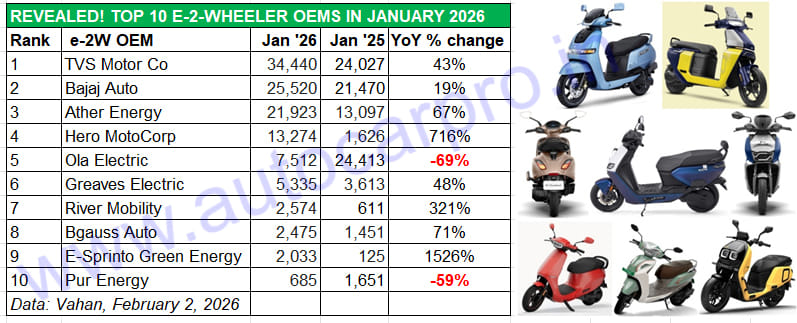

Carrying on its strong performance in CY2025 when it sold nearly 300,000 units, electric two-wheeler market leader TVS Motor Co has opened CY2026 on a really strong note. As per the latest Vahan retail sales data, the Chennai-based manufacturer of the iQube and Orbiter e-scooters delivered 34,440 units in January 2026, a handsome 43% YoY increase (January 2025: 24,027 units).

Having sold 15,935 units in the first-half of January, TVS went on to sell another 18,505 units in the second half and accounted for 28% of the 122,477 e-2Ws sold in India last month.

January 2026, which saw TVS sell 1,111 e-scooters each day, is now the company’s best-ever monthly retail score since it entered the EV market in January 2020. It is also the fourth instance of 30,000-plus retails. The other three months are October 2024 (30,240 units), March 2025 (30,772 units) and November 2025 (30,584 units).

Given the robust customer demand for its e-scooters, TVS is exploring expansion of its e-2W manufacturing capacity. The company currently produces around 30,000 iQubes a month while Orbiter production is nearing the 10,000-units-a-month mark. Speaking after the company’s Q3 FY2026 results were announced recently, K N Radhakrishan, CEO and director, said demand for both the flagship iQube as well as the new Orbiter, which address different customer segments, has been encouraging. Commenting on the Orbiter, he said: “It is too early to give actual usage trends but the demand is excellent in the markets where we have launched. The good news is iQube is also growing, and Orbiter is also growing.” January’s strong sales depict just that.

With a record 34,440 e-scooters, TVS had a market-topping 28% share of the 122,477 e-2Ws sold in India in January 2026. Bajaj Auto, Ather Energy and Hero MotoCorp too saw strong retail sales.

Bajaj Auto sold 25,520 Chetak e-scooters last month, up 19% YoY (January 2025: 21,470 units). This gives the company a market share of 21 percent. On January 14, Bajaj Auto launched the new and more affordable Chetak C2501 priced at Rs 91,399 (ex-showroom Bengaluru). Powered by a 2.5kWh battery, the Chetak C2501 has a claimed IDC range of 113km on a full charge and goes head- to-head against the TVS iQube 2.2kWh and the Hero Vida VX2 Go. It’s early days yet for the new Chetak C2501 and it remains to be seen if it helps the company narrow the sales gap with rival TVS. Meanwhile, Bajaj Auto continues to expand its Chetak network which now stands at 390 exclusive stores and 4,000 points of sale in 800 cities.

Ather Energy, like TVS and Bajaj Auto, continues to witness strong sales and is firmly positioned as the No. 3 OEM. In January, the e-2W startup sold 21,923 units, up 67% YoY (January 2025: 13,097 units), which gives it a market share of 18 percent. The second half of CY2026 will see Ather expand its manufacturing capacity from the current 420,000 units per annum from its two plants – one each for e-2W assembly and battery production. A third plant in Maharashtra, with annual capacity of a million units, will expand capacity to 1.42 million units.

Fourth-ranked Hero MotoCorp with its Vida brand has sold 10,000-plus units for the seventh month in a row, having first crossed that milestone in July 2024. This January, the company sold 13,274 units, up 716% (January 2025: 1,626 units) for an 11% market share. The company has recently expanded its VX2 portfolio with the 3.4kWh variant (Rs 84,800) which joins the VX2 Go 2.2 kWh (Rs 73,850) and the VX2 Plus (Rs 94,800). Hero Vida also sells the V2 Pro (Rs 140,000) and V2 Plus (Rs 104,800). Meanwhile, Hero MotoCorp has entered the electric motorcycle market with a very different product – the Dirt.E K3 off-roader designed exclusively for young riders aged from four to 10 years old.

Ola Electric is ranked fifth on the e-2W OEM scale with 7,512 units in January 2026, down 69% YoY (January 2025: 24,413 units) for a 6% market share. This is a big climbdown from the 24% share it had in January 2025 when it outsold both TVS and Bajaj. The company, which consistently registered five-figure retails every month, has slipped into four-figure sales since November 2025.

Ola Electric’ portfolio comprises S1 scooters and Roadster X motorcycles. The premium S1 Gen 3 portfolio includes S1 Pro+ in 5.2kWh (with 4680 Bharat Cell), and 4kWh battery pack configurations, and S1 Pro in 4kWh, and 3kWh battery pack configurations respectively. The mass market offerings include Gen 3 S1 X+ (4kWh), and Gen 3 S1 X (4kWh, 3kWh, 2kWh). The Roadster motorcycle portfolio includes Roadster X+ in 9.1 kWh (with 4680 Bharat Cell), and 4.5kWh battery pack configurations respectively. The Roadster X comes with 4.5kWh, 3.5kWh, and 2.5kWh battery packs.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, remains the longstanding No. 6 OEM as in CY2025. Last month, the company sold 5,335 units, up 48% YoY (January 2025: 3,613 units) The company currently has a five-model portfolio comprising the Nexus, Magnus Neo, Magnus Grand and the Reo 80 / Li Plus. The latest model is the Magnus G Max launched on January 19 at an introductory price of Rs 94,999. Powered by a 3 kWh LFP battery, the Magnus G Max delivers over 100km real-world range in Eco mode, with a certified range of 142km.

Bengaluru-based River Mobility, which has a single product – the River Indie – is now a regular fixture in the Top 10 e-2W listing and the No. 7 OEM in January with 2,574 units, up 321% on a low year-ago base of 611 units. This is River’s highest number of Indie deliveries yet in a single month, beating the previous best of November 2025 (1,821 units).

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is ranked eighth amongst the Top 10 e-2W OEMs. Bgauss delivered 2,475 units of its e-2Ws comprising the RUV 350 and Max C12.

E-Sprinto Green Energy has sprinted into the Top 10 listing with its best-ever monthly sales of 2,033 units, up 656% on a low year-ago base of just 125 units.

Pur Energy or Pure EV wraps up the Top 10 list with 685 units, down 59% YoY (January 2025: 1,651 units).

OVER A MILLION ELECTRIC 2Ws SOLD IN FIRST 10 MONTHS OF FY2026

The strong retail sales in January (122,477 units, up 24% YoY) have also ensured that cumulative sales in the first 10 months of FY2026 have surpassed the million-units mark. At 10,96,722 units between April 2025 and January 2026 and a YoY increase of 30% (April 2024-January 2025: 942,586 units), retail sales have gone ahead of FY2025’s record 11,50,765 units.

If the same growth momentum is maintained in February and March, India’s electric 2W industry could well be looking at a new fiscal year sales benchmark of over 1.35 million units in FY2026.

ALSO READ: Record 1.28 million electric 2Ws sold in India in CY2025

South India is top buyer of electric 2Ws in CY2025 with 34% share

TVS iQube and Bajaj Chetak Sales Cross 1.45 Million Units Six Years After Launch