go from here? Will it achieve a 17% YoY increase over CY2025 and go past 1.5 million retail sales in CY2026? That’s difficult to say at the dawn of the new year, more so with the price gap reducing between ICE two-wheelers as a result of the GST 2.0-driven price cut and their zero-emission cousins.

Nevertheless, the draw of the two-wheeled EV remains its lower cost of operation, far easier on the pocket than tanking up on expensive petrol – e-2Ws cost as little as 30 paise per kilometre compared to Rs 2 per kilometre for petrol-powered e-2Ws. Furthermore, with no need for oil change or regular servicing, maintenance costs for EVs are far lower.

Government incentives in the form of subsidies also help reduce the EV sticker cost. And, of course, the e-2W user is contributing to the larger mission of green mobility and a cleaner world. Stay firmly plugged in as we bring you up-to-date on the advance of the e-mobility segment, across categories, in India.